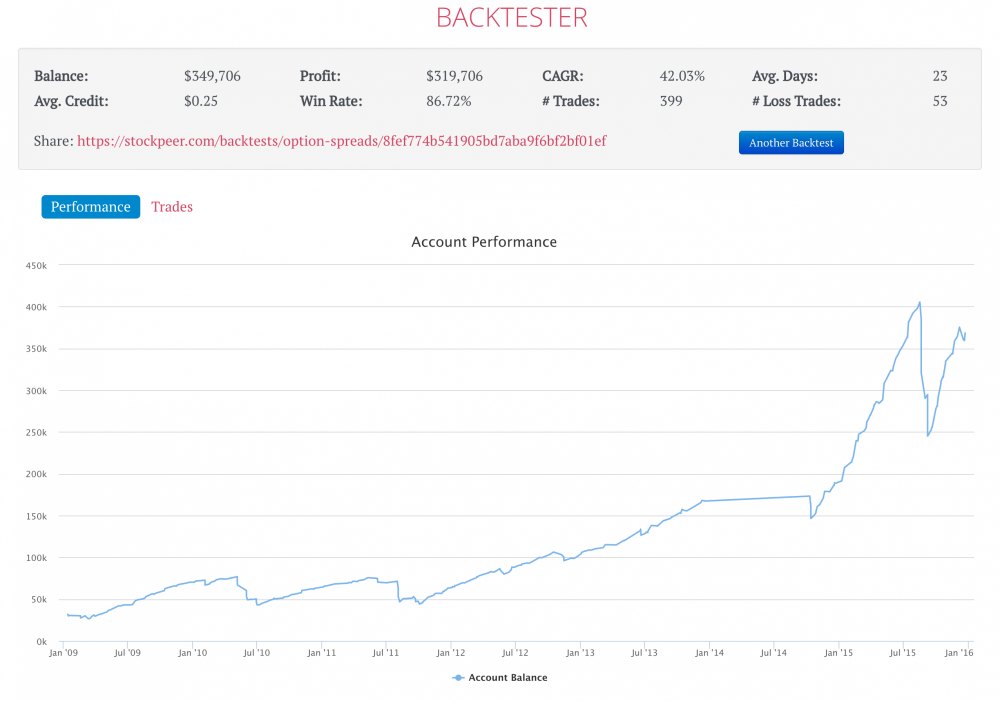

Have you ever wondered how your options trading strategy would perform over time? I have, so I built a backtester. I wanted a way to simulate trading the options market day to day to see how well my strategies would have fared. Until now I have kept this backtester to myself, but today I am happy to introduce the Stockpeer backtester to the world. You can play with it by visiting https://stockpeer.com/backtest.

Full disclosure: the backtester is far from complete. Consider this a super early alpha launch. I am offering only the ability to backtest the SPY, using put credit spreads, on end-of-day data. Want to see more options? More features? Share the love. Let me and others know you think the Stockpeer backtester is a cool tool by tweeting about it or sharing it on Facebook. Why? Because a good backtester is cumbersome and expensive to build, but your support and feedback will motivate me to continue making progress.

Backtester Goals

Although backtesting an investment strategy is not a new concept, the options world seems to lack good backtesting tools. My goal was to build something simple yet robust. Something that does not require the user to be a computer programmer. A backtester that allows you to test different strategies quickly just by pointing and clicking.

Most important, I aspire to build something that helps others learn and contributes to the conversation about options trading. Real data with real results eliminates subjective thinking and promotes objective thinking.

The Stockpeer backtester is still in development, but I believe there is value in sharing earlier rather than later. I invite you to play with the backtester, share your results with others, and pass along any feedback you might have. Enjoy!

Related Topics: Backtesting