The wheel strategy is one of the most reliable ways to generate consistent income from options trading. But here's what many traders miss: your stock selection matters more than your options execution. You can have perfect timing and flawless trade management, but if you're running the wheel on the wrong stocks, you're setting yourself up for disappointment. On this website, I share my real trades and results, and I've learned through experience which stocks work best for this strategy.

Why Stock Selection Is Everything

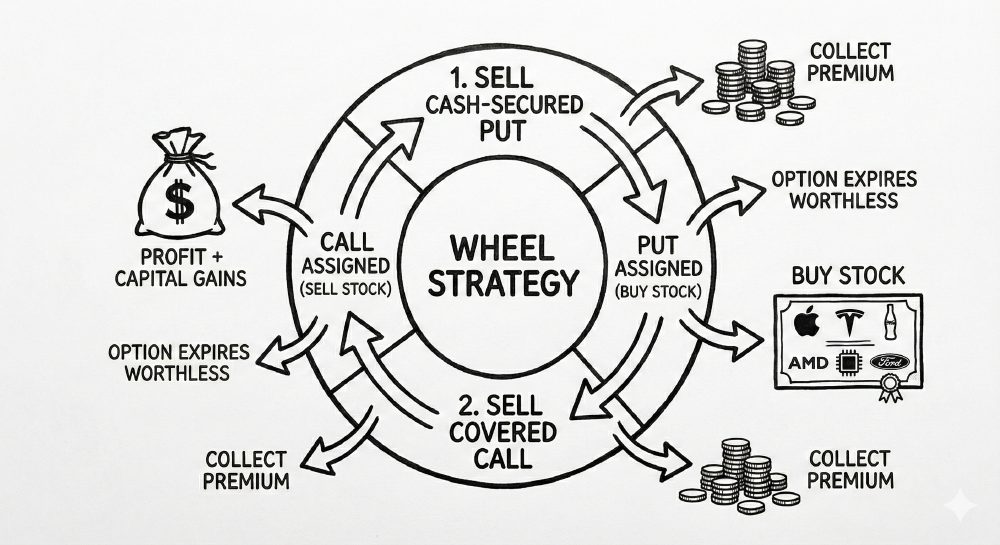

The wheel strategy involves selling cash-secured puts until you get assigned shares, then selling covered calls until your shares get called away. It's a simple cycle that can generate 1-3% monthly returns when done correctly. But the entire strategy hinges on one assumption: you're comfortable owning the underlying stock.

If you pick a stock that tanks 50% after assignment, no amount of premium collection will save you. I've seen traders blow up their accounts by running the wheel on meme stocks or speculative tech names. The premium looks attractive until the stock craters and never recovers.

The 6 Criteria for Wheel Strategy Stocks

After years of trading the wheel and tracking my results, I've developed a checklist for evaluating potential wheel candidates. A stock needs to meet most of these criteria before I'll consider it.

High Options Liquidity

This is non-negotiable. You need tight bid-ask spreads to avoid giving up your profits to market makers.

- Average daily options volume of at least 1,000 contracts

- Bid-ask spreads under $0.10 for at-the-money options

- Multiple strike prices available near the current price

Stock Price $20-$150

The sweet spot for wheel trading balances premium potential with capital requirements.

- Too cheap (<$20): Low premium, violent moves, speculative companies

- Too expensive (>$150): Requires $15,000+ capital per position

IV Rank of 20-50%

You want enough volatility for decent premium, but not so much that wild swings are likely.

- Premium is reasonably elevated vs. historical norms

- Market isn't pricing in extreme uncertainty

- You're getting paid fairly for the risk taken

Strong Fundamentals

You might own these shares for weeks or months. Stick with solid businesses.

- Profitable companies with positive earnings

- Reasonable debt levels

- Stable or growing revenue

- Established market position

No Binary Events

Avoid stocks with upcoming events that could cause massive price swings.

- Earnings announcements within 2 weeks

- FDA drug approvals (biotech)

- Major legal rulings

- Acquisition announcements

Happy to Own It

The gut check: If assigned shares and the stock dropped 20%, would you be comfortable holding?

If the answer is no, don't trade it. I only run the wheel on companies I understand and believe in long-term. This psychological comfort makes it easier to stick to the strategy during drawdowns.

If you're paying $0.20-0.30 in slippage on every trade, that's eating directly into your returns. Stick to liquid names where you can get filled at fair prices.

A $50 stock lets you run the wheel with $5,000 in capital per position. This allows for proper diversification across 3-5 positions without needing a massive account.

Stocks with IV Rank above 70% often have that volatility for a reason—earnings, FDA decisions, legal issues. That's not the kind of uncertainty you want when running a mechanical income strategy.

Stock Categories That Work Well

Based on these criteria, certain categories of stocks tend to work better for the wheel strategy than others.

🎯 Blue Chip Dividend Payers

Large, established companies with dividend histories make excellent wheel candidates. The dividend payments while holding shares are a bonus.

💻 Stable Technology

Mature tech companies with diversified revenue streams. These aren't the high-flying growth stocks that double or get cut in half—they're established tech giants with predictable businesses.

💰 ETFs: The Safest Option

If individual stock selection feels overwhelming, ETFs eliminate single-stock risk entirely. You don't have to worry about earnings surprises, scandals, or company-specific disasters.

I've written extensively about trading SPY options, and ETFs remain my preferred vehicle for options income strategies.

Stocks to Avoid

Just as important as knowing what to trade is knowing what to avoid. These categories should be off-limits for wheel trading:

⚠️ Meme Stocks

GME, AMC, and their ilk offer tempting premium. Don't fall for it. These stocks can move 30-50% in a day on nothing but social media sentiment. The volatility that creates high premiums also creates the gap risk that destroys accounts.

⚠️ Small-Cap Biotech

Small biotech companies live and die by FDA decisions. A single approval or rejection can move the stock 50-80% overnight. This is gambling, not income generation.

⚠️ Pre-Revenue Growth Stocks

Companies with no earnings and sky-high valuations based on future potential are terrible wheel candidates. When sentiment shifts, these stocks can lose 70-90% of their value and never recover.

⚠️ Penny Stocks

Stocks under $10 typically have poor options liquidity, wide spreads, and high bankruptcy risk. The math simply doesn't work for generating consistent income.

⚠️ Stocks Near Earnings

Even great companies become risky around earnings. I avoid opening new wheel positions within 2 weeks of an earnings announcement. The elevated IV looks attractive, but you're taking on significant gap risk.

How Many Stocks Should You Trade?

Diversification matters, but over-diversification creates problems too. My recommendations based on account size:

More positions means more management overhead. Each wheel position requires monitoring, rolling decisions, and potential adjustments. Don't spread yourself too thin.

Adjusting for Market Conditions

Stock selection isn't static. You should adjust your approach based on current market conditions:

High Volatility (VIX > 25)

- Be more selective—stick to highest quality names

- Consider ETFs over individual stocks

- Accept lower delta (further OTM) for same premium

Low Volatility (VIX < 15)

- Premium will be thin across the board

- Focus on stocks with elevated individual IV

- Consider sitting on hands if premium doesn't justify risk

Earnings Season

- Many stocks become temporarily untradeable

- Focus on positions that reported recently

- ETFs become more attractive (diversified earnings exposure)

My Stock Screening Process

Here's the exact process I use to find wheel candidates:

This process takes about 10 minutes once you have your watchlist established. The key is having a systematic approach rather than chasing whatever stock has the highest premium today.

Building Your Watchlist

Start with these categories and build a watchlist of 20-30 names:

You don't need to trade all of them. The watchlist gives you options when market conditions favor certain sectors or when individual stocks reach attractive IV levels.

Final Thoughts

The wheel strategy is mechanical by design, but stock selection requires judgment. Take the time to build a quality watchlist of stocks you understand and would be comfortable owning. Screen them systematically using the criteria above. And remember: it's always better to wait for the right opportunity than to force a trade on a marginal stock.

Ready to Master the Wheel Strategy?

Check out my comprehensive guide on mastering the options wheel strategy. And if you want to see how I apply these principles in real trades, follow my wheel strategy results where I share every trade with full transparency.

Stock selection is the foundation. Get it right, and the wheel strategy becomes a reliable income engine. Get it wrong, and no amount of options expertise will save you.

Related Topics: Wheel Strategy, Best Stocks for Wheel Strategy, Options Trading, Cash Secured Puts, Covered Calls, Stock Selection, Options Income, Wheel Strategy Stocks, Selling Puts, Premium Income