If you are reading this blog post you most likely have a good understanding of what an option is. If you don't, maybe start by reading these posts:

Most people get interested in options trading as a leveraged bet on a stock trade. An options contract controls 100 shares of an underlying stock. If I wanted to purchase 100 shares of the SPY it would cost me around $27,600 (based on today’s price). Or I could buy one SPY at the money call option for around $311.

Let’s say the SPY goes up in value by $5.00. My stock holdings would be worth $28,100, a profit of $500. On the other hand, my options trade would go to $500 (assuming no time value premium). If I subtract out the original $311 cost, I would have a profit of $189.

In one trade I risked $27,600 to make $500, and in the other trade, I risked $311 to make $189. Seems like a no brainer to just trade options instead of stock. Options provide a lot of built-in leverage. This is how newer options traders tend to think. While there are valid strategies trading options as such, I submit it is very hard to maintain a consistent monthly income trading options in this form.

The above strategy requires you to be correct on the direction of the stock (and in the case of options, to be right on the timing of that direction). We all know the stock market is pretty random. It is very hard to predict where the market is going and when.

For these reasons, many options traders are turning to a strategy of trading credit spreads using options.

What is a Credit Spread Option?

A credit spread option is an act of taking two or more options and selling the premium they produce. Yes, that sounds confusing. I'll explain, but first, let's explore quickly the concept of writing a contract.

Instead of buying the SPY call option I mentioned above for $311 let's say I wrote the contract. By writing this contract someone would pay me $311 in exchange for the right to buy from me 100 shares of the SPY at a certain price in the future. I am more or less selling insurance. Someone gives me $311 today to ensure they can fix the price to buy the SPY in the future. Should the SPY not reach the strike price of the option I keep the $311. If the option expires in the money I have to deliver the SPY shares (meaning I lose money).

With that explained, how about the idea of selling one option while buying another. Let’s look at the credit spread trade I trade most, a put credit spread. For easy numbers let’s assume the SPY is trading at a price of $250. Let's assume today is September 1st. I could open the following trade.

Buy: SPY Nov 14 2018 $233.00 Put @ 1.00

Sell: SPY Nov 14 2018 $235.00 Put @ 1.25

Simultaneously, I am buying an out of the money (OTM) put option and writing (selling) an OTM put option with a higher strike. Since the higher strike is closer to being in the money (ITM) it sells for more money. Combining these trades I collect a credit of .25 (or $25). The option I am selling would bring in a credit of $125 but I have to use the credit to pay the $100 for the second option.

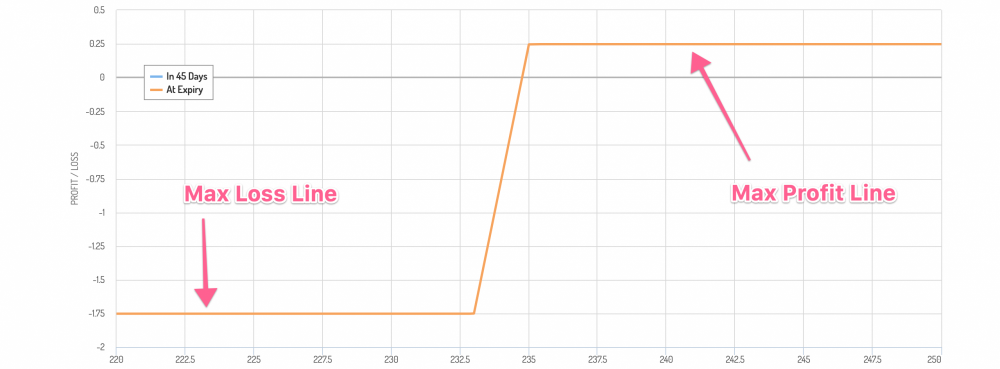

The graph above does a good job of visualizing this trade. The x-axis is the price of the SPY on November 14th, 2018. The y-axis is the profit based on the possible outcomes of the final SPY price. As a reminder, option pricing is the price of one share but every contract is really 100 shares. So when the chart shows $0.25 that means $25.00 (0.25 * 100) in your brokerage account. Also, we are assuming you are trading just one contract here. If for example, you could trade 20 contracts (10 on the short side and 10 on the long side) you would have $250 instead of $25.

I found optionsprofitcalculator.com and Option Creator to be rather useful for understanding how pricing works with credit spreads.

Guessing Market Direction is a Fools Game

Continuing with the trade mentioned above let’s explore the risk we just put on. November 14th is around 45 days in the future. At the end of 45 days if the SPY is $235 or higher I get to keep the $25 credit I collected. If the SPY is below $235 I start to lose money.

Downside protection is why I purchased the second option. If the SPY falls lower than $233 that option will kick in and protect me. Our maximum loss is $200 ($235-$233 * 100), plus the $25 we received as a credit. Meaning the most we can lose on this trade is $175.

As a quick side note, the SPY does not drop more than 5% often. Take a look at, How Often the SPY Falls More Than 5% in a 30-Day Period and Why You Should Care to learn more.

Why do I like this style of the trade so much? Often when you are collecting a premium (a credit) you only have to worry about an extreme move in the underlying stock. In the example above, I simply do not care if the stock price of the SPY goes up, stays flat, or goes down a little. I just care that the SPY does not drop in value below $235. I do not need a crystal ball to tell me where the market is going. I just need the market to not have wild swings.

Best Stock to Trade Credit Spreads on

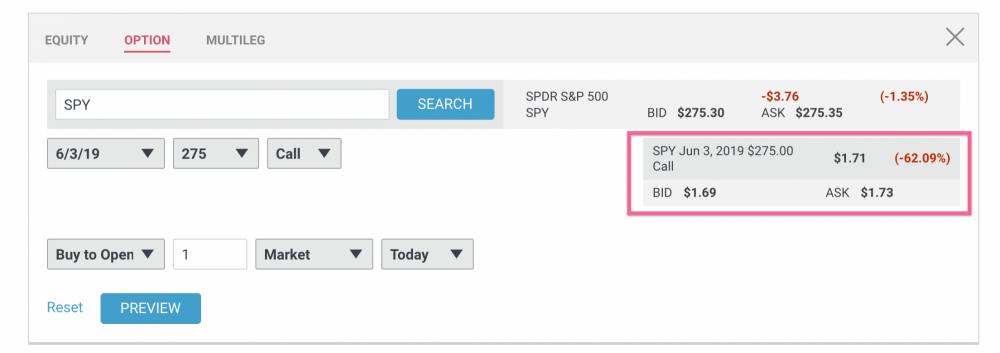

In the example above we mainly looked at trading the SPY which is the ETF tracking the S&P 500. We can place credit spread option trades on just about any stock, however, there are some that are better than others. When selecting an underlying stock you want to make sure there is plenty of volume in the options market. Volume, often related to liquidity, is key to this type of trading. The main reason is without liquidity the gap between the bid and the asking price can be rather large. For example, if you can buy an option for $1.00 but you can only write an option for $0.20 the math would not work out. You really want the bid and ask prices to be very close together. A great example is in the screenshot below. That is a more reasonable bid and ask spread.

Most traders like high volume ETF. My personal favorite is the SPY (as I am sure you have guessed by now). However, here is a list of popular stocks on which people often trade credit spread options.

- SPY: ETF S&P 500

- QQQ: Nonfinancial stocks listed on NASDAQ (mainly tech stocks)

- IWM: ETF Russell 2000

- AAPL: Apple

- NFLX: Netflix

- AMZN: Amazon

- GOOGL: Alphabet (Google)

- XOM: Exxon Mobile

- TSLA: Tesla

The list above is a short list, there are many stocks you can trade. I give you this list so you can compare other stocks you are considering trading against this list to see if they exhibit the same characteristics.

As a quick aside I would like to mention I am not a big fan of trading individual stocks without a reason. I might trade credit spreads on individual stocks going into an earnings announcement or something but not day to day. One wrong news headline and a stock can make a wild swing in price. I much prefer ETFs on big indexes (such as SPY or QQQ). While ETFs can have swings, they tend to be much smaller in directional change.

Drawdowns when Trading Spreads in the Options Market

If you have made it this far you might have the impression that credit spreads are an amazing way to make money quickly. Let’s take off our rose color glasses and look at reality. Typically a credit spread option strategy will lead to many wins where you profit a little, and a few losses where you lose a lot of money. To profit, you need to make sure your little wins outpaces your big losses. You will have losses--it is only a matter of time. This is called a drawdown period. I share my put credit spread trades on our blog via the category “Spicer’s Trades.” I highly recommend you look through the different months and get an idea of what a drawdown looks like vs. a successful month.

The best options traders tend to trade a very small percentage of their account size per trade, but place a big number of trades. It is highly recommended to keep each trade to somewhere around 5% of your planned capital. I have been known to go a little higher on more stable ETFs such as the SPY but I tend to do this with money that is a result of profit, not capital I put into the account from other earnings.

Trading Options where you Receive a Credit is DaBomb!

I hope I did well above in highlighting some of the benefits of trading options where you receive a credit vs. buy and hope the price goes up. Personally, I find it so liberating and stress-free to not have to worry about the direction of the market. Once again when trading credit spreads you can often build a strategy where you only lose in the case of a drastic move in the underlying stock price.

For some parting words, I would suggest if you are new to options trading, you start out small. Maybe paper trade for a while before committing real capital and when you do commit real capital assume you will lose it all. Personally, I have blown up many accounts before learning how to trade these strategies profitably. Once you figure out the correct strategy and learn to size your trades profitably, you will never want to buy and pray again.

Related Topics: Credit Spreads