Anytime a stock looks headed for a drawdown, a good option technique that can profit from this price movement is the bear call spread. The derivative play receives a net credit at the commencement of the trade, and this profit will be the maximum the strategy earns if the stock sinks below the short call’s strike price.

Details of the Bear Call Spread

There are two legs in a bear call spread, and as the name implies, each one is a call option. One is short, and the other is long. The written contract has a lower strike price. Both contracts have the same expiration date and underlying equity. The long contract is purchased out-of-the-money, while the short option is sold in-the-money. This means the bear call spread has an assignment risk from the very beginning.

Despite this hazard, the trade receives a net credit at the entry point. The hope is that the stock price will decline below the strike price of the short call, sending it OTM.

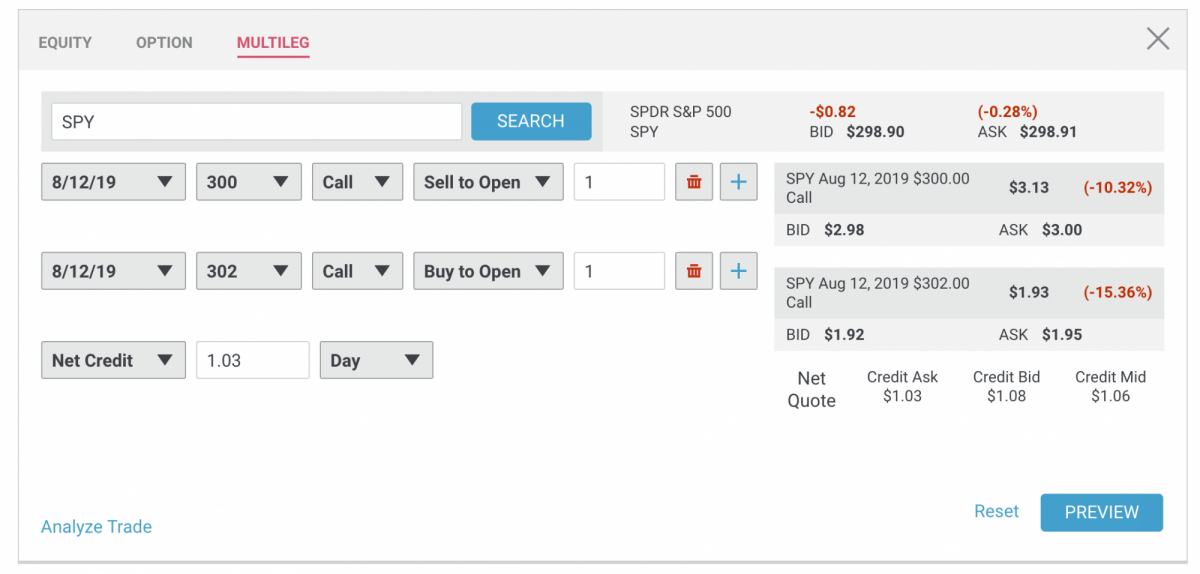

Here is an example of placing an order for a bear call spread on the SPY:

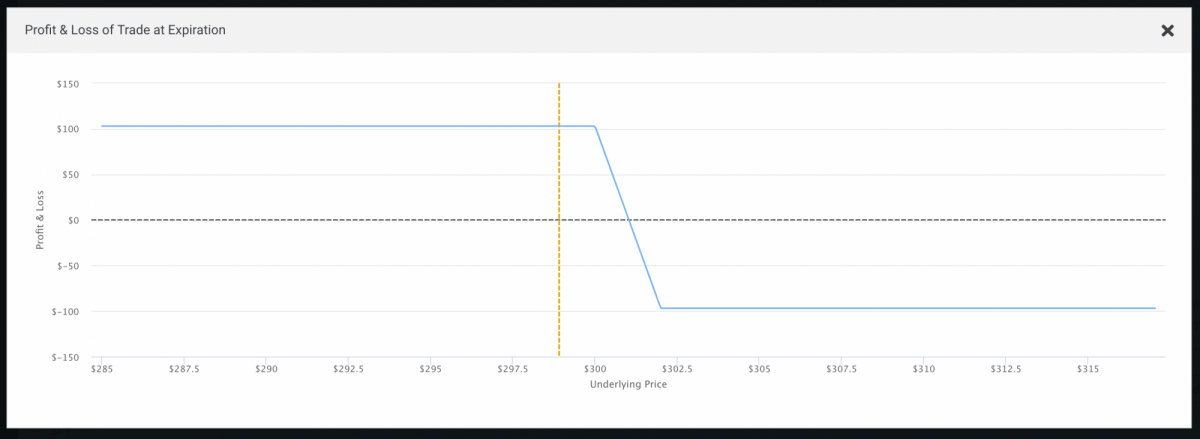

Here is an example of the profit and loss graph for this trade.

Option assignments are frequently related to dividends, so keep an eye on the ex-dividend date of the underlying equity. Short calls are frequently assigned right before the ex-dividend date of a stock; therefore, be sure to verify the stock’s dividend schedule when creating a bear call spread.

Example of a Bear Call Spread

In order for a bear call spread to remain profitable at the expiration of the two contracts, the underlying stock price needs to retreat below the strike price of the short call. This typically isn’t very far, as the strike price may only be a few dollars or even less from the stock price at the start of the trade. A major collapse in stock price isn’t necessary; in fact, a bear call spread will earn just as much as if the stock only retreated below the short call’s strike price. There isn’t a third leg in the trade that increases in price if the stock declines substantially.

You begin looking for stocks that you think are overvalued and therefore might decline in price in the near future. The stock screener that is available on your broker’s website has a feature that allows you to look for equities that have a high amount of short interest. This means that many investors are shorting the stock. Such bearish sentiment indicates a high degree of confidence that such a stock is overbought.

You see that Netflix has a lot of bearish interest. Although the stock has a great performance history, many investors think the price is too high and is set for a pull back. You analyze the stock using both fundamental and technical methods. You see that the company is not set to pay a dividend within the next four weeks. Based on your research, you decide that NFLX is a good candidate for a price decline in the near future.

Submitting the Order

You’re fairly confident in your analysis of Netflix, so you decide to trade three contracts per leg. You sell three call options with a strike price of $187.50. Netflix is currently trading at $188.50, so these written contracts are ITM. The sale earns $6.50 per share. With three contracts, that’s a total inflow of $1,950 (300 × $6.50).

The second and final leg is a long call with a $190 strike price. The cost is $5.20 per share, for a total expenditure of $1,560. Because this leg has a lower cost than the first, the bear call spread earns a profit at the outset. The details of the trade are seen in the following table, for a net credit of $390:

Short NFLX 187.50 Call @ 6.50 $1,950

Long NFLX 190.00 Call @ -5.20 -$1,560

The contracts expire in four weeks. The hope is that the short contract, which is ITM immediately, isn’t assigned before the stock retreats below $187.50.

Outcome

Going into the first week, Netflix experiences quite a bit of volatility. The price reaches a low of $187 on the third day of the trade, which puts the short option OTM. This is what you were hoping for, and you can close the trade at this point by buying to close the short contract and selling to close the long one. Choosing this route so early in the trade, however, will be very expensive because there’s a lot of time value left in the contracts. You look at this possibility and see that the price would be $370, leaving you with just a $20 profit, not considering commissions, which will exceed $20. So you decide to leave the trade as it is.

The second week, Netflix experiences less volatility, although it moves back above $187.50. Now the short contract is assignable once again. Going into the third week, investors continue to push NFLX higher, sending it to $189.

You become concerned at this point that you may receive an assignment. If this happens, you can meet your obligation in one of two ways. You can either go into the market and purchase 300 shares of Netflix and sell them to your counterparty, or you can exercise your long call at $190.00 and use those shares for the assignment. Since the stock is under $189, you would buy in the market.

The fourth and final week shows up, and robust trading activity continues to send the stock higher. NFLX reaches $191 by the end of the week, and you receive an assignment on the last day of the trade. You exercise your long call, which allows you to purchase the stock at a cheaper $190. After buying these shares, you immediately sell them at $187.50 to meet your assignment.

Determining the Loss

This trade is definitely going to result in a loss because the stock went in the opposite direction that you were expecting. The total loss can be discovered with the following equation:

Net credit – Long call exercise + Short call assignment – commissions = Loss

$390 – $57,000 + $56,250 = -$360

It’s a $360 loss before commissions are thrown into the equation. If you had exited the trade after the first week, you would have saved over $300. Don’t forget that the IRS will allow you to use this capital loss to offset capital gains in the same tax year. And excess capital losses can be carried forward for future tax years.

Stock Market and Options Market

One of the lessons we can gain from this hypothetical trade is that the stock market can never be divorced from the options market. While the derivative trade looked good on paper, trading activity in NFLX created an unprofitable environment. While the market price of Netflix may be in a bubble, you don’t get to buy and sell based on fundamental value. Options reflect market value, not fundamental value. Whatever the actual worth of NFLX, buyers and sellers decide what the stock price is going to be, and this impacts option prices.

Vital Points

The maximum gain a bear call spread can earn is the net credit received at the start of the trade. Commissions will lower this limit. This maximum point is achieved if the market price of the underlying equity is below or equal to the strike price of the written contract.

The highest possible loss is the difference between the options’ strike prices minus the net premium earned. Trading fees should also be added to increase the maximum loss.

There is one breakeven point. It is the short option’s strike price plus the net credit per share.

Related Topics: Call Options, Call Spread