Education

The wheel strategy is one of the most reliable ways to generate consistent income from options trading. But here's what many traders miss: your stock selection matters more than your options execution. You can have perfect timing and flawless trade management, but if you're running the wheel on the wrong stocks, you're setting yourself up for disappointment.

The wheel strategy is one of the most reliable ways to generate consistent income from options trading. But here's what many traders miss: your stock selection matters more than your options execution. You can have perfect timing and flawless trade management, but if you're running the wheel on the wrong stocks, you're setting yourself up for disappointment.

The wheel options strategy is one of the most reliable income-generating approaches for options traders. Since 2024, I have generated over $27,000 in profit using this strategy—and I share every trade publicly on this website.

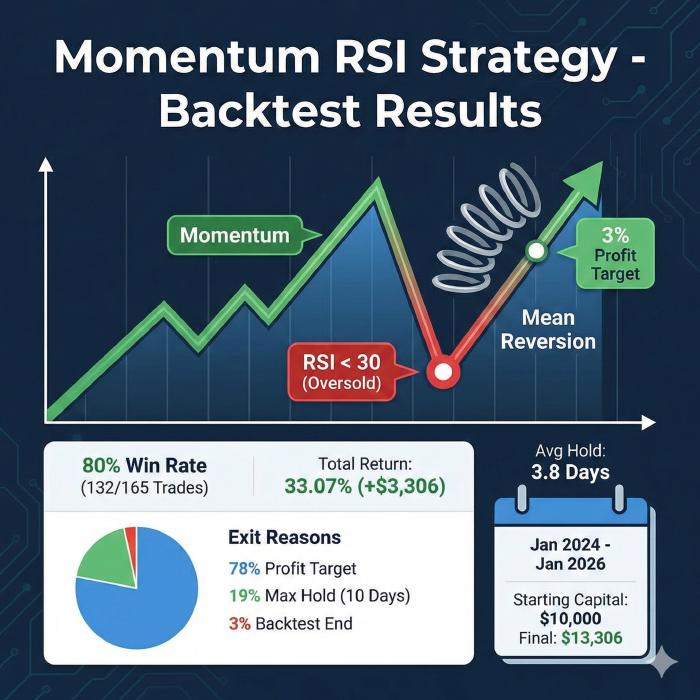

I'm always tinkering with new trading ideas and running backtests. It's one of my favorite parts of being a trader—exploring what works, what doesn't, and why. Recently, I came across a Reddit post in r/algotrading that caught my attention. The poster claimed an 81.6% win rate with impressive gains using a momentum-based approach.

I'm always tinkering with new trading ideas and running backtests. It's one of my favorite parts of being a trader—exploring what works, what doesn't, and why. Recently, I came across a Reddit post in r/algotrading that caught my attention. The poster claimed an 81.6% win rate with impressive gains using a momentum-based approach. Let me be honest with you: 2025 started with one of the most brutal drawdowns I've experienced in my entire options trading career. If you've been following my trades on this website, you already know the pain. Both my SPY Put Credit Spread strategy and my Zero DTE SPX Iron Butterfly strategy took devastating losses in the first quarter—losses that completely wiped out the previous year's gains and then some.

Let me be honest with you: 2025 started with one of the most brutal drawdowns I've experienced in my entire options trading career. If you've been following my trades on this website, you already know the pain. Both my SPY Put Credit Spread strategy and my Zero DTE SPX Iron Butterfly strategy took devastating losses in the first quarter—losses that completely wiped out the previous year's gains and then some.

Day trading options can be a lucrative venture for traders who understand the intricacies of the options market. Unlike the typical buy-and-hold strategy, day trading involves quick decision-making and strategic planning to capitalize on short-term movements in the market.

Deciding between SPX and SPY for your investments? The key difference lies in SPX being a non-tradable index and SPY a tradable ETF. Our guide focuses on the distinct trading dynamics and opportunities each presents, helping clarify which might suit your strategy without overwhelming you with the finer points reserved for our in-depth exploration of “spx vs spy”.

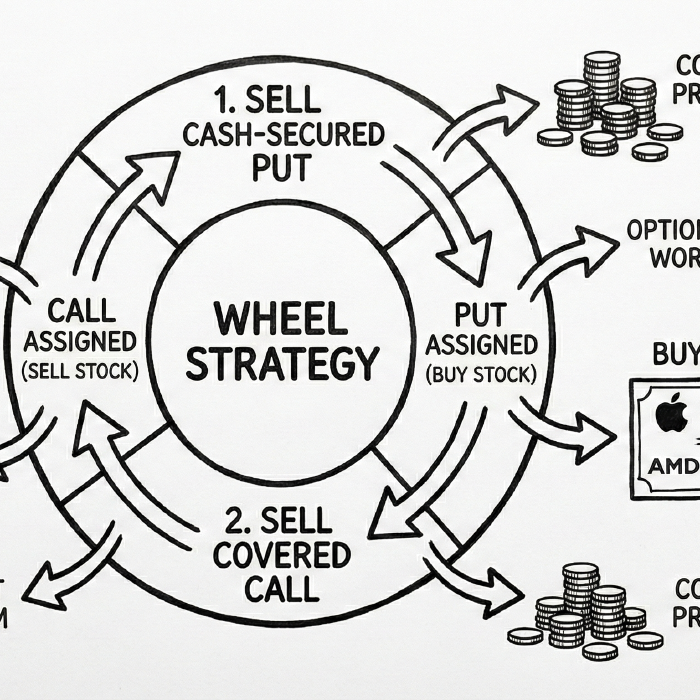

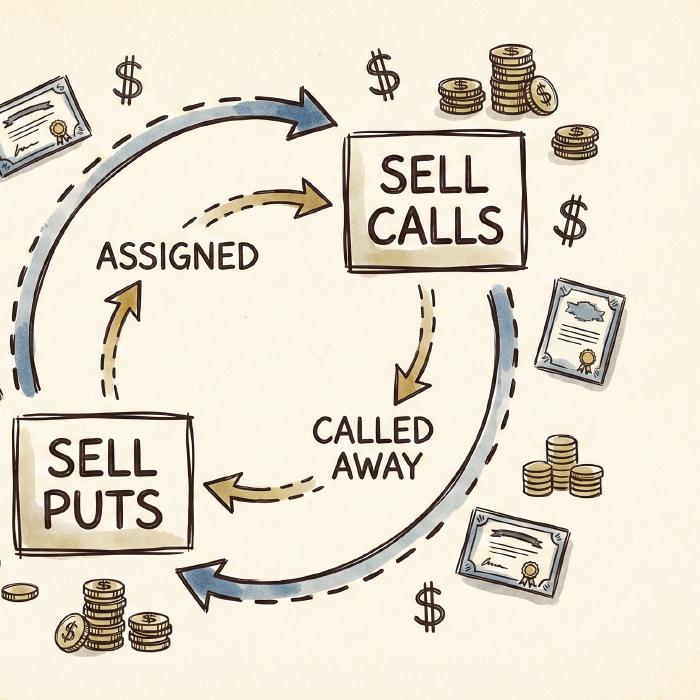

The Options Wheel Strategy is a methodical approach to options trading that combines both income generation and potential stock ownership in a seamless cycle.

If you’re shorting stocks, there’s a way you can do it while protecting your upside risk. Using an option spread, the short stock position will be protected during the lifetime of the derivatives. The strategy can also earn a small amount of income at the outset of the trade. Here’s a rundown on using short collars.

If you’re shorting stocks, there’s a way you can do it while protecting your upside risk. Using an option spread, the short stock position will be protected during the lifetime of the derivatives. The strategy can also earn a small amount of income at the outset of the trade. Here’s a rundown on using short collars. Options trading can often seem like a complex maze, but one strategy stands out for those with a bullish outlook on the market: the bull put credit spread. This multi-leg, risk-defined strategy has limited profit potential but can significantly benefit from an increase in the underlying asset's price before expiration.

Options trading can often seem like a complex maze, but one strategy stands out for those with a bullish outlook on the market: the bull put credit spread. This multi-leg, risk-defined strategy has limited profit potential but can significantly benefit from an increase in the underlying asset's price before expiration. IV crush is a phenomenon that occurs when implied volatility (IV) drops significantly after an event or earnings announcement. This can cause option prices to decline, even if the underlying stock price remains unchanged. Why Does IV Crush Happen? IV is a measure of the expected volatility of a security over a period of time.

IV crush is a phenomenon that occurs when implied volatility (IV) drops significantly after an event or earnings announcement. This can cause option prices to decline, even if the underlying stock price remains unchanged. Why Does IV Crush Happen? IV is a measure of the expected volatility of a security over a period of time.