Options trading can be a great way to generate income, reduce risk, or speculate on the future direction of the market. However, it is important to understand the risks involved before you start trading options.

Education

The world of options trading can be both exciting and lucrative for investors who know how to navigate its complexities. Among the many tools and strategies available to traders, the Put Call Ratio is one of the most valuable indicators. In this blog post, we will discuss what the Put Call Ratio is, how it's calculated.

The world of options trading can be both exciting and lucrative for investors who know how to navigate its complexities. Among the many tools and strategies available to traders, the Put Call Ratio is one of the most valuable indicators. In this blog post, we will discuss what the Put Call Ratio is, how it's calculated. Options trading strategies can provide opportunities to profit from short-term stock movements while managing risk. It's essential to understand the risks and rewards associated with each strategy and to consider factors such as transaction costs, taxes, and liquidity.

Options trading strategies can provide opportunities to profit from short-term stock movements while managing risk. It's essential to understand the risks and rewards associated with each strategy and to consider factors such as transaction costs, taxes, and liquidity.

As an investor, you're probably familiar with the traditional buy-and-hold strategy, which involves purchasing a stock or other security and holding onto it for an extended period. Leap options offer a compelling alternative that allows you to capitalize on long-term growth while potentially reducing your investment costs.

Options trading strategies have the potential to be highly lucrative, but they can also be incredibly complex to figure out. Unlike traditional stock trading strategies, options trading introduces numerous variables, such as strike price, type, expiration, delta, gamma, and volatility, among others.

Options trading strategies have the potential to be highly lucrative, but they can also be incredibly complex to figure out. Unlike traditional stock trading strategies, options trading introduces numerous variables, such as strike price, type, expiration, delta, gamma, and volatility, among others.

Bearish pressure on a stock can generate profits for short sellers. It can also earn money for option traders. Using a bear call spread, a net premium is earned, and this income will be pocketed if the stock makes just a modest decline.

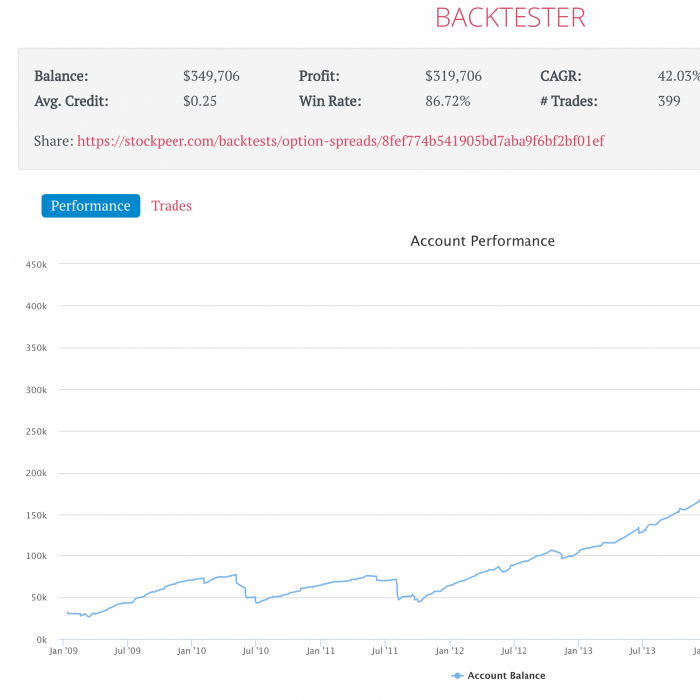

A credit spread option is an act of taking two or more options and selling the premium they produce. Yes, that sounds confusing. I'll explain, but first, let's explore quickly the concept of writing a contract. In this post, we will explore how traders can make monthly income trading options via spreads.

When you foresee upcoming volatility in a stock, an option play that can make money from it is the short call calendar spread. Because there are two expiration dates in the strategy, it has a considerable amount of complexity and should only be attempted by experienced traders.

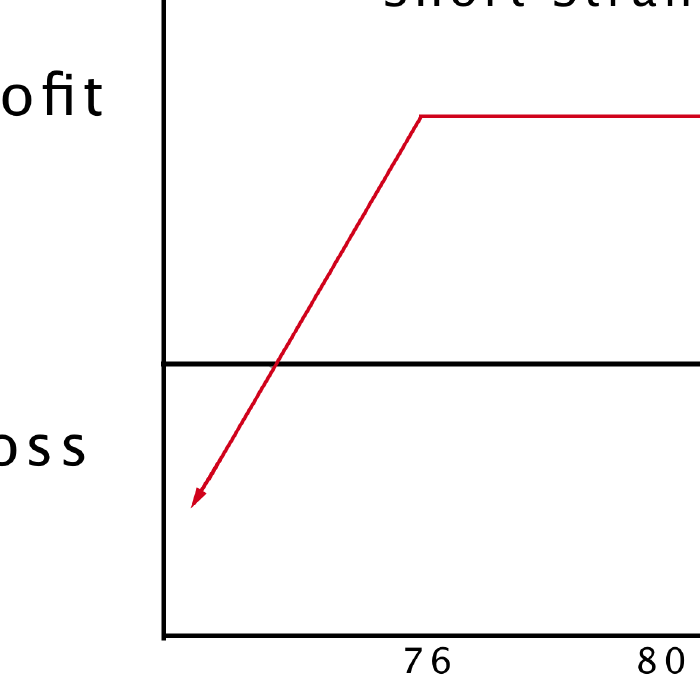

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.

American corporations release their earnings reports every 3 months. The data gives investors an idea of how well the companies are doing financially. If an earnings announcement contains any information traders weren’t expecting, the stock price could plummet or skyrocket, depending on whether the release is negative or positive.