Education

Options trading strategies have the potential to be highly lucrative, but they can also be incredibly complex to figure out. Unlike traditional stock trading strategies, options trading introduces numerous variables, such as strike price, type, expiration, delta, gamma, and volatility, among others.

Options trading strategies have the potential to be highly lucrative, but they can also be incredibly complex to figure out. Unlike traditional stock trading strategies, options trading introduces numerous variables, such as strike price, type, expiration, delta, gamma, and volatility, among others.

Bearish pressure on a stock can generate profits for short sellers. It can also earn money for option traders. Using a bear call spread, a net premium is earned, and this income will be pocketed if the stock makes just a modest decline.

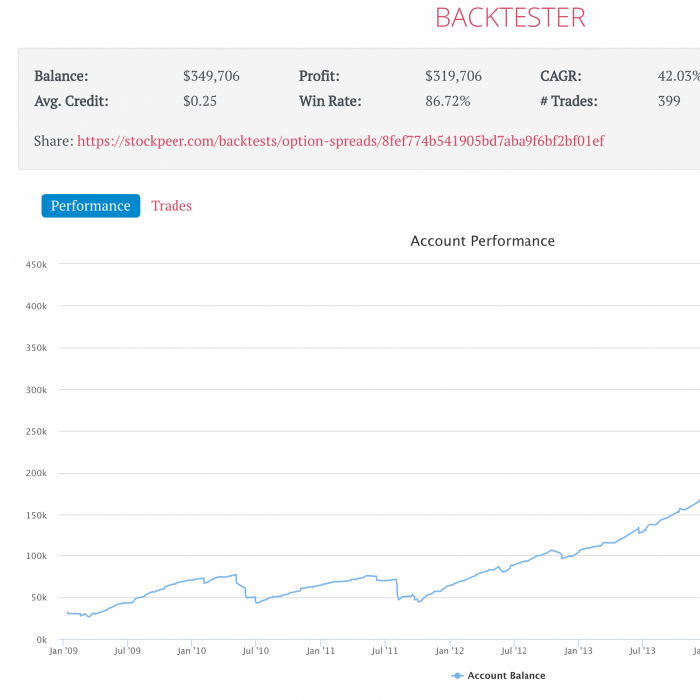

A credit spread option is an act of taking two or more options and selling the premium they produce. Yes, that sounds confusing. I'll explain, but first, let's explore quickly the concept of writing a contract. In this post, we will explore how traders can make monthly income trading options via spreads.

When you foresee upcoming volatility in a stock, an option play that can make money from it is the short call calendar spread. Because there are two expiration dates in the strategy, it has a considerable amount of complexity and should only be attempted by experienced traders.

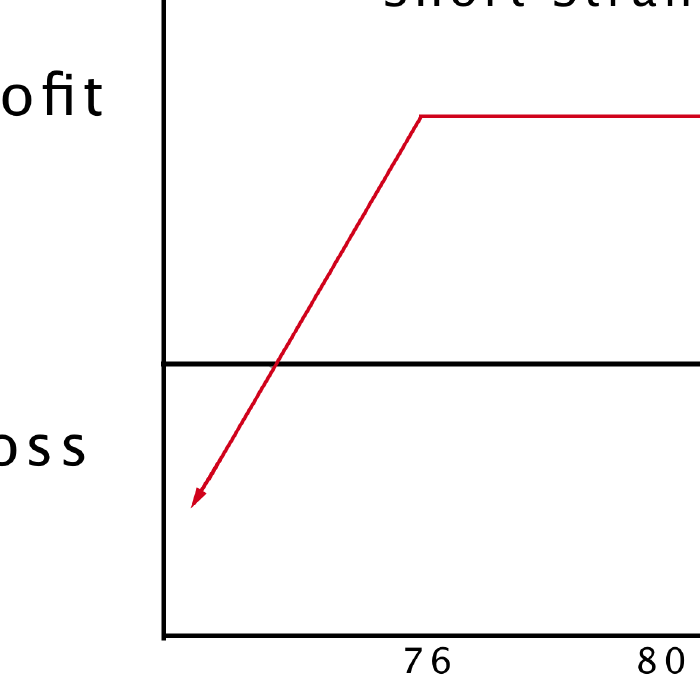

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.

American corporations release their earnings reports every 3 months. The data gives investors an idea of how well the companies are doing financially. If an earnings announcement contains any information traders weren’t expecting, the stock price could plummet or skyrocket, depending on whether the release is negative or positive.

Instead of trading stocks or other securities, why not trade time? The long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. The maximum loss of this strategy is capped at the net debit the investment incurs at the entry point.

Many stock traders are jumping into options trading. Options offer a fantastic way to diversify and to produce extraordinary returns. Let’s look at the key differences between options and stocks, and why so many stock traders are becoming options traders.

The short calendar spread is a good opportunity to profit from a stock’s impending upswing or decline. The maximum gain from the investment is the net credit received when entering the trade, and the maximum loss could be substantial. Therefore, this option strategy should only be used by experienced traders.

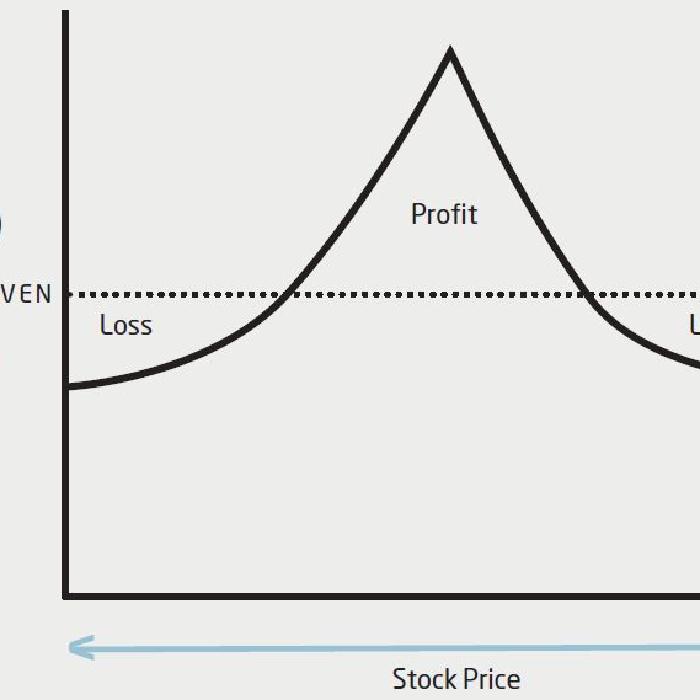

The options butterfly spread is a low-risk options trading strategy that stands a high chance of producing a small profit. The butterfly options trading strategy uses four options contracts to produce profits off of price stable markets.