There are six variables that determine an option’s theoretical value. But, theoretical value is not the same things as market value. The thing that links theoretical and market value together is one key variable out of the whole mix. This one key variable is volatility and it has a huge influence on how an option is going to trade.

Education

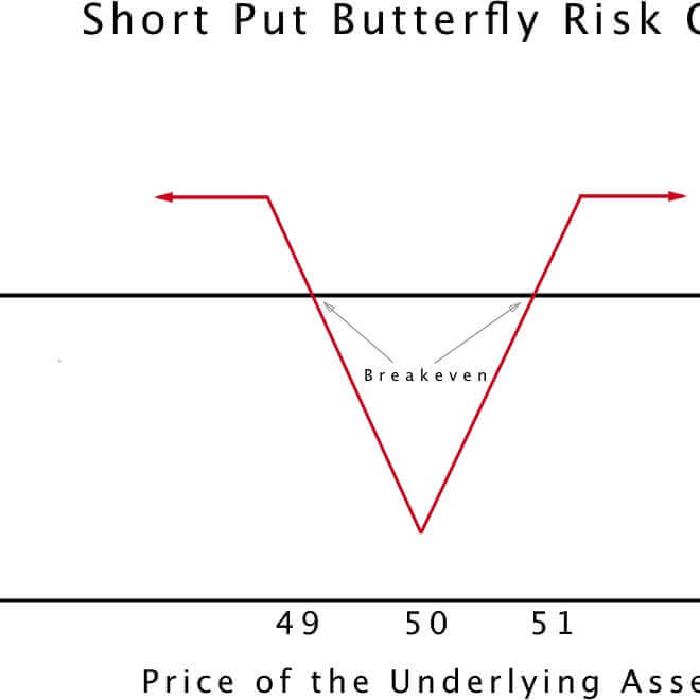

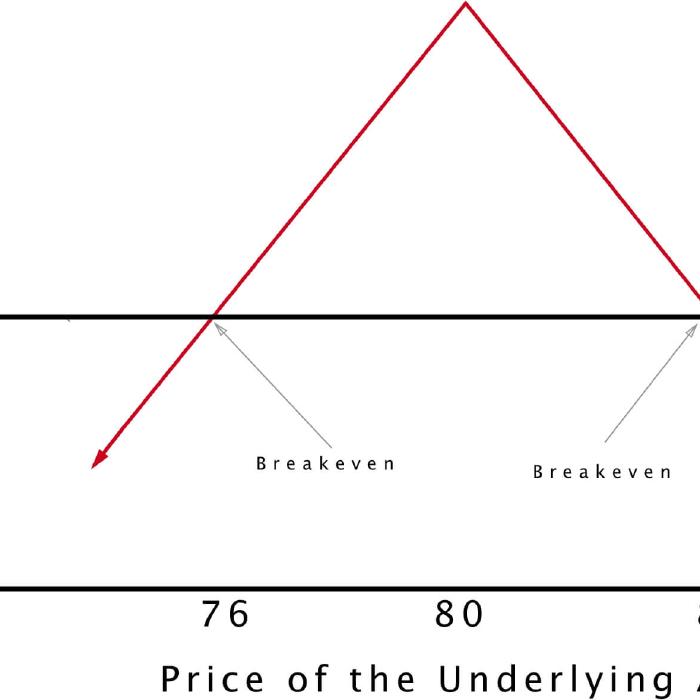

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

Investing comes with risks, that’s a fact of life. Generally speaking, the greater the risks, the greater the potential for profits. In these regards, options trading offers a high potential for profits, but does come with some higher risks. This is especially true for newer investors. Experienced and/or well-educated options traders, however, can utilize a variety of strategies to lower risks. For newer investors, paper trading options is a great way to get started.

Investing comes with risks, that’s a fact of life. Generally speaking, the greater the risks, the greater the potential for profits. In these regards, options trading offers a high potential for profits, but does come with some higher risks. This is especially true for newer investors. Experienced and/or well-educated options traders, however, can utilize a variety of strategies to lower risks. For newer investors, paper trading options is a great way to get started.

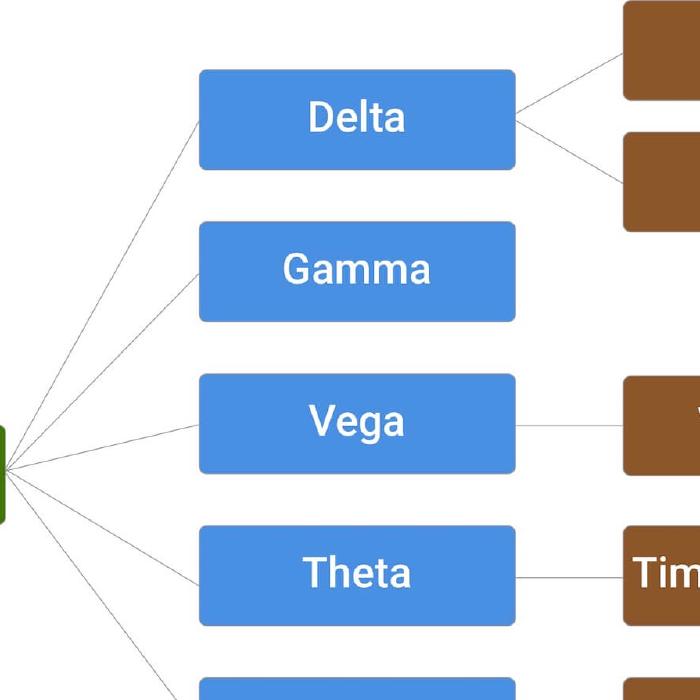

Knowing how the Greeks influence premium is not academic. Understanding how they are likely to affect your next trade is a critical component of that trade’s set up. You should always perform an analysis of the Greeks before you send an order to your broker. Here are some important things to look for.

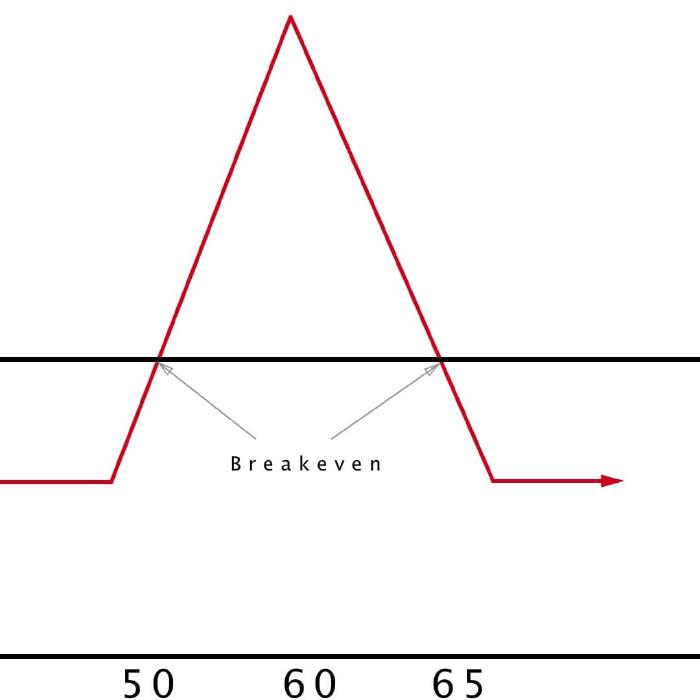

If you want a conservative option investment that controls losses, take a look at the butterfly strategy. This derivative tactic comes with finite profitability, but also downside protection. The butterfly play is best for stocks that have low volatility.

Most traders realize that options increase or decrease in value as the underlying stock moves up or down in price. But, there’s a lot more to how an option’s price changes over the course of time before expiration. A better understanding of option greeks will go a long way to improving the success of your trades.

Making money trading delta options is how top options traders trade. What many traders don’t consider is that your delta doesn’t have to stay consistent throughout a trade. Many professional options traders manage their positions in order to add or decrease delta.

Volatility Trading is a variable in an option pricing model used to determine the theoretical value of an option. And, among all the variables in an option pricing model, it is the only one that is derived from market sentiment. But, the market doesn’t always get it right. That creates opportunity for an options trader.

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

There are many different types of options. Options are “derivatives”, which simply means that their value is derived from another asset. Consider stock-based options, they derive their value from the stocks that they are based on. In general, derivatives can be based on a huge range of assets. This is true of options as well. Different Types Of Options Explained While many options are tied to stocks, options can also be based on a huge range of different assets.

There are many different types of options. Options are “derivatives”, which simply means that their value is derived from another asset. Consider stock-based options, they derive their value from the stocks that they are based on. In general, derivatives can be based on a huge range of assets. This is true of options as well. Different Types Of Options Explained While many options are tied to stocks, options can also be based on a huge range of different assets.