Have you ever entered an options position and had difficulty understanding how the price fluctuates? Perhaps you were confused by the amount of profit or loss caused by stock movement relative to your position? If this has ever happened to you, you could learn more about delta, and how long delta strategies fits into your trading strategy.

Education

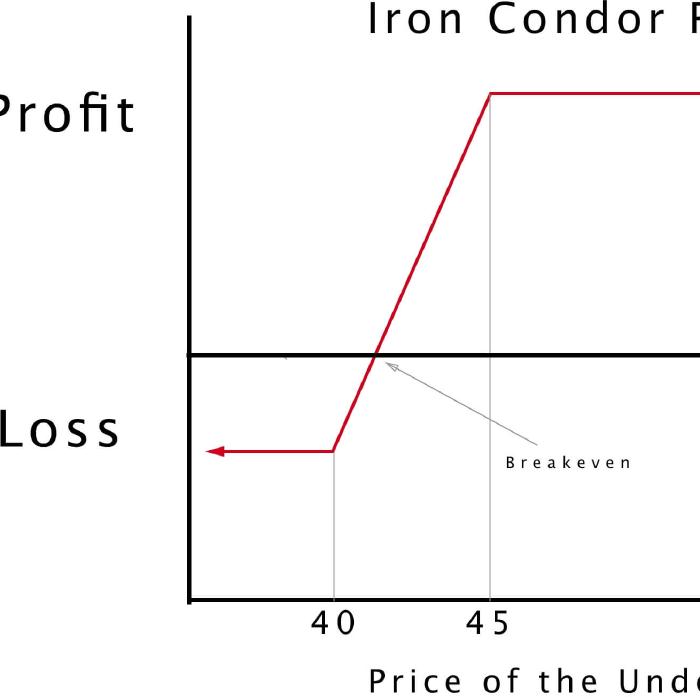

The Iron Condor is a very useful options trading strategy. While considered "advanced" by many, once you get a good handle on the iron condor, traders at any level can use it. This options trading strategy is especially useful for profiting off of stable markets that are experiencing sideways price movements. Next up ........Iron Condor Explained.

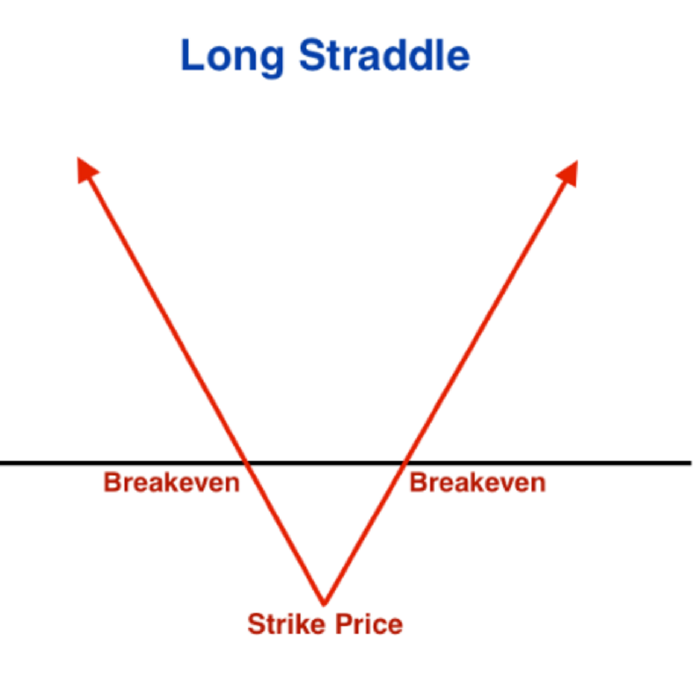

Although volatility is often spoken of in the financial press as undesirable, long straddles are one case where you can profit from it. If you foresee major price swings in the near future. Time to learn about long straddles.

The catch is if your strategy is not well planned or implemented with discipline. Meaning that what makes the 3 factors so definitive when trading credit spreads is implementing a brilliant strategy with fidelity.

In the options trading world there is a type of trade called a put credit spread. The goal of this trade is to collect money and hope the market does not move against you.

A put option is the opposite of a call option—and if you don’t know what that is, see my previous post What Is a Call Option? This post uses a fictional scenario to illustrate the basics of what a put option is.

Let’s imagine that I have a tractor I am offering for sale for $20,000—which is a smoking deal because the same tractor is selling elsewhere for $25,000. My neighbor realizes that I am unaware of the fair market price and concludes that my tractor would be a good investment for him.

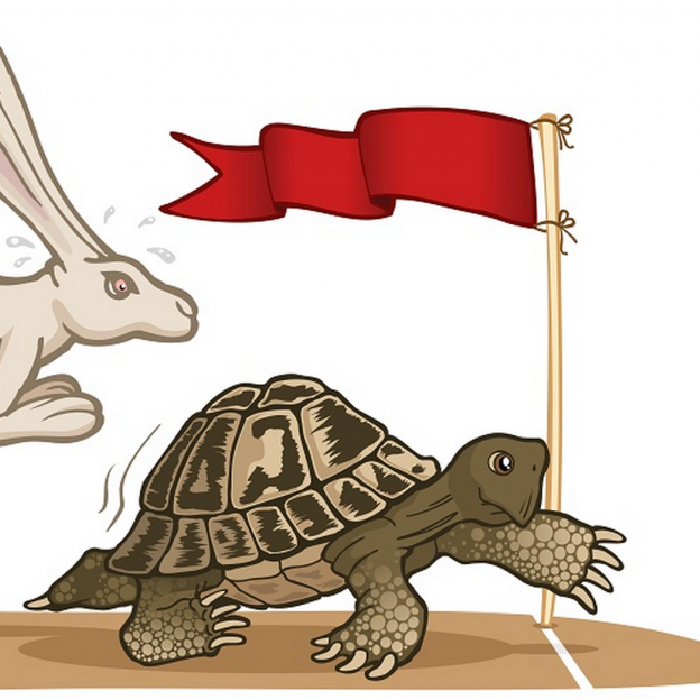

Wall Street is the domain of traders and investors. Typically we envision traders sitting in front of rows of monitors looking to make a quick buck by continually getting into and out of financial positions. In contrast, investors are the Warren Buffett types who buy and hold stocks for long periods of time.