Today I’m going to go over Option Greeks: what they are; what their impact is on premium; and, what you ought to be looking for as you set up a trade.

For some of you, this post will be remedial. For others it may be a helpful refresher. And, for sure others, this information may be completely new material. Readers that don’t already have at least some experience with options – either trading them or reading about them – may miss some important points. So, if you are not familiar with basic options terminology, then you may have a hard time following along.

What Are Option Greeks?

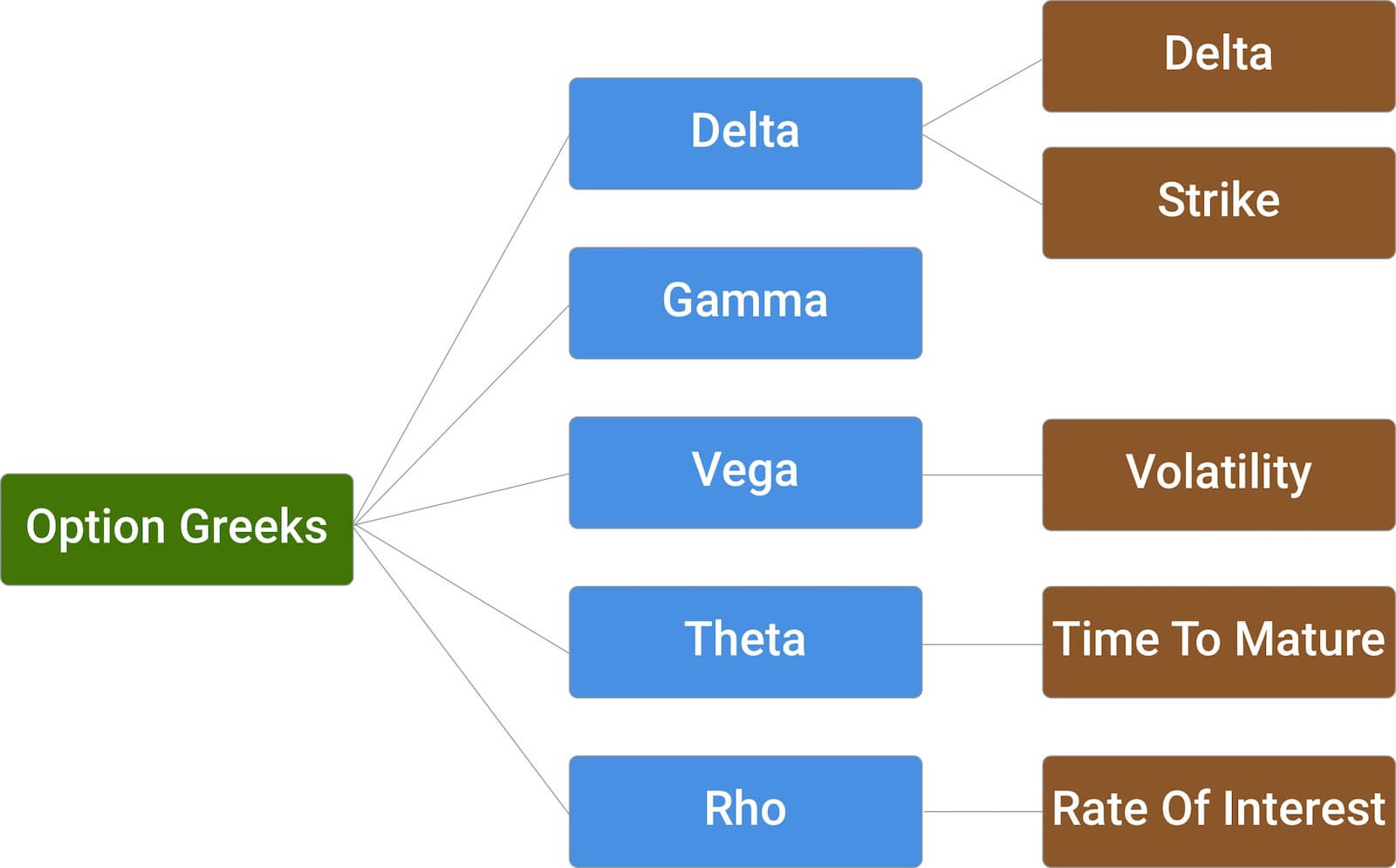

The Greeks are a collection of metrics that help a trader understand how option premium is going to change in relation to a move in something else. There are five Greeks. They are Delta, Gamma, Rho, Theta, and Vega.

Right off the bat, I’m going to tell you that I don’t pay any attention to Rho. Rho tells you how premium is going to change with a 1% move, up or down, in interest rates. Now, the likelihood that you’re going to see that big a move in rates before a contract expires is not very high. This is especially the case if most of the trades you make go out fewer than 60 days. So, unless your trading methodology centers around buying or selling LEAPs, I suggest that you don’t need to pay much attention to Rho.

Now, with that said, some day interest rates may be higher than they are now. You never know. So, just in case that happens, here’s how Rho affects premium. If interest rates rise by 1%, then a call’s premium will decrease by the value of its Rho. Call premium will increase by the value of Rho when interest rates fall by 1%. The exact opposite is true of put premium. The reason a change in interest rates will affect premium is because it costs money to maintain an open options position. When interest rates rise the cost to carry a position becomes more expensive. When rates fall, the cost to carry becomes less expensive. Rho compensates for this and adjusts premium accordingly.

Gamma, Gamma, Gamma!

Another one of the Option Greeks that I don’t consider when setting up a trade is Gamma. Gamma tells us how much Delta is going to move with each one-point change in the underlying. If Delta is at .50 and Gamma is at .10 and the underlying moves up by one point, then Delta will move to .60. If the underlying declines by one point, then Delta will go to .40. Gamma affects puts the exact same way it affects calls. But, bear in mind that this assumes you’re long. When you’re long Gamma is a positive number. When you’re short, it’s negative. Gamma is at its zenith when the option is at-the-money and trails off the further the option goes in-the-money or out-of-the-money.

The reason that I don’t factor Gamma into my decision making when I model out a trade is because if I’ve gotten the other components right, then Gamma will just be along for the ride. And, if I’m in a trade that goes south, then it’s because something else went wrong. Gamma won’t be the cause of either a winning or a losing trade. Winners and losers will be much more affected by Delta, Theta, and Vega.

The Big Three – Delta, Theta, and Vega – The Must Know Greeks

Delta....

Delta tells you how much premium is going to change with every one-point move, up or down, in the value of the underlying. It’s expressed as a decimal number. So, for example, if an option you’re considering has a Delta of .50 the ramification of a one-point move in the underlying is a 50-cent move in premium. Traders also use Delta as a predictor of the likelihood that a given option will be in-the-money at expiration. So, traders say that an option with a .30 Delta has just a 30% chance of expiring in-the-money. But, one with a .80 Delta has an 80% chance.

Each Delta lies on a continuum numerically between 0 and 1.00. Call Deltas are positive; put Deltas are negative. When an option is at-the-money, a call’s Delta will be at .50 and a put’s Delta will be at -.50. As you set up trades you should be using Delta to help you model your exit strategy (assuming the trade goes to plan) based on an assumed price target for the underlying. The other Greek that you want to pay close attention to is Theta.

Theta - What You Need To Know

Time value is an option’s excess premium over and above its intrinsic value and the rate at which an option loses time value is represented by its Theta. Time value wastes away at an exponential rate. The closer the calendar gets to expiration, the more rapidly an option loses time value. On any given trading day, Theta represents the amount of premium that will be lost to time decay by the close of business tomorrow. And, then tomorrow, it will do the same thing all over again, except that Theta will be a bigger number.

Losing premium to time value is good if you’re short. When you sell a position, you’re looking for it to expire worthless. So, Theta is your ally. The opposite is the case if you’re long. Being long Theta requires that you pay close attention during trade setup.

The reason for this is that you’ll want to know how much your trade is at risk if the underlying doesn’t go in your direction pretty quickly. The longer you have to sit around and wait for the underlying to move, the quicker that contract is going to lose value. Even if the underlying is moving higher the contract will still lose premium unless the option is deep in-the-money.

Vega - Volatility In Da House

So, when setting up a trade you want to make sure that you avoid strikes that are ridiculously out-of-the-money and that you give yourself plenty of time to have the underlying make the move you anticipate. And, that brings us to the last Option Greek you need to pay attention to: Vega. This is the most important one in my opinion.

For me, trading options is really all about trading volatility. The one variable that has the greatest impact on premium is implied volatility (IV). If it expands, premium expands; if it contracts, premium contracts. The rate at which this expansion or contraction will take place is revealed to us by Vega. It tells us how much our premium is going to change with every one percent move in IV.

So, when you set up a trade you want to make sure that you understand how Vega sensitive your position is. For example, if you’re long and Vega is a big number, then you want IV to expand. If it does, then your premium will increase by the percent change in IV multiplied by Vega. If you’re short and Vega is a big number, then you want IV to shrink. That will also shrink premium in the exact same manner; percent change in IV multiplied by Vega. Understanding Vega will help you to understand how much volatility risk you have in a position as well as help you model out possible exit points and stop losses.

Paying attention to Option Greeks as you set up new trades will help to make them more successful. And, in the next installment of this blog I’ll show you the things I look for from them when I set up a trade.