If you’ve been trading put and call options because you’re bullish or bearish on a particular stock, you’re only capturing part of the market. There will be times when there’s too much uncertainty around a company to know where its stock is headed. Maybe there’s a big news announcement around the corner, or the latest quarterly earnings are soon to be released. But the exact details are unknown. In these types of scenarios, a put or call option isn’t the best course of action, nor is going long or short on the underlying stock.

That’s where an option straddle comes in and allows you to profit using long straddles. This strategy is profitable whenever there is a significant movement in the underlying stock’s price, either up or down. The direction doesn’t matter, so you don’t have to take a bullish or bearish stance on the company. But the stock’s price has to move significantly; otherwise, the straddle won’t make a dime.

Placing a Long Straddle Trade

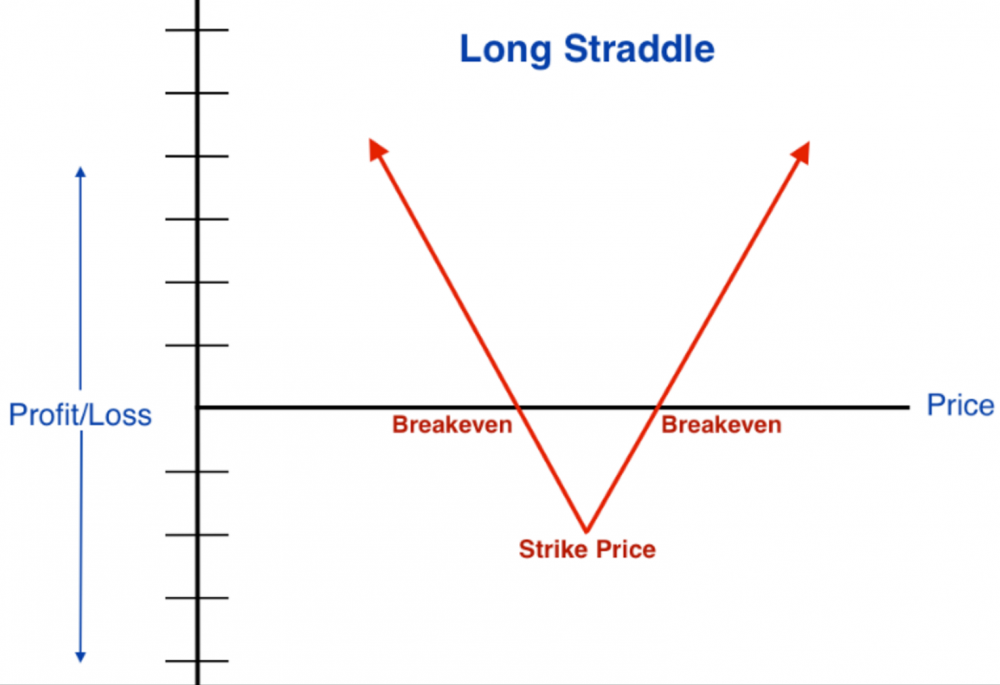

To create a long straddle position, you buy one put option and one call option, both of which have the same expiration date and strike price. By purchasing a call and a put together, the maximum loss is limited, while the maximum profit is unlimited. Because of this, straddles are an attractive strategy to include in any derivative investment plan.

Of course, you can purchase multiple calls and puts simultaneously. The straddle position requires that the number of calls equal the number of puts.

Example of a Profiting Using Long Straddles

As an example, say you want to enter a long straddle position in IBM. The stock is trading at $145. You buy a call option with a strike price of $143 for $4 and a put option with the same strike price and expiration date at $1. The total premium is $5. If the price of IBM moves sufficiently to cause one of the contracts to increase enough to outweigh the cost of the contracts (the premiums plus whatever you paid in commissions), the trade will be successful. But the stock price has to move enough for that to happen.

If IBM hovers around $145, the straddle investment will be a loss, capped at the total amount paid in premiums and commissions. If the price of the equity ends at the strike price at expiration, the greatest possible loss will be achieved.

Straddle Equations

If you play with the numbers in the above example, you will discover the following break-even equations, which reveal how far the stock price needs to move so that you don’t lose any money on the trade.

Upper break-even price = Strike price + total premiums and commissions paid

Lower break-even price = Strike price – total premiums and commissions paid

Using these equations, we can determine the break-even points for the IBM straddle trade. Assuming you paid nothing in commissions, the range of no profit would be $148 to $138. If the stock breaks out of that range, you will begin to make money.

Analyzing the numbers in the example also reveals the equations for profit.

Profit (above the range) = Stock price – strike price – total premiums and commissions paid

Profit (below the range) = Strike price – stock price – total premiums and commissions paid

Although volatility is often spoken of in the financial press as undesirable, long straddles are one case where you can profit from it. If you foresee major price swings in the near future, break out your straddles playbook.

Related Topics: Long Straddles, Straddles, Volatility