American corporations release their earnings reports every 3 months. The data gives investors an idea of how well the companies are doing financially. If an earnings announcement contains any information traders weren’t expecting, the stock price could plummet or skyrocket, depending on whether the release is negative or positive. On the other hand, if an earnings report is in line with market expectations, the stock price will probably be little affected.

Finding a Way to Profit from Earnings Announcements

Knowing that earnings surprises usually produce significant price movements, either to the upside or downside, it would be nice to have an investment strategy that could profit from a major price movement. You could buy the stock ahead of the earnings announcement; but if the release is negative, you’re going to be on the wrong side of the trade. If you shorted the stock, you could also end up on the losing side.

Enter the world of options, where it’s possible to profit in either direction. There are two types of derivative strategies that can be successful regardless of whether a stock moves up or down, as long as the stock moves a sufficient amount. These are the strangle and straddle plays.

Using Straddles and Strangles

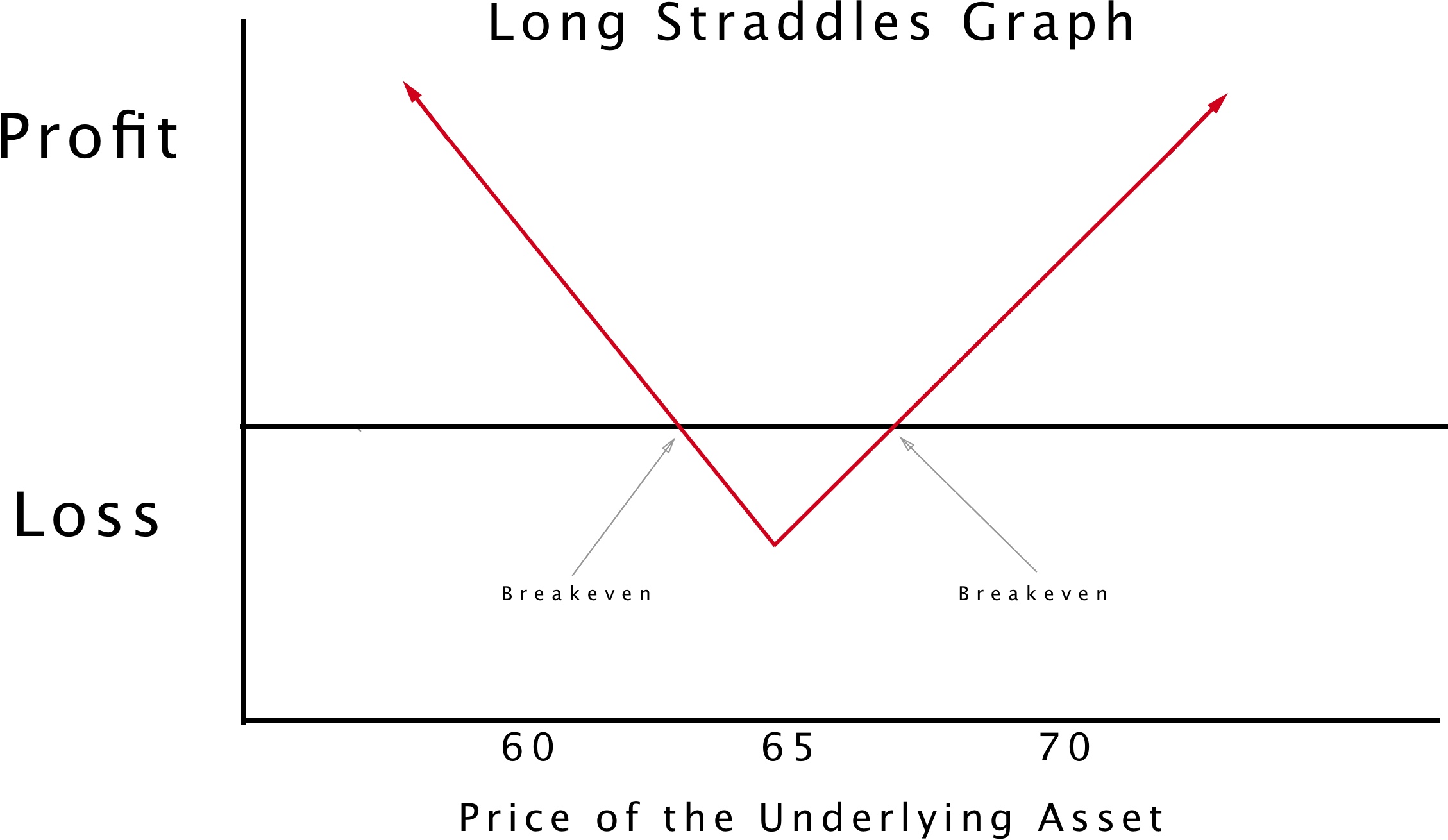

With both strangles and straddles, you buy one call option and one put option. The two contracts have the same underlying equity and expiration date. For the straddle, the strike prices are the same. For the strangle, the call option has a higher strike than the put, and both contracts are out-of-the-money.

Straddles v. Strangles

Because both contracts of a strangle position are out-of-the-money, the investment is usually a little cheaper than the straddle. However, the break-even points of the strangle are further apart than a straddle. The strangle also has a greater chance of resulting in a complete loss than a comparable straddle. Time decay is a greater risk for strangles, which means they will deteriorate in price more quickly over a given time period.

Timing is Key

Like other investments, buying at the appropriate time is crucial in either a straddle or strangle play. Entering the trade a few days before an earnings announcement is not recommended, because at this time the cost of the option premiums will be too high. Implied volatility also tends to be higher right before an earnings release.

A good time to enter a long straddle or strangle position is two to six weeks before a company is set to release its quarterly earnings data. If you try to buy a week before the announcement or earlier, you’ll probably see higher prices for the contracts.

Choosing the Correct Strike Price

You want a strike price that is near-the-money. This will keep the cost of the trade to a bare minimum, while maintaining the unlimited potential gain. For example, if the cost of a stock is $79, you would buy a straddle with a strike price of $80. If you wanted to try a strangle instead, you would buy a put option with a strike price of $75, and a call option with a strike price of $80.

Getting the Right Expiration Date

Time decay erodes a contract’s value, especially during the last month of its life; so you want to avoid options that are set to expire in under 30 days. You also want to allow at least two to three weeks for an earnings announcement to affect a stock’s price. If you buy a month before the earnings announcement, and you want half a month of time after the release for the stock price to move, and you want to avoid the last month of a contract’s life, you should purchase options that have at least 2½ months of life in them.

Example

Suppose you were expecting an earnings surprise from Dillard’s, Inc. in its next quarterly release. The stock trades on the Big Board under the ticker symbol DDS. The share price has been hovering around $73 for a few weeks. The company is set to announce its earnings data soon. What should you do?

For the straddle, you would buy one call and one put, each with a strike price of $73, if the contracts exist. If they don’t, you could buy contracts with strikes of $75. For the strangle play, a call with a strike price of $75 and a put with a $70 strike would work. The cost of either trade is the maximum loss you can suffer. You can’t lose more than premiums plus commissions on either a long straddle or long strangle.

Suppose you buy a Dillard’s straddle three weeks before the earnings release. You purchase one call option for $4 per share and one put contract for $3 per share. The strike price is $72.50, and both contracts are for 100 shares each. The total cost of the trade is $700. Assuming no commission paid, that’s the most you can lose.

You could have bought the stock instead, hoping for a positive release. If you had done so, you would have guessed very wrong. Analysts were expecting 21¢ per share of earnings, but on August 10, 2017, the company reported a loss of 58¢ per share. By the end of the trading day, investors had sent the stock down to $61, a loss of 16%.

In just one day, the call contract you bought is worthless, but the put has a value of $1,150. Subtracting the $700 you paid in premiums, it’s a one-day profit of $450.

And yes, you could have shorted the stock. But that would entail an unlimited amount of risk on the upside and a limited gain on the downside. The straddle, on the other hand, had a maximum risk of $700 with unlimited return potential.