Let’s go over the options butterfly spread, a popular advanced trading strategy used by many options traders. It uses four options contracts with the same expiration date. The butterfly allows traders to produce profits off of stable prices, and is generally a low risk but also low profit potential strategy. Let’s dig into why that’s the case, and what it means.

A butterfly spread is a neutral options trading strategy. What does that mean? It means that you want asset prices to stay neutral, and that you don’t want prices to swing far either way. Simpler trading strategies often rely on a price swing in one direction, meaning an asset will either gain or lose value.

With a butterfly strategy you use four options contracts with the same expiration date but with three different strike prices. These contracts are used to create a range of prices at which you can produce a profit. The four option strategies you buy will either be all calls, or all puts. The two options in the middle can either be bought or sold. The high and low priced options are always the opposite of the middle contracts. So if you buy the middle contracts, you will sell the outer ones.

We’ll dig into the mechanics of the butterfly strategy later in this article. If you want to learn more now, click here.

The Risk & Reward of Butterfly Options Trading

Before digging into how you can produce profits off of butterfly trading, let’s first discuss the risks. When investing, it is important to know what you’re getting yourself “into.” Different options trading strategies will have vastly different risk and reward profiles. So let’s go over the risk and reward profile of the butterfly trading strategy.

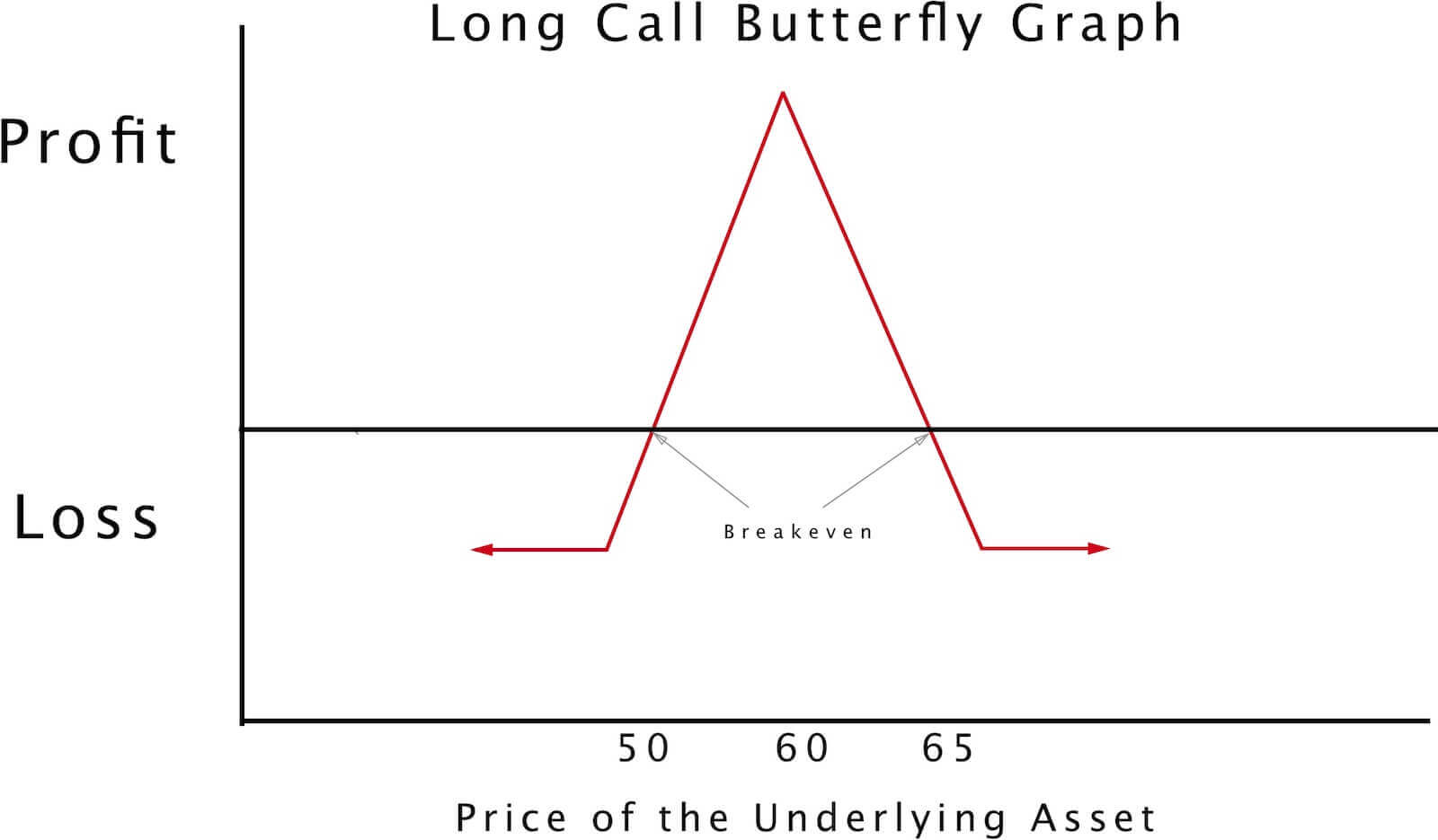

In terms of risk profile, butterfly spreads are generally low risk. This also means that the profit potential is also restrained. Generally, higher profit potential correlates with higher risk, while lower risk correlates with lower profit potential. This is true not just of options trading and strategies, but investing as a whole. While profit potential is low with the butterfly trading strategy, the chance of actually producing a profit is high.

Butterfly trading strategies are similar to the “iron condor” strategy in that they produce profits with horizontal price movements. Both the butterfly and the iron condor are useful for producing profits off of price stability. The two strategies are different, however. If you want to learn about iron condors as well, we suggest checking out our Iron Condor article here.

Understanding Vertical Spreads In Options Trading

Before we dig into butterfly strategies, it’s important to understand what vertical spreads are. A butterfly strategy will use both a bear spread and a bull spread, with each of these being vertical spreads. So what is a vertical spread?

With a vertical spread, you buy one option with a lower strike price and sell them, and then purchase options with a higher strike price. In other words, you buy and sell two options of the same type at the same time, with the exact same expiration date, but they have different strike prices. Vertical spreads can be created with either all calls, or all puts. They can also be bullish or bearish. A butterfly strategy is both bearish and bullish, but we’ll dig into that later.

How a Butterfly Spread Works

We’ve already outlined the basics of the butterfly options trading strategy. Can you recall them? First, the butterfly will use four different options. All four options with have the same expiration date. One option will be set at a higher strike price, another option will be set at a lower strike price. Two of the options will be placed in the dead center, meaning the difference between the upper bound option and the lower bound will be the exact same.

It’s important to note that there are two types of butterfly spreads. The following example will be a long butterfly spread and will create a net debit. A short butterfly spread will create a net credit. We will outline the difference between the two in the next section.

Let’s assume you want to execute a butterfly strategy for ACME Computers, which is currently selling for $100 dollars a share. You believe prices will hold steady over the next month so you execute a long butterfly trade. As such, you sell two call options with an expiration date in one month and with a strike price of $100 dollars. Now, it’s time to buy two call options, one at a higher price, and one at a lower price. So, you buy one call option at $110 and buy another at $90. Notice that they are the exact same distance from the middle options you sold.

Let’s assume that the ACME $90 call option sold for $10 dollars, and the one ACME $110 option sold for $7 dollars, and that the two $100 call options that you sold netted you $6 dollars a piece. Remember, when you write a trade, the money is credited to you, meaning you get money but have to cover the options. You will notice, however, that the overall trade in this case is a net debit of $5 dollars. Since options are sold in batches of 100, you multiply 5 X 100 to determine your maximum loss, which in this case is $500 dollars (+ commissions & fees with your broker).

In this case, the butterfly strategy basically creates two trades at once. There is a long $90 dollar trade and a short $100 dollar trade. This is the first trade. The second trade is a short $110 call and a long $100 dollar call. With a butterfly spread, your profit is maximized the closer the ACME stocks are to $100 dollars (the middle) upon expiration. Let’s assume your instincts are proven 100% correct, and Acme is at exactly $100 dollars upon expiration.

If this were to happen, the ACME $90 call would expire in the money with an intrinsic value of $10 dollars. The ACME $100 dollar calls would expire worthless, meaning you get to pocket the credit you received, which was $12 dollars. The ACME $110 options would also expire out of the money and would be worthless, meaning you’d lose all of the money you invested in them ($7 dollars per share). Remember, the above numbers are multiplied by 100 because options are sold in batches of 100.

If Acme’s stock prices rise or drop, but stay close to $100, you will still produce a profit, but it’ll be reduced.

Long vs Short and Call Versus Put Butterfly Spreads

A butterfly spread basically “revolves” around the two center options. These two options will determine the overall nature of your butterfly strategy, and whether it is a long or short option. The butterfly option example outlined above was a long call option. This means that you sold the two middle options, collecting a credit. The upper and lower options, however, were bought, requiring you to pay for them. Generally, this will create a net debit. A long put option is basically the opposite. You buy the two middle options, and sell the two outer options. This will generally create a net credit.

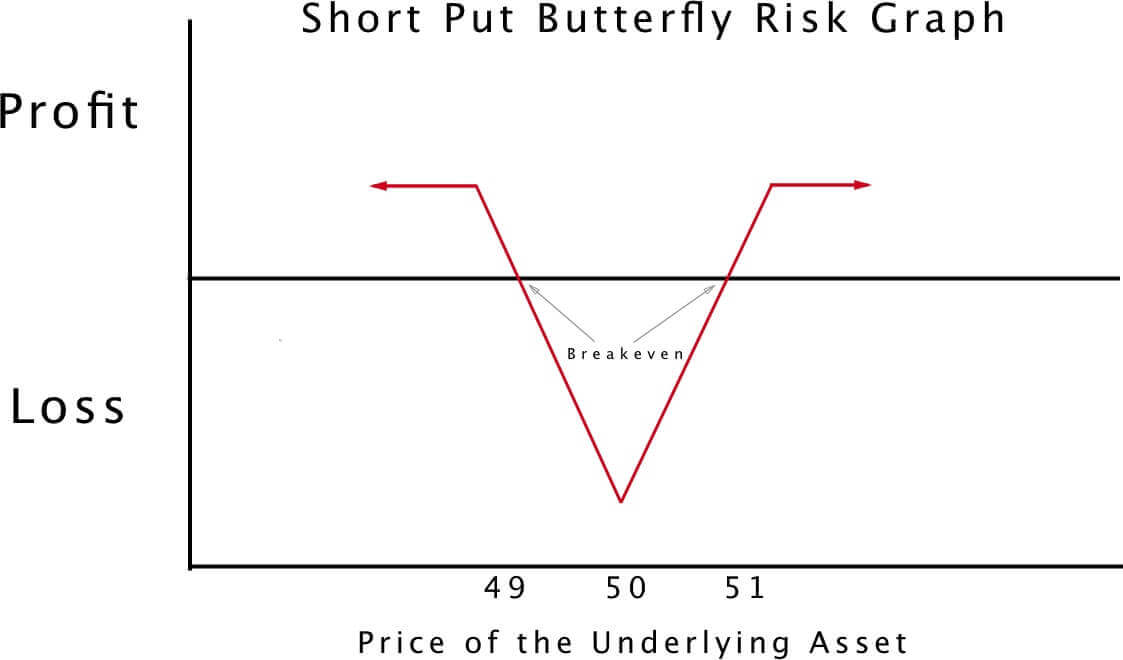

There are also long put butterfly spreads, and short put butterfly spreads. With a long put butterfly spread you buy one put at a higher strike price, sell the two at-the-money puts in the middle, and then buy one put at the lower price. The short put butterfly spread is the opposite. You sell (or write) one the higher strike price put option (meaning it’s out of the money). Then you buy the two middle in-the-money options, and sell another out-of-the-money option with a higher strike price.

All the various choices for your butterfly options trading strategy can get confusing. Don’t worry yourself if you don’t understand everything just yet. As with many investment strategies, it will start to make more sense as you work with the trades themselves.

Conclusion: When and Why to Use the Butterfly Spread

The butterfly spread is a great tool for relatively stable markets that are not suffering large price swings. If there is a lot of uncertainty and volatility in the market, the risks will increase while profits will remain limited. This means that butterfly spreads, like iron condors (LINK), are great when prices are moving sideways, and are either rising or declining at a slow, stable rate.

If there are serious concerns over a financial crisis, or economic downturn, you probably don’t want to use a butterfly. Likewise, if the government is considering a massive stimulus plan that could lead to generally rising asset prices, such as quantitative easing, again it’s best to avoid the butterfly.

Still, when markets are relatively stable, butterfly options offer a great way to profit off of that stability while also limiting yourself to risks. Remember, the most you can lose is what you invest. This makes it easier for you to project your finances and to manage your overall portfolio and its risk composition.

Related Topics: Butterfly Spread, Monthly Income