Iron condor. That might sound like a term that belongs in a World War II documentary, but it’s actually a very effective options trading strategy. With an iron condor, you utilize four different options contracts, or legs, to profit off of relatively stable stock prices. This is a bit different from most investment strategies, which typically rely on asset prices moving up or down. For investors, however, the ability to generate returns off of stable markets, or sideways prices movements as they are often called, adds yet another tool to the investing tool box.

The Risks & Benefits of the Iron Condor Explained

As with all investments, there are risks with the iron condor trading strategy. When you break down the probabilities, there is a high probability of the iron condor being profitable when markets are trending flat. However, you will have to risk a relatively large amount of money in order to secure a comparatively small profit. Before making any investments, it’s important to understand the risk profiles of that investment.

That being said, the iron condor trading strategy is relatively easy to implement and the chance of producing a profit can be relatively high. Iron condors are "credit" options, which means you will be paid money up front. However, you are exposed to long-term risks and could have to pay out more money than what you put it (more on that later). So how does iron condor work? Lets explain.

The Nuts & Bolts of Iron Condor Explained

An iron condor uses two vertical spreads for more on vertical spreads CLICK HERE, and four options contracts with four different strike prices. Let’s use a fictional stock, ACME Computers to illustrate. And let’s assume that ACME is currently trading for $43 dollars a share at the beginning of September. You believe stock prices are going to remain stable over the next several weeks, and so you decide to set up an iron condor to profit off of that stability.

You are going to set up two vertical spreads. First, you are going to create a put spread by selling a put option, and then buying another put option with a lower strike price. Next, you are going to create a call spread by selling a call option, and buying another call at a higher strike price. This will create the four legs needed to set up an iron condor. With most brokers you can place both legs of this trade at the same time.

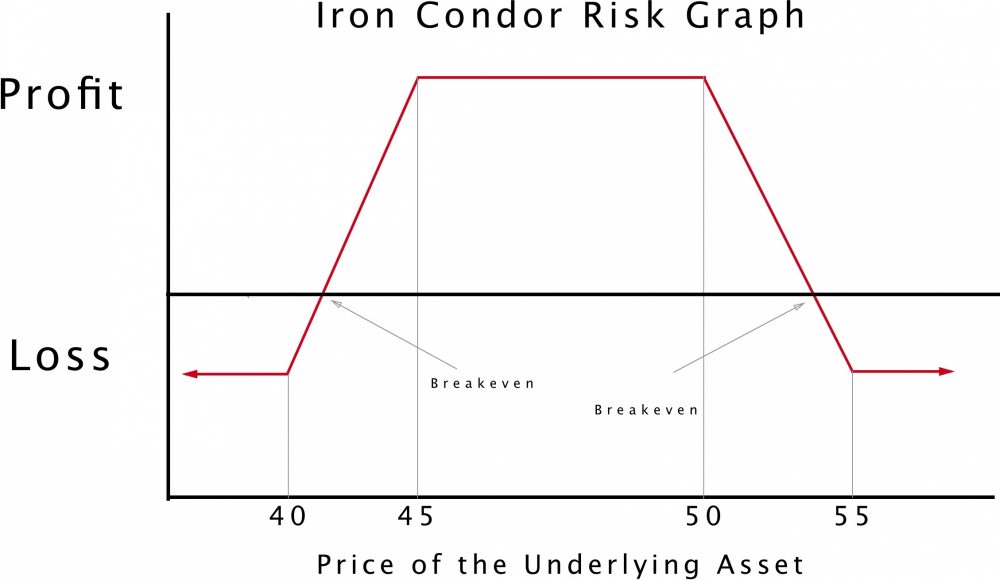

Remember, ACME is currently trading for $43. Let’s say you sell a put at $45 and buy another put at $40. Then you sell a call at $50 and buy a call at $55. You’re making these trades in early September with an expiration date in October (meaning, the Saturday following the third Friday of October). Thus, you have four legs to your Iron Condor as such (numbers fictionalized):

Buy 10 ACME Oct $55 calls at $.50

Sell 10 ACME Oct $50 calls at $ 1

Sell 10 ACME Oct $45 puts at $1

Buy 10 ACME Oct $40 puts $ .50

So what does that mean in actual numbers? Let’s break it down.

Breaking Down an Iron Condor Trade

Keep in mind that options are bought and sold in batches of 100, meaning one option represents 100 share of the underlying asset. First, you sell 10 ACME $50 calls at $1 a stock, getting $1000 dollars. Then you buy 10 ACME $55 calls at $0.50 cents a share, thus giving you a credit of $500 dollars. You do the same with the put options; sell 10 ACME $45 puts at $1.00, and buy 10 ACME $40 puts at $0.50. Between the calls and puts, you end up with with a $1,000 credit (meaning $1,000 cash in your account). Ideally, ACME will stay somewhere between $45 and $50. If this happens, the options all expire worthless, and you get to keep the full $1,000 credit. This is your maximum profit potential.

Your maximum losses are determined by the differences in strike prices, which in this case is $5. At a maximum, you could be on the hook for $5 x the total number of shares, which in this case is 1,000 (10 option contracts @ 100 shares per contract). This means your total risk is $5,000. Risks won’t exceed this because the options you bought (versus sold) will cover any losses that would exceed it. So, if ACME jumps to $60 dollars, you’d exercise your call options to buy ACME at $55 per share. Likewise, if ACME fell to $35 dollars, you’d exercise your put options to sell the shares at $40.

In this way, the iron condor limits your exposure. However, it’s important to remember that you are risking up to $5,000 dollars in order to secure a profit of $1,000. On top of this, you will also have to pay commissions for each contract, which must then be added to your losses, or subtracted from your gains. Still, when markets are stable, the iron condor offers a great way to produce profits off of that stability.

Related Topics: Iron Condor, Credit Spreads