When a stock looks poised for a significant rise or fall, it may be time for a short butterfly play. This option strategy will profit if the underlying stock moves in either direction, so it’s a good choice when you expect a major price movement, but aren’t sure in which direction it will be.

For instance, say a pharmaceutical company is soon to release news about a recent study on the effectiveness of an experimental drug. It’s possible that the results could be mediocre; but you think it’s more likely that the results will be significant, sending the stock price up or down considerably. If you guess correctly, the short butterfly will earn a nice profit. If you turn out wrong, the loss is capped.

Taking a Short Butterfly Position

The short butterfly strategy involves four option contracts. Two of them are purchased at-the-money, while another is sold in-the-money, and the fourth is written out-of-the-money. All of them have the same expiration dates and are of the same derivative type, either calls or puts. The two strike prices above and below the center point should be equidistant from the center strike. Whether using puts or calls, a net credit is received when entering the trade. Any commission paid will of course reduce the income earned.

Short Butterfly Example

Suppose that Abbott Laboratories (ticker symbol ABT) is about to publish a study on a promising drug used to treat blood diseases. If the research is favorable, the stock price will probably increase significantly; and if the analysis shows the medicine is ineffective, the company’s stock price will likely suffer.

You decide that a short butterfly strategy has a high probability of profiting from the impending news, whatever it may be. The stock is trading at $50, so you purchase two put contracts with $50 strikes. You simultaneously sell another put contract with a $51 strike, while writing a fourth put option with a $49 strike. All four contracts have the same expiration dates.

The two center options cost $75 each, for a total of $150. The upper contract earns $30, while the lower contract, which is out-of-the-money, earns a very nice $140. The total amount received is $170, while the total spent is $150. The net credit is $20, which will be reduced by any commission paid.

After a week, you hear in the news that Abbott Labs has cancelled the study, because several patients developed severe side effects from the drug. Investors send the stock price down to $43. The two options you purchased are worth $700 each at expiration, while the short contract with the highest strike is worth $800, and the lowest-strike contract has a value of $600. You can exit these last two positions by buying to close. Doing so costs $1,400, and you have the other two long contracts that are worth a total of $1,400. The contracts obviously offset each other, leaving the $20 credit obtained at the outset.

Maximum Loss and Gain

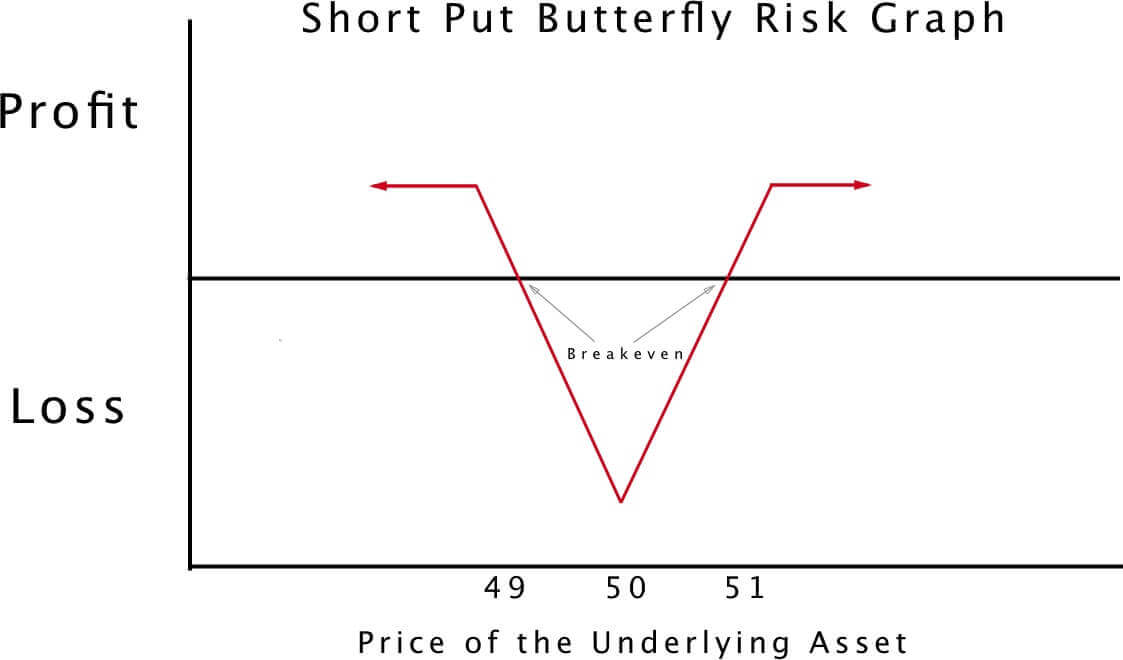

The $20 earned is the maximum gain for our example. Because there are two shorted contracts with two long contracts in the butterfly spread, the options will always negate each other if they are in-the-money, assuming that the strike prices of the butterfly’s wings are equidistant from the center strike, which they should be.

If the stock moves in the opposite direction, all derivatives will be out-of-the-money with no value. This also leaves the $20 net credit earned at the start of the trade. If the stock hovers around the center strike value, one of the shorted contracts will be in-the-money. Upon exercise, this will decrease the net credit or produce a loss on the trade.

Equations

Looking at what we have learned in our example with Abbott, the following equations are revealed:

Maximum loss = 100 × (Center strike – Lower strike) – net credit + commission

Maximum profit = Net credit – commission

Because the short butterfly play has these caps, only limited gains can be made with it. But the limits also create an inherent safety mechanism that makes the short butterfly safer than many security investments, including equity trading.

Related Topics: Butterfly Spread, Credit Spreads, Put Options, Put Credit Spread