The Options Wheel Strategy is a methodical approach to options trading that combines both income generation and potential stock ownership in a seamless cycle. This post aims to provide a detailed breakdown of the strategy, practical tips for trading, and important considerations for investors looking to implement this technique.

Introduction to the Options Wheel Strategy

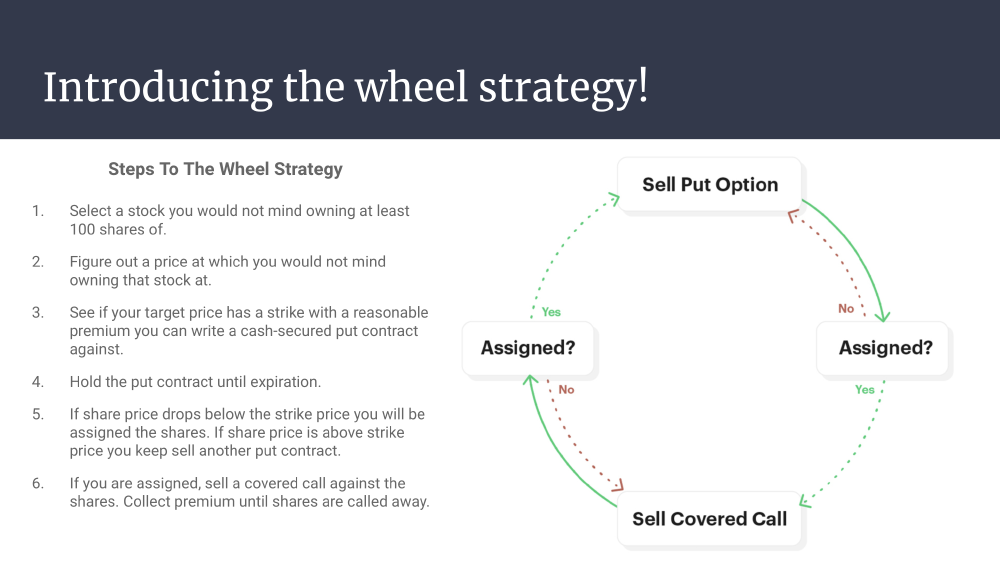

The wheel strategy is an advanced options strategy used by investors to generate consistent income through selling options, with the possibility of owning the underlying stock. The goal is not primarily to own stock but to continuously receive credit by selling put options. The process involves two main components: selling a cash-secured put option, and if assigned the stock, selling a covered call.

Step-by-Step Execution

1. Selling Cash-Secured Puts

The journey begins with selling a put option that is out-of-the-money (OTM). This means setting a strike price below the current market price of the stock, which ensures the option is sold with lower risk of assignment. This position garners an immediate premium, which is a credit to the investor's account, representing potential income.

If the option expires worthless (stock price above the strike at expiration), the investor retains the full premium and can repeat the process. Should the stock price drop below the strike, the investor is then obligated to buy the stock at the strike price, effectively initiating stock ownership at a predetermined price, reduced by the premium received.

2. Writing Covered Calls

Once the shares are owned, the next step is to write covered calls against the stock. Here, the call's strike price is typically set above the current market value, allowing room for potential stock price appreciation. This strategy aims to generate additional income from the premiums while waiting for the stock to be called away. If the call expires worthless (stock price below the strike at expiration), the premium is kept, and the process can be repeated.

Options Trading Course: The Wheel Strategy With Options

Our comprehensive options trading course delves deeply into the Options Wheel Strategy, providing students with an in-depth understanding of its mechanics, applications, and benefits. This segment of the course covers every aspect of the strategy, from the initial sell of put options to the final sale of calls. Students will learn through detailed examples, step-by-step walkthroughs, and interactive elements designed to reinforce learning. For a closer look at how we break down the Options Wheel Strategy, please visit our detailed slide presentation here.

Benefits of the Wheel Strategy

- Income Generation: Consistent premium collection from selling puts and calls provides a steady income stream.

- Cost Basis Reduction: Each cycle of selling puts and calls can lower the stock's cost basis, enhancing the profitability of the strategy.

- Potential Stock Ownership: Investors can acquire stocks at a lower net cost, making it an attractive strategy for those looking to build or diversify their portfolio with specific stocks.

Strategic Considerations

Stock Selection: It's crucial to implement this strategy with stocks you are comfortable owning, as there is always a possibility of assignment.

Risk Management: Understanding the risks associated with options trading is vital. The strategy requires sufficient capital to cover potential stock assignments and withstand market volatility.

Profit Potential vs. Risk: While the wheel strategy can provide regular income, it also caps the potential upside of stock ownership due to the obligation to sell the stock if the call options are exercised.

Advanced Techniques

Rolling Options: To manage positions actively, investors can "roll" their puts and calls to different strike prices or expiration dates, based on market conditions and stock performance. This can help avoid assignment or capture higher premiums.

Technical Analysis: Utilizing technical analysis to choose strike prices around key support and resistance levels can enhance the strategy's effectiveness, aligning entry and exit points with market psychology.

Conclusion

The Options Wheel Strategy is an effective tool for investors seeking to augment their income through a disciplined options trading approach. By mastering this strategy, investors can potentially turn market movements into opportunities, regardless of the market cycle.

This comprehensive guide aims to equip you with the knowledge to implement the wheel strategy effectively, combining theoretical insights with practical trading techniques. Whether you're new to options trading or looking to refine your strategies, the wheel strategy offers a structured path to achieving your investment goals.

For more insights and detailed examples of the options wheel strategy in action, feel free to explore additional resources and real-life case studies to enhance your understanding and application of this powerful investment strategy.

Related Topics: Options Course, Wheel Strategy, Options Trading, Income Generation, Stock Ownership, Covered Calls, Cash Secured Puts, Risk Management