Options trading strategies have the potential to be highly lucrative, but they can also be incredibly complex to figure out. Unlike traditional stock trading strategies, options trading introduces numerous variables, such as strike price, type, expiration, delta, gamma, and volatility, among others. Given the multivariate nature of options trading, it's nearly impossible to formulate a robust, long-term trading strategy without relying on data analysis. One of the most effective ways to analyze this data is by backtesting options trading strategies, which involves simulating how your strategy would have performed in the past. In this blog post, we'll explore the process of building, backtesting, and perfecting options trading strategies to help you succeed in the world of options trading.

1. Building Options Trading Strategies: Exploring Ideas and Analyzing Data

The first step in building an options trading strategy is to explore different ideas by asking simple questions like "How much do SPY options decay every day?" or "How often in a 45-day period does the SPY drop more than 5%?" To answer these questions, you'll need to collect trading data for different time windows and analyze the key metrics using a spreadsheet. The act of scrubbing through data over and over again often leads to the formation of a viable strategy.

2. Backtesting Options Trading Strategies: Evaluating Performance Over Time

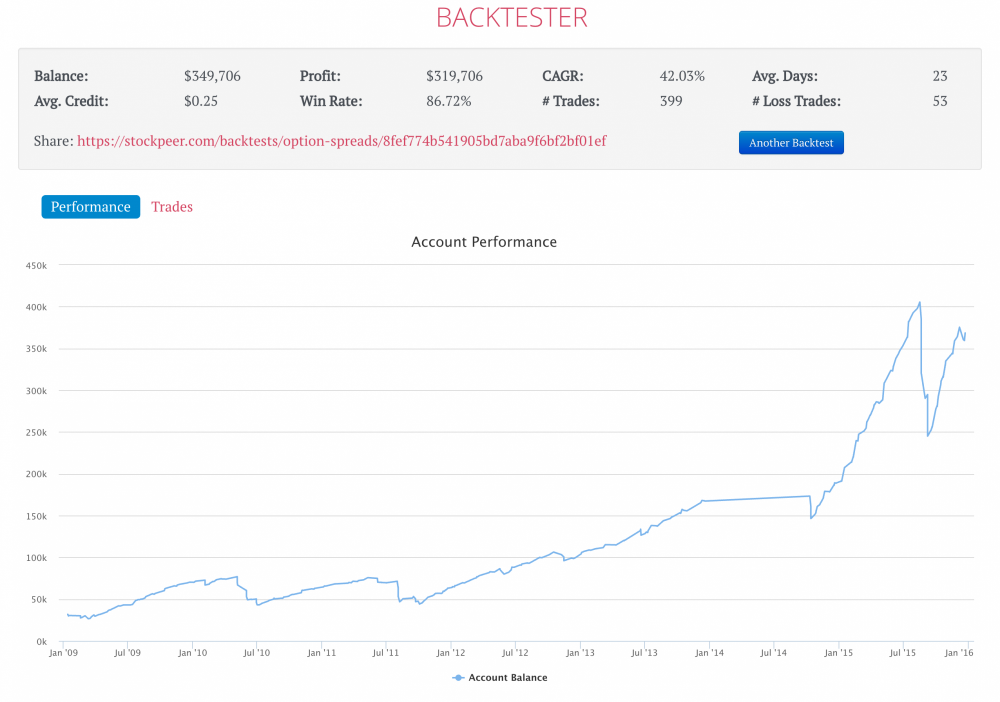

Once you have a strategy idea, you'll need to backtest it to see how it performs over time. This will help you identify whether your strategy works only during certain time periods, doesn't outperform enough to be worth pursuing, or shows real promise. When your strategy shows promise, it's time to dig deeper and stress test it.

As a side note I wrote a backtester years ago and shared it on this website but sadly it became too much to maintain. There is a reason there is not already a great options backtesting tool out there currently. It is very hard to build a generic tool that will work for everyone's strategy. I have been working on a new backtester that will be much more flexible and powerful. I hope to have it ready sometime in 2023. I will be sure to share it here when it is ready.

3. Stress Testing and Fine-Tuning Parameters: Avoiding Overfitting

During the stress testing phase, you'll want to fine-tune your strategy's parameters while being careful not to overfit. Overfitting in trading occurs when a trading system adapts so closely to historical data that it becomes ineffective in the future. In addition to fine-tuning parameters, you'll need to consider money management, risk-taking, and cash flow during drawdowns. Tweaking the money management aspect can often turn a losing strategy into a winning one.

4. Software and Tools for Backtesting Options Trading Strategies

A good software approach is crucial for backtesting options trading strategies. While there aren't many great off-the-shelf tools available, Options Alpha offers a reasonably good backtesting tool. It's useful for exploring different ideas and as an educational tool for examining various trading strategies through backtesting. Although it's not a one-stop-shop for all your backtesting needs, it's the best option currently available.

5. Programming Your Own Backtesting Strategies

If you're willing to get your hands dirty, you can obtain options data and program your own backtesting strategies. With basic programming skills, you can battle test any idea you might have. Two excellent sources for historical options data are Polygon and Historical Option Data. Almost any programming language can work with the data these services offer, allowing you to iterate over each day and assess your options trading strategy's performance. I recommend starting with Python using a Jupyter Notebook, or, if you're an Excel whiz, you can avoid coding altogether and use Excel to analyze the data.

Conclusion: Overcoming Complexities and Gaining Access to Options Trading

One of the main challenges in options trading is the inherent complexity and lack of tools for learning, exploring, and validating trading ideas. To be a successful options trader, it's essential to learn basic programming skills and obtain quality datasets. By following the steps outlined in this blog post, you'll be well on your way to mastering

Related Topics: Backtesting, Data Analysis