If you’re shorting stocks, there’s a way you can do it while protecting your upside risk. Using an option spread, the short stock position will be protected during the lifetime of the derivatives. The strategy can also earn a small amount of income at the outset of the trade. Here’s a rundown on using short collars.

Details

The short collar spread has three legs. As the name implies, the first leg is a short stock position. One hundred shares are shorted. Margin privileges will be required for this at your brokerage firm. Normally, a short stock position entails substantial risk, but here it is counterbalanced with two derivatives, which will mitigate any upside damage.

The second leg is a long call option, and the final portion of the strategy is a short put. Both derivatives are on a share-for-share basis, which means they should have the same number of shares as the equity leg. The contracts can be entered either for a net debit or a net credit. Oftentimes, although not always, the short put will be more expensive than the long call, which will produce an immediate profit on the trade.

Example of a Short Collar

You have a margin account at your broker, and this gives you shorting privileges. Based on your interpretation of economic data, you expect a major downturn in the auto industry in the coming months. Therefore, you decide that placing a short bet on an automobile company would be a wise move. Because you’re only moderately bearish in the short term, you decide to add option contracts to the equity trade, which will mitigate risk if you turn out wrong.

After looking over stock reports from independent analysts, you think Ford Motor Company has the bleakest outlook. The stock’s price ratios seem very high, and the majority of stock watchers agree that Ford is headed for a downturn.

Placing an Order

After choosing the underlying stock for your short collar investment, it’s time to submit an order. Using a brokerage house that has pre-defined option strategies will make filling out the order form quick and easy. Bid and ask prices will be displayed for collar trades. Clicking on an ask price will produce a ticket for a long position, while the bid price will generate a short ticket.

The first leg of the trade will be a short stock position of 100 shares. At a market price of $12, this produces an immediate gain of $1,200, although this will have to be covered eventually. Also remember that the broker will impose any margin interest this equity trade incurs, and margin calls and other issues regarding short stock positions will be in full effect while the position is maintained.

The next leg is the long call position, and it costs just $2 with a $15 strike price. While purchasing this leg, you also write one put option with a $10 strike. It earns $9, which produces a net credit of $7. While this is a very small profit, it can be increased by doubling or tripling the number of contracts. If you choose to do this, remember that the number of puts should equal the number of calls, and they should be traded on a share-for-share basis, meaning that the number of equity shares should equal the number of shares in one leg of the option contracts. For example, if you short 700 shares of Ford, you should have 7 puts and 7 calls.

Any commission paid to the broker will reduce the profit of this trade. Both derivatives are traded out-of-the-money, and they expire on the same day in three months. There is no exact expiration date that needs to be selected for this option strategy. It could be shorter or longer than the three months in this example. A good rule of thumb is to choose an expiration date based on how long you think the stock could remain in a neutral or bullish range.

Outcome of the Investment

After shorting F at $12, the stock declines to $11.50, and both contracts remain OTM. With a gain of 50¢ per share, you see a nice $50 unrealized profit, and no margin interest needs to be paid to the broker.

Two months into the trade, Ford begins to head back up after the U.S. government releases positive economic data. This move to the upside erases the $50 gain you had. The stock reaches $13, which creates a $100 loss on the stock position. With just a few weeks left on the derivatives, you decide to hang onto all three legs of the trade. Ford continues to rise, and it reaches $14 on the expiration date of the options. They end with no value.

Making a Decision after Expiration

Now you need to decide what to do with the trade. You could re-enter the short collar by writing a put and buying a call. Another idea is to purchase a call by itself to protect against upside risk. Going this route will incur monthly premiums. While you’re analyzing the available choices to you, Ford advances further to $14. At this point, you don’t see any potential of a drawdown, so you decide to simply cover the stock position and end the collar trade.

Determining the Bottom Line

The net loss on this investment is calculated with the following equation:

(Short stock gain – cost of cover) + net option credit – commission – margin interest = net loss/profit

Plugging in our numbers we get:

($1,200 – $1,400) + $7 = -$193

This loss will be reduced further by trading fees and margin interest that is charged by the broker.

Making Money and Losing Money

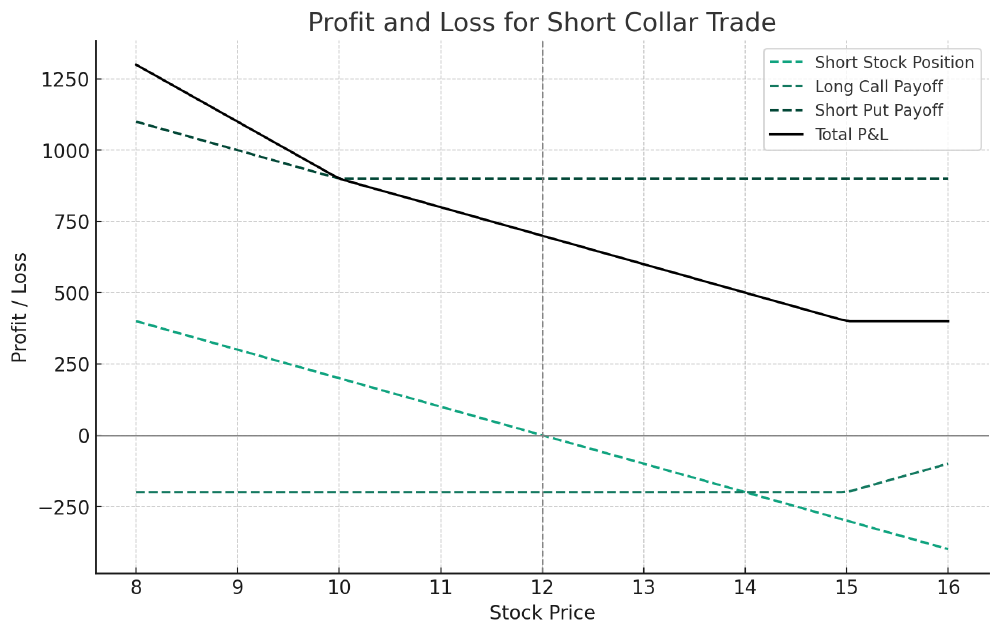

During the life of the contracts, any loss on the short stock position is balanced by the long call. If the stock heads in the right direction, the profit will be checked by the short put. The maximum loss or gain of the strategy depends on what choice is made when the first set of derivatives expires. If the short stock position is left unchecked, the maximum gain will be reached if the equity goes to zero, and there is no maximum loss if the stock rises.

Related Topics: Options Course