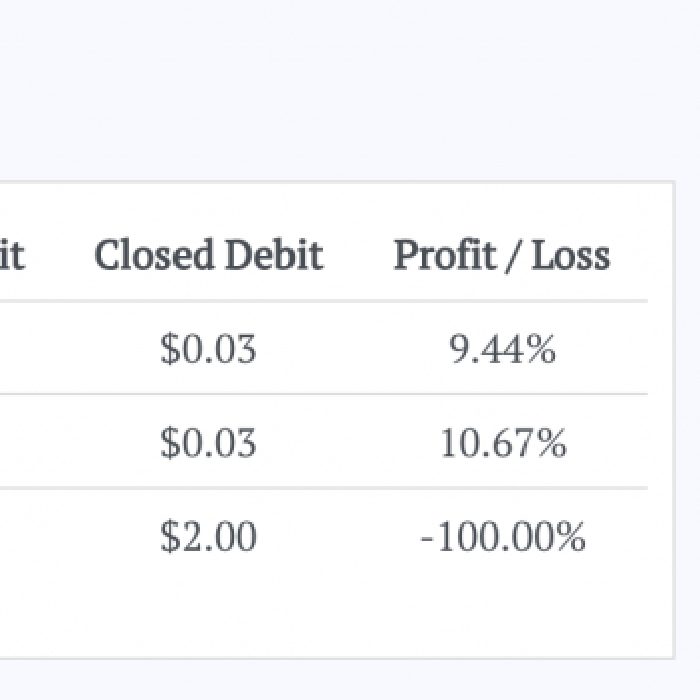

Here we explore the put credit spread trades I placed on the SPY durning the month of August 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Here we explore the put credit spread trades I placed on the SPY durning the month of July 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

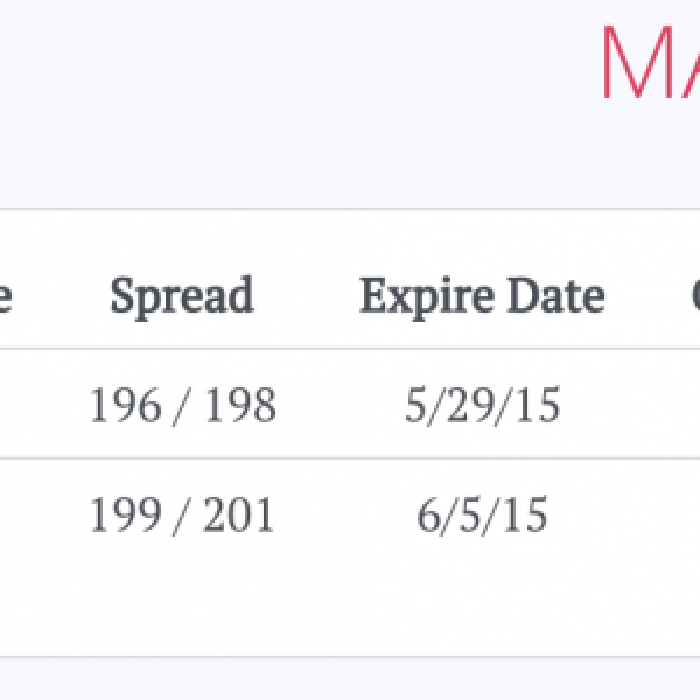

Here we explore the put credit spread trades I placed on the SPY durning the month of June 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

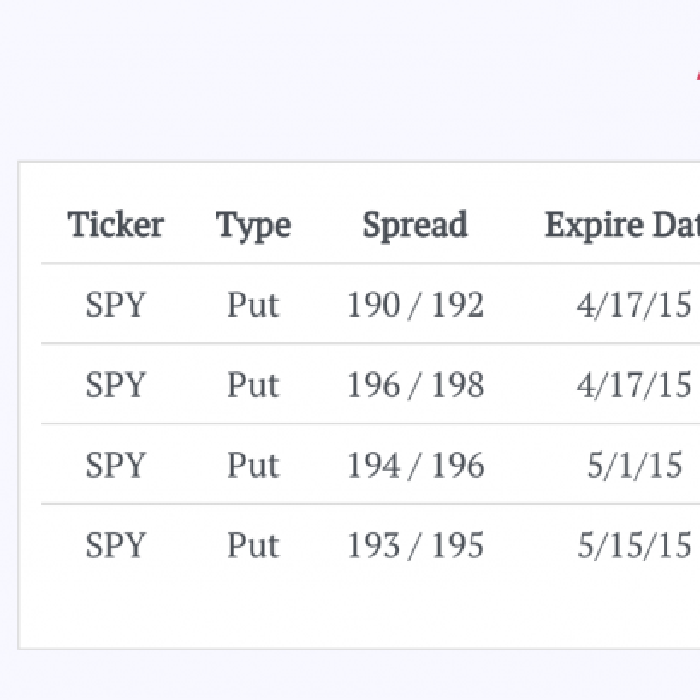

Here we explore the put credit spread trades I placed on the SPY durning the month of May 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Here we explore the put credit spread trades I placed on the SPY durning the month of April 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Warren Buffett often says that he tap dances to work. He has found a method of trading that gets him high. I, however, would be bored to tears if I invested the way Buffett invests: I need more action, which is why I like to trade credit spreads and day trade the SPY.

Here we explore the put credit spread trades I placed on the SPY durning the month of March 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

How much money should you risk with each trade? Trade size is one of the most important considerations of an active trading strategy, and maintaining optimal trade size over time involves technique. In this post we will examine 3 methods for determining trade size.

Many people think day trading is gambling: you might win for awhile, but eventually you will blow up your account. I agree—yet I day trade the SPY almost every day. Day trading is part of my overflow method and multiple strategy approach to managing my portfolio.

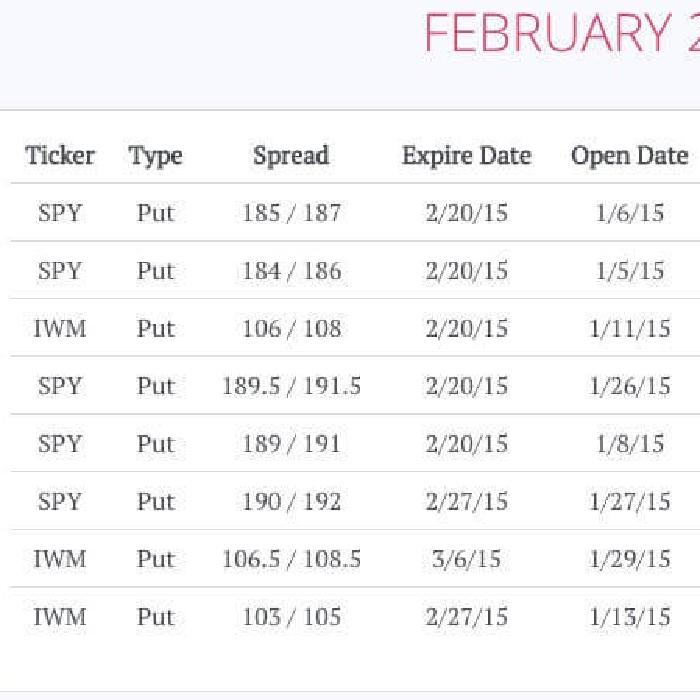

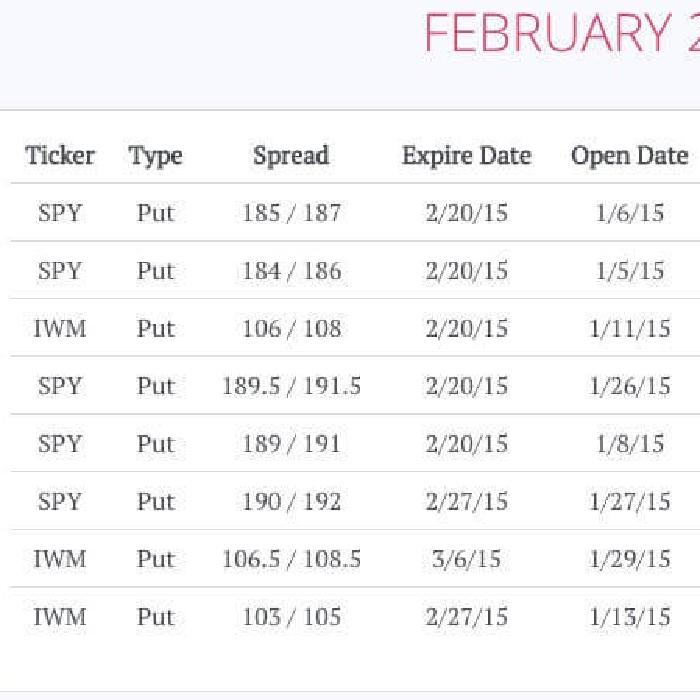

Here we explore the put credit spread trades I placed on the SPY durning the month of February 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.