When I talk to people about my credit spread trading strategy I often hear the claim that credit spread trading works great for 5, 10, or 20 thousand dollars, but the strategy can’t be scaled up. Are these skeptics suggesting a lack of liquidity to fill bigger orders?

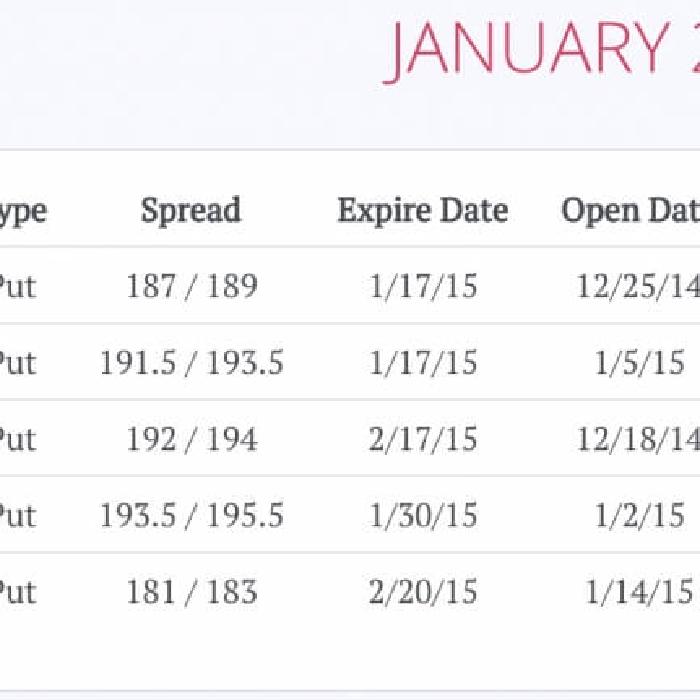

Here we explore the put credit spread trades I placed on the SPY durning the month of January 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

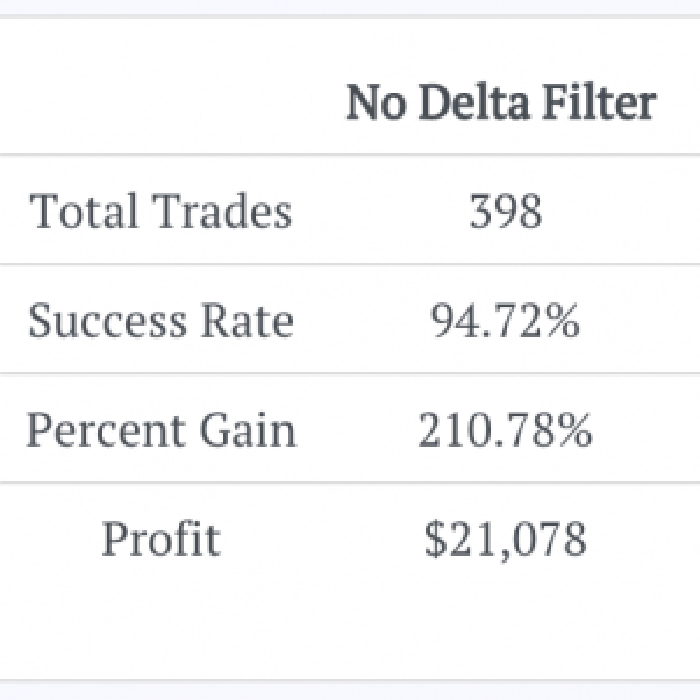

To study how delta affects an opening trade I did—of course—some backtesting. I took a $10,000 account and placed put credit spread trades from 2011 to current. I opened up spreads that were $2 wide, at least 4% out of the money, and no more than 45 days to expiration.

Almost all of my credit spread trading is focused on the S&P 500 via the SPY or S&P 500 futures. Why am I hyperfocused on the SPY? So I can sleep at night (well, try to sleep—I do have a young son and a daughter on the way).

Every great trader has a bag of tricks. Each of these opportunities, if you will, is a predefined market condition signaling when to enter a trade and when to close it. One that has been in my bag for awhile is buying the SPY when the Relative Strength Index (RSI) indicator hits 30.

Like most traders I got started as a stock picker following the most basic of rules: do your homework and have a diversified portfolio. This credo is sound, and it’s the approach I use for some of my accounts. The key to this more traditional approach is understanding that your emotions do play a factor in your investing decisions—and that learning how to manage your emotions can be the pivot between success and failure.

Like most traders I got started as a stock picker following the most basic of rules: do your homework and have a diversified portfolio. This credo is sound, and it’s the approach I use for some of my accounts. The key to this more traditional approach is understanding that your emotions do play a factor in your investing decisions—and that learning how to manage your emotions can be the pivot between success and failure.

The day I learned to pay attention to volatility was the day I started to be consistently profitable in options trading. Most options traders start out trading stocks and they learn that if a stock is associated with good news its value often increases, whereas bad news sends a stock down.

During any 30-day period from 1993 through 2014 the SPY (the Exchange Traded Funds, or ETFs, tracking the S&P 500) closed down 5% or more 11% of the time. I know this obscure fact because for every one of the 5,502 trading days during that period I compared the SPY closing price with the closing price 30 trading days later.

By my best calculations, going back to my piggy bank years, my personal spending has increased by 10% annually—and my assumption is that I will continue shelling out at this rate well into the future. Sure, I am a spender, but when you really think about it 10% is not crazy.

Anyone who manages their own money should use a multiple strategy approach—a form of diversification, if you will. I personally maintain 4 strategies: buying & holding stocks, investing in real estate, index option credit spread trading, and directional option trading. I find these to be great options for diversification.