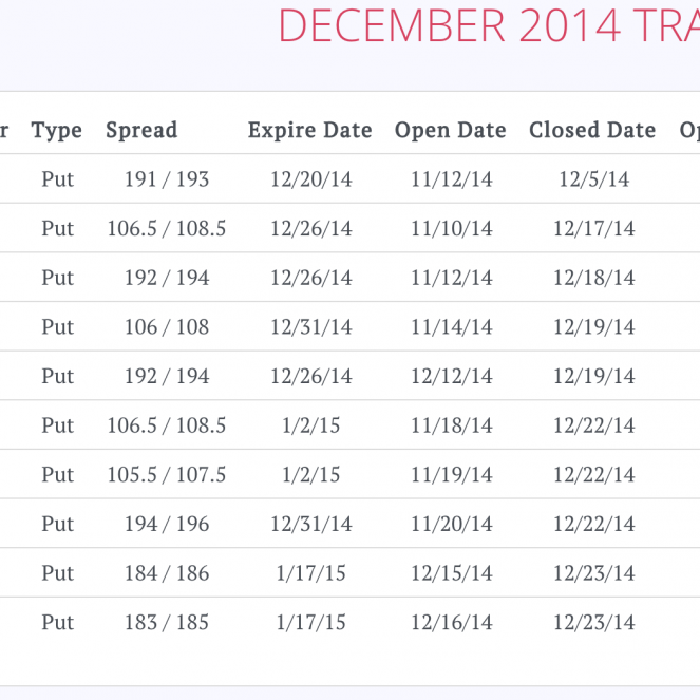

Here we explore the put credit spread trades I placed on the SPY durning the month of December 2014. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

I love this time of year: vacation, family, drinks, parties, gifts, Santa, and the rest are all great. Almost equally I love this time of year because I am reminded to take time to reflect on the past year, which gives me an opportunity to map a game plan for the coming year.

The catch is if your strategy is not well planned or implemented with discipline. Meaning that what makes the 3 factors so definitive when trading credit spreads is implementing a brilliant strategy with fidelity.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront. A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio.

A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio. A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.

A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.

The difference between success, failure, and mediocrity on Wall Street is your ability to pick a smart trading or investing strategy and stick to it. Jumping into the market without first carefully defining your strategy is akin to driving a car with a blindfold on—and, likewise, you will crash at some point.

Wall Street is the domain of traders and investors. Typically we envision traders sitting in front of rows of monitors looking to make a quick buck by continually getting into and out of financial positions. In contrast, investors are the Warren Buffett types who buy and hold stocks for long periods of time.

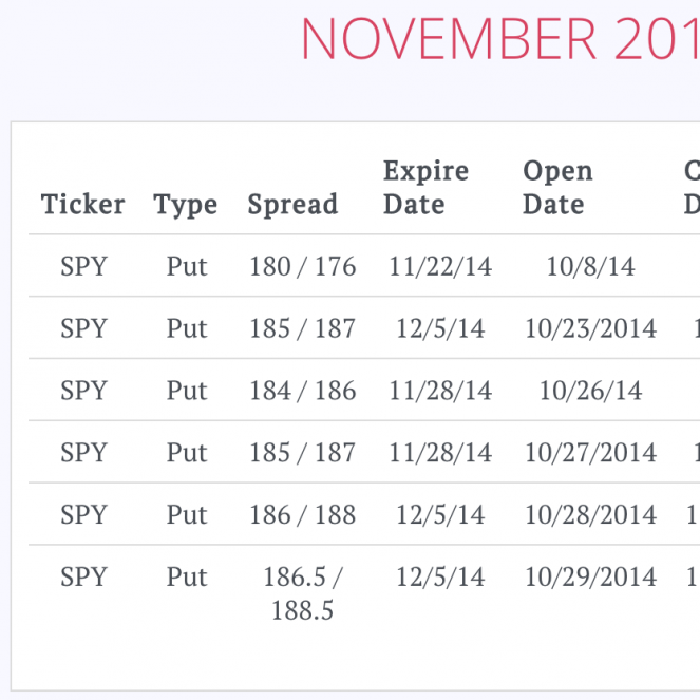

Here we explore the put credit spread trades I placed on the SPY durning the month of November 2014. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

What I mean by a consistent trading strategy is if you build a smart trading strategy and stick to it you are almost certain to make money. I make this claim with such conviction because I assume that you backtest your strategy. That you factor in maximum drawdown periods (times when you lose money). And most critical, that you understand the importance of fidelity to your strategy—because inconsistent strategy is the road to a blown-out account.