Wall Street is the domain of traders and investors. Typically we envision traders sitting in front of rows of monitors looking to make a quick buck by continually getting into and out of financial positions. In contrast, investors are the Warren Buffett types who buy and hold stocks for long periods of time.

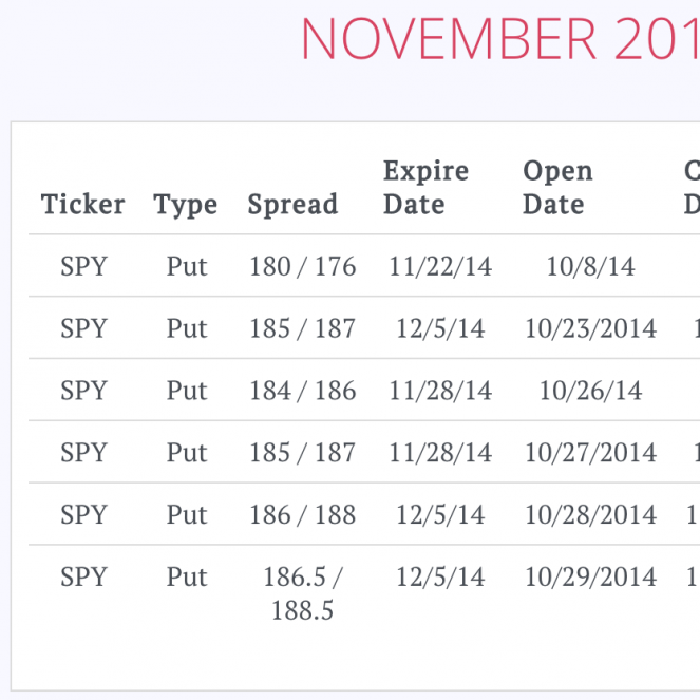

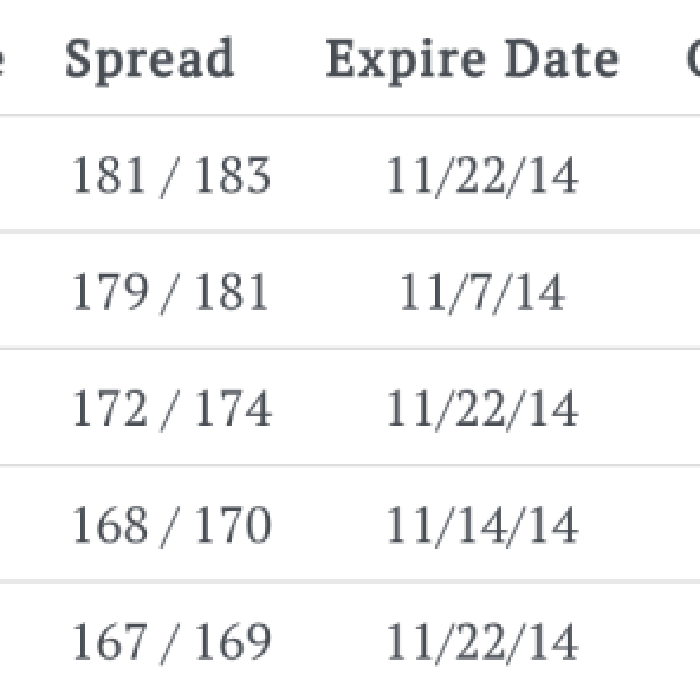

Here we explore the put credit spread trades I placed on the SPY durning the month of November 2014. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

What I mean by a consistent trading strategy is if you build a smart trading strategy and stick to it you are almost certain to make money. I make this claim with such conviction because I assume that you backtest your strategy. That you factor in maximum drawdown periods (times when you lose money). And most critical, that you understand the importance of fidelity to your strategy—because inconsistent strategy is the road to a blown-out account.

Below you will find all of the trades I closed out in October 2014. I plan to post a summary of my complete (not cherry picked) credit spread portfolio each month, and in the future I will share trades as I make them.

Welcome to the inaugural blog post of Stockpeer.com. To find out more about me, Spicer, take a detour and check out the About page. To learn more about Stockpeer, read on.