Wow! What an unfortunate month for Put Credit Spreads. Afraid this month returned all my yearly gains and then some. A bit of a disappointing way to end the year. We know months like this will happen.

Well, finally an engaging month. Afraid the engagement was in the wrong direction. In November we took some losses. Not a big deal since we have had so many winning past months. However, losses are never fun.

With October 2018 completed we move on to November. Again this was a little bit of a boring month as we only closed one trade. We do have some trades on the board that will close in November.

With September 2018 over we look forward to autumn. This was a little bit of a boring month as we only closed one trade. We do have some trades on the board that will close in October.

With August 2018 in the bag we look forward to September. Traders leave their Hamptons pads and get back to work. My SPY Put Credit Spread trading strategy only closed one trade this month. Hoping for a creep up in IVR next month.

July has come and gone. We partied for America's birthday and closed a few profitable trades! Darn good month! My SPY Put Credit Spread trading strategy continued to do well.

June 2018 was another winning month for my SPY Put Credit Spread trading strategy. Since IVR has been pretty low closing this many trades was a darn good thing. Just have to be careful to not trade too big.

May 2018 was a winning month for my SPY Put Credit Spread trading strategy. It felt good to lock away some winning trades after last month.

Throughout my investing career, I have always applied my energies to basis reduction and not seeking discounts when buying a position in a company. I love to use call options or put credit spreads to reduce the basis of a core holding. In this post, I will share with you some of my basis reducing ideas.

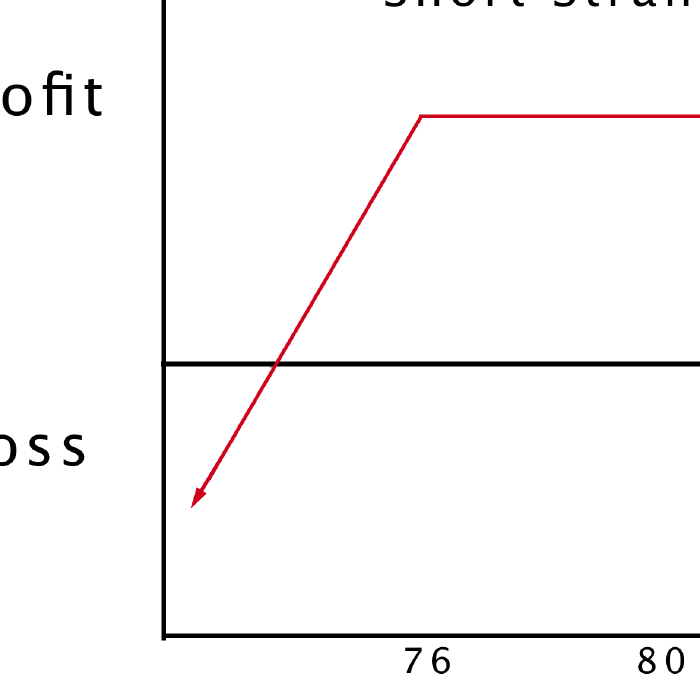

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.