A credit spread option is an act of taking two or more options and selling the premium they produce. Yes, that sounds confusing. I'll explain, but first, let's explore quickly the concept of writing a contract. In this post, we will explore how traders can make monthly income trading options via spreads.

When you foresee upcoming volatility in a stock, an option play that can make money from it is the short call calendar spread. Because there are two expiration dates in the strategy, it has a considerable amount of complexity and should only be attempted by experienced traders.

April showers bring epic put credit spread trades! Another good month of trading!

Our Put Credit Spreads strategy is looking good!

March had some good trades!! A very winning month. The best part about the month, for me at least, is Oregon had some epic snow. I had some amazing turns in! I digress.....back to options.

Our Put Credit Spreads strategy is looking good!

February......The month of love.....(at least here in the US)......The market gave us tons of love!!

Finally, some winning trades this month for our Put Credit Spreads strategy. These wins really helped build back up our drawdown from past months.

More losses this month for our Put Credit Spreads strategy. Mainly a losing trade that was put on in 2018 and crossed over. I think the markets are calming down and we will start to draw back up.

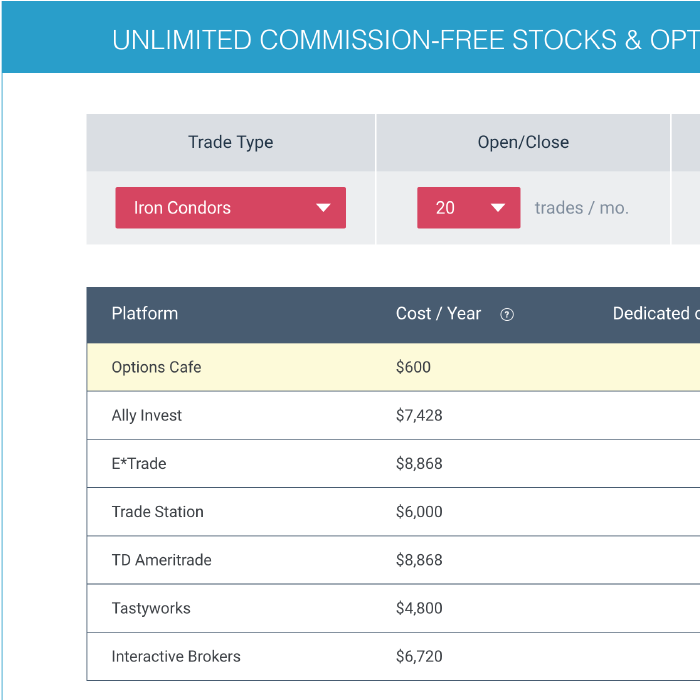

I have some big news!! Today, we are officially announcing the launch of Options Cafe. You can now use our platform to make options trades via Tradier. No other trading platform allows you to discover, trade, and review your trades like Options Cafe. We have built Options Cafe from the ground up with one thing in mind — making multi-leg options trading a snap. Also, get commission-free stock and options trades.

Wow! What an unfortunate month for Put Credit Spreads. Afraid this month returned all my yearly gains and then some. A bit of a disappointing way to end the year. We know months like this will happen.

Well, finally an engaging month. Afraid the engagement was in the wrong direction. In November we took some losses. Not a big deal since we have had so many winning past months. However, losses are never fun.

With October 2018 completed we move on to November. Again this was a little bit of a boring month as we only closed one trade. We do have some trades on the board that will close in November.