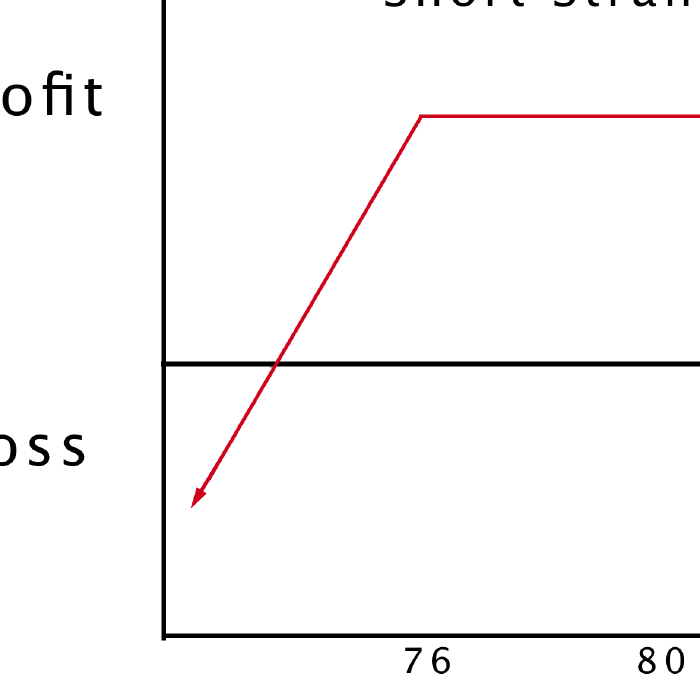

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.

April 2018 was a losing month for my SPY Put Credit Spread trading strategy. While these months are never fun they serve as an opportunity to remember to be humble in this trading strategy.

Here we explore the put credit spread trades I placed on the SPY durning the month of March 2018. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Volatility is back! Seems the day of the market just creeping up every day are over. In February 2018 the market tanked creating tons of new opportunities for entering Put Credit Spread trades. Sadly, we took some losses but in this post I explain that is not a bad thing.

In January 2018 the markets where pretty stable -- Well stable in the eyes of an options volatility trader. It was not until the end of January when the market made a turn and volatility came back into the market. I opened a few trades in January 2018 but none closed.

American corporations release their earnings reports every 3 months. The data gives investors an idea of how well the companies are doing financially. If an earnings announcement contains any information traders weren’t expecting, the stock price could plummet or skyrocket, depending on whether the release is negative or positive.

Options traders in December were laughing like this kid all the way to the bank! Well maybe not really. No retirement plans just yet. After a bit of a dry spell I closed 2 put credit spread trades. This month is a good example of why you never second guess your strategy. You will notice I put on 2 spreads a day apart with nearly the same strikes prices and the same expiration.

If you are an options volatility trader November was a boring month. I opened 2 put credit spread trades in November -- none closed. We will look at these closing trades in December.

We are in sit and wait mode. Just like this dog......

If your an options volatility trader this is how you felt in the month of October. I was unable to open any put credit spread trades in October. Bottomline......volatility was super low! I think the market is just sort of flat waiting for tax reform.

Tradier is a powerful brokerage API that allows non-brokers to provide broker services. Let’s talk about why Options Cafe selected Tradier as our first official partner.