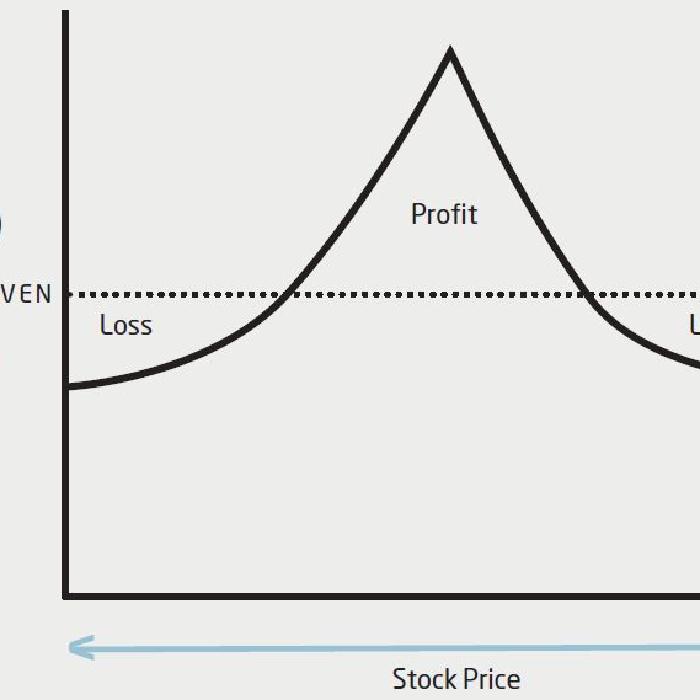

Instead of trading stocks or other securities, why not trade time? The long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. The maximum loss of this strategy is capped at the net debit the investment incurs at the entry point.

Many stock traders are jumping into options trading. Options offer a fantastic way to diversify and to produce extraordinary returns. Let’s look at the key differences between options and stocks, and why so many stock traders are becoming options traders.

The short calendar spread is a good opportunity to profit from a stock’s impending upswing or decline. The maximum gain from the investment is the net credit received when entering the trade, and the maximum loss could be substantial. Therefore, this option strategy should only be used by experienced traders.

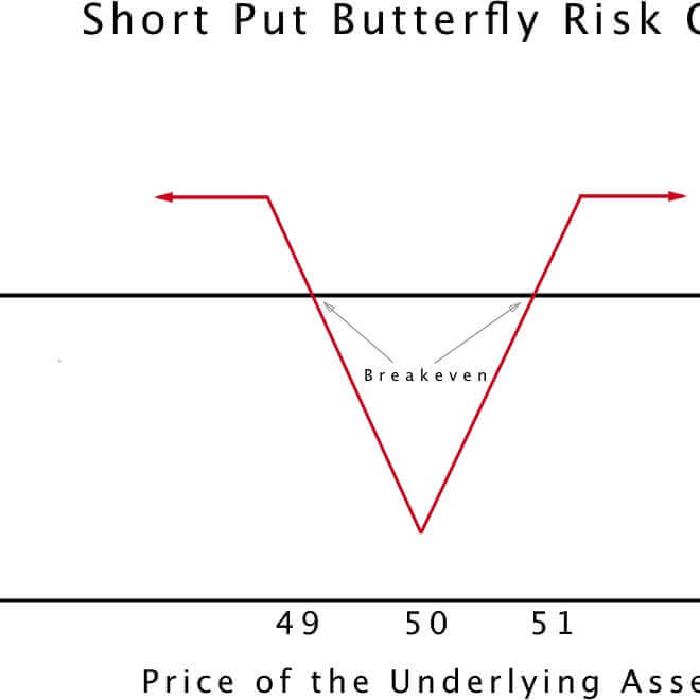

The options butterfly spread is a low-risk options trading strategy that stands a high chance of producing a small profit. The butterfly options trading strategy uses four options contracts to produce profits off of price stable markets.

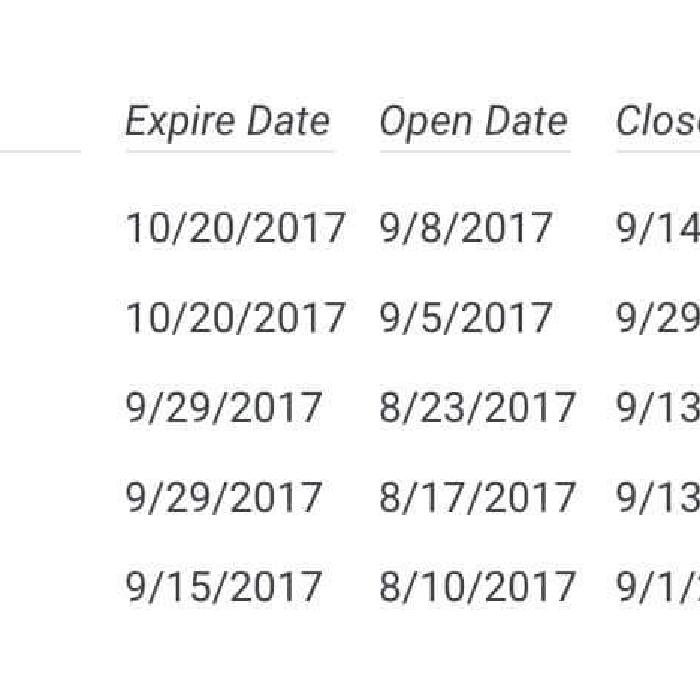

Once again it is time for our monthly summary of trades I closed. Below are the put credit spread trades I closed in September 2017. My birthday month!! Compared to August a number of put credit spreads closed this month. Volatility continues to be very low. When volatility is low we have less opportunities to place trades. Click to take a look at the trades.

There are six variables that determine an option’s theoretical value. But, theoretical value is not the same things as market value. The thing that links theoretical and market value together is one key variable out of the whole mix. This one key variable is volatility and it has a huge influence on how an option is going to trade.

Many people think they can quit their day job and start day trading. The truth is, most do not succeed day trading long term. There is an alternative that can generate monthly income just like you hoped to do by day trading. In this post we explore the concept of selling premium in the options market using probability-based options trading.

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

Investing comes with risks, that’s a fact of life. Generally speaking, the greater the risks, the greater the potential for profits. In these regards, options trading offers a high potential for profits, but does come with some higher risks. This is especially true for newer investors. Experienced and/or well-educated options traders, however, can utilize a variety of strategies to lower risks.

Investing comes with risks, that’s a fact of life. Generally speaking, the greater the risks, the greater the potential for profits. In these regards, options trading offers a high potential for profits, but does come with some higher risks. This is especially true for newer investors. Experienced and/or well-educated options traders, however, can utilize a variety of strategies to lower risks.

Knowing how the Greeks influence premium is not academic. Understanding how they are likely to affect your next trade is a critical component of that trade’s set up. You should always perform an analysis of the Greeks before you send an order to your broker. Here are some important things to look for.