If your a follower of this blog or a follower of my trades you might have noticed I stopped posting trades. That is all about to change starting with this post. I am once again committed to posting the trades I place monthly. The reason for the absence in trade posting is we have been crazy busy preparing for the launch of our new trading platform -- Just not enough hours in the day :(.

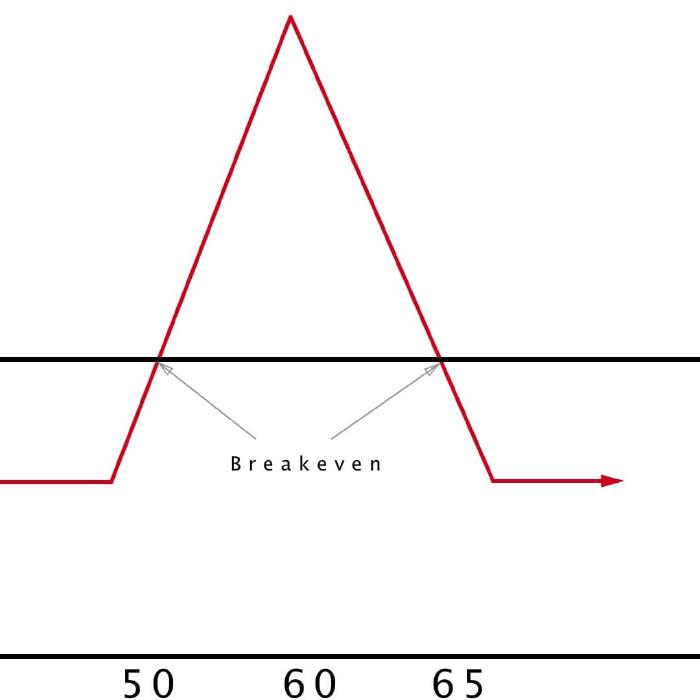

If you want a conservative option investment that controls losses, take a look at the butterfly strategy. This derivative tactic comes with finite profitability, but also downside protection. The butterfly play is best for stocks that have low volatility.

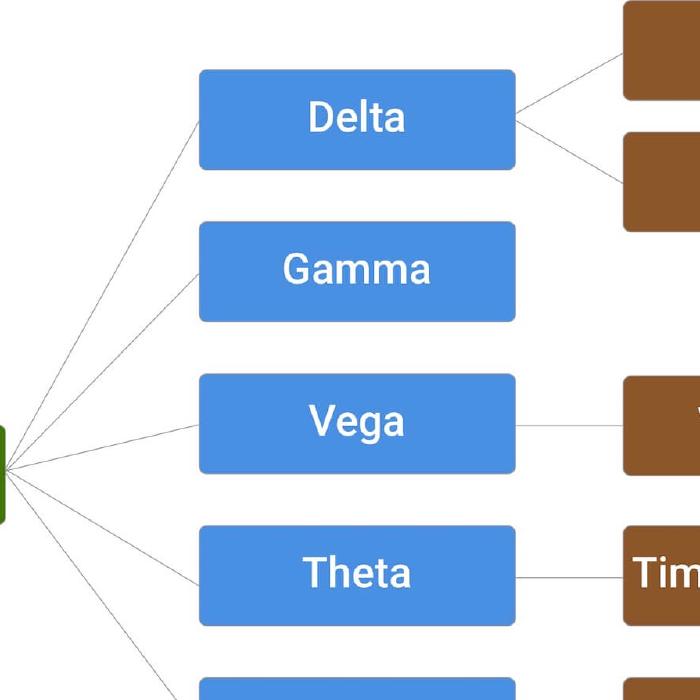

Most traders realize that options increase or decrease in value as the underlying stock moves up or down in price. But, there’s a lot more to how an option’s price changes over the course of time before expiration. A better understanding of option greeks will go a long way to improving the success of your trades.

Making money trading delta options is how top options traders trade. What many traders don’t consider is that your delta doesn’t have to stay consistent throughout a trade. Many professional options traders manage their positions in order to add or decrease delta.

Volatility Trading is a variable in an option pricing model used to determine the theoretical value of an option. And, among all the variables in an option pricing model, it is the only one that is derived from market sentiment. But, the market doesn’t always get it right. That creates opportunity for an options trader.

Over the years I have learned that there is no upside to emotional trading. The market is random, and if you try to guess what the next tick will be you will lose. In this post I walk you through designing a trading strategy that prevents your emotions from sabotaging your trading through the wildest of times.

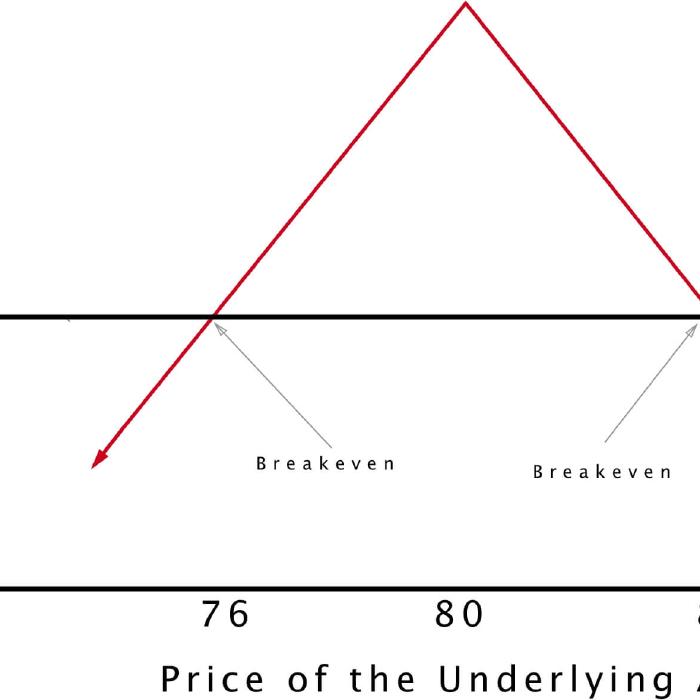

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

There are many different types of options. Options are “derivatives”, which simply means that their value is derived from another asset. Consider stock-based options, they derive their value from the stocks that they are based on. In general, derivatives can be based on a huge range of assets. This is true of options as well.

There are many different types of options. Options are “derivatives”, which simply means that their value is derived from another asset. Consider stock-based options, they derive their value from the stocks that they are based on. In general, derivatives can be based on a huge range of assets. This is true of options as well.

Have you ever entered an options position and had difficulty understanding how the price fluctuates? Perhaps you were confused by the amount of profit or loss caused by stock movement relative to your position? If this has ever happened to you, you could learn more about delta, and how long delta strategies fits into your trading strategy.

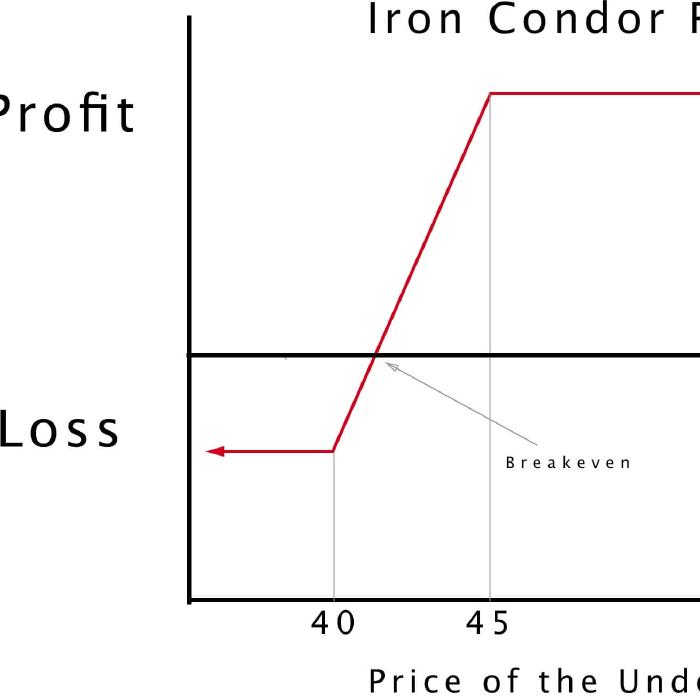

The Iron Condor is a very useful options trading strategy. While considered "advanced" by many, once you get a good handle on the iron condor, traders at any level can use it. This options trading strategy is especially useful for profiting off of stable markets that are experiencing sideways price movements. Next up ........Iron Condor Explained.