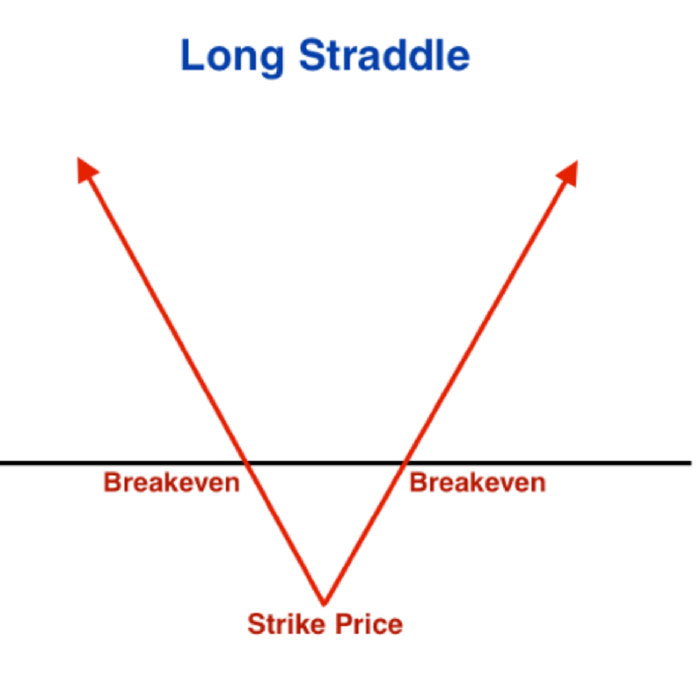

Although volatility is often spoken of in the financial press as undesirable, long straddles are one case where you can profit from it. If you foresee major price swings in the near future. Time to learn about long straddles.

Say hello to Options Cafe! As the Founder and CEO of Stockpeer, and a tenured software developer, I am excited to announce that the Stockpeer.com blog is retiring and Options.Cafe is taking over. When I registered Stockpeer.com nearly 10 years ago, I had a much different vision. While I was trading options, at the time, stocks were my passion.

Say hello to Options Cafe! As the Founder and CEO of Stockpeer, and a tenured software developer, I am excited to announce that the Stockpeer.com blog is retiring and Options.Cafe is taking over. When I registered Stockpeer.com nearly 10 years ago, I had a much different vision. While I was trading options, at the time, stocks were my passion.

I like directional trading but for the most part directional options trading is a hobby. There is nothing better than picking a direction, applying a leveraged bet via options or futures, and watching that trade take off. Here I will explain why directional trading is just a hobby.

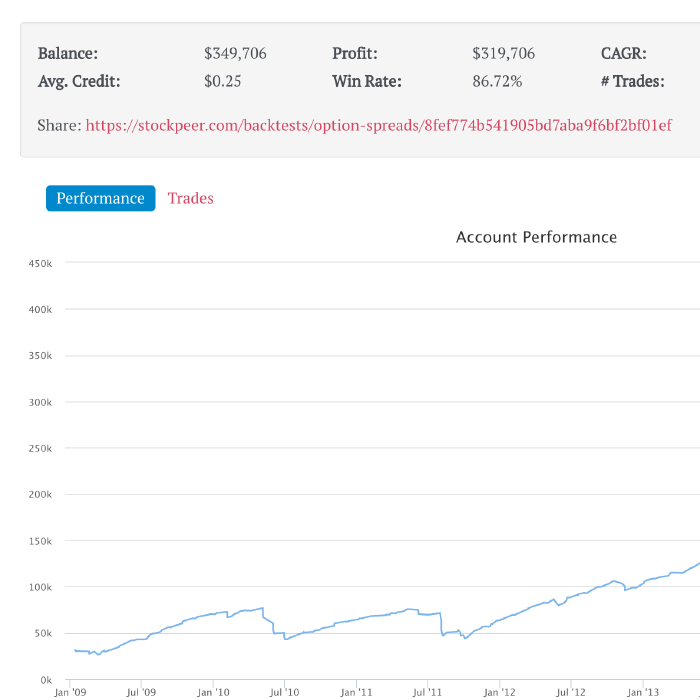

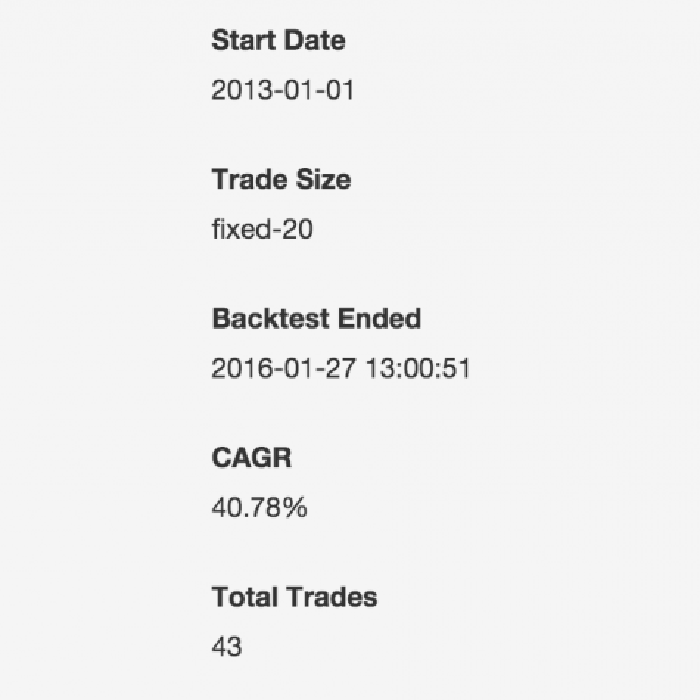

Options Cafe backtester is here. Have you ever wondered how your options trading strategy would perform over time? I have, so I built a backtester. I wanted a way to simulate trading the options market day to day to see how well my strategies would have fared.

When I first started Stockpeer I expected to mostly share my experiences trading the stock market via automation. But I find myself talking less about automation for an important reason: automation can lead to a lack of engagement—aka complacency.

Recently I have been playing around with something new: trading the futures market as a hedge against my options trading strategy. Why hedge a good bet you ask? Though the strategy I rely on the most—trading put credit spreads on a consistent basis.

To start I want to point out 2 things: this idea is not originally mine, and though I talk mostly about trading I think the concept applies to all forms of investing (buy-and-hold, real estate, fixed income, and so on). From time to time I attend a meetup group.

Want day trading returns without the headache of sitting in front of 26 big-ass monitors all day? You’re in luck because today we are going to discuss trading weekly put credit spreads on the SPY. The idea is pretty basic. I sell a put credit spread on the SPY that expires in 7 days.

I’m baaaaaack! But that’s not to say I am returning empty handed. . . You did notice that I took a nearly 5-month sabbatical from Stockpeer blogging—right? The catalyst was the arrival of my second child, a dangerously sweet little girl!

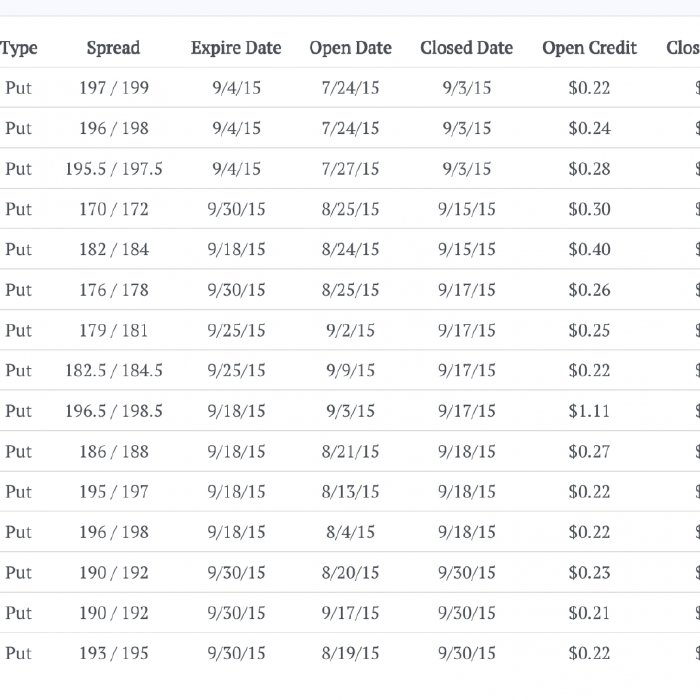

September was a tough month. The market took a major pull back. I lost a fair amount of money. I think if the next 3 months are good I should be able to recoup the losses. Some of the trades were rolled trades (the ones with high credits).