When a stock appears to be in a range-bound phase, with little expectation that the price will undergo any significant movement, a short straddle may be a wise investment. The maximum profit from this strategy is quite limited; it is just the premiums collected minus commissions. At the same time, the maximum loss is unlimited if the underlying stock goes up. The strategy could also create a significant loss if the stock goes down substantially.

Taking a Short Straddle Position

To make a short straddle position, you sell one uncovered call option and one uncovered put option. The contracts must have the same underlying stock, expiration date, and strike price. Of course, you can write more than two options. Just be sure that the number of puts equals the number of calls.

By writing two contracts instead of one, you collect two premiums. Taking a double position creates greater sensitivity to time decay than single options. The short straddle will be more profitable if time passes while the stock has little price action. These are the primary advantages of the strategy. There are significant downsides.

Risks Associated With Short Straddles

The ideal situation is for the stock price to reach the strike price at expiration. This is where the maximum profit would be achieved, and no contracts are assigned. If a contract is in the money by a penny or more, it will automatically be exercised on the expiration date.

If the equity price is higher than the strike price, the call option will be assigned, and you’ll have to first buy the stock in the market and then sell it at the strike price to the counterparty. On the other hand, if the stock price is lower, the put option will be assigned. This will force you to buy shares of the underlying stock at a higher price than what they are selling for on the open market.

Short Straddle Example

Suppose you expect Wal-Mart to have neutral price action in the next few months. You sell one call option for $1 and one put option for $3. Both have a strike price of $80 and the same expiration date. The most you can make on the trade is $4 minus any commissions you paid for the trade. If you want to make more money, just sell more contracts, keeping the number of puts equal to the number of calls. In this case, 10 contracts on both sides would generate $4,000 of revenue (10 contracts per side × 100 shares per contract × $4 credit), not taking into account trading fees. The further the price of the underlying equity moves from the strike price, the more money is lost on the investment.

Short Straddle Equations

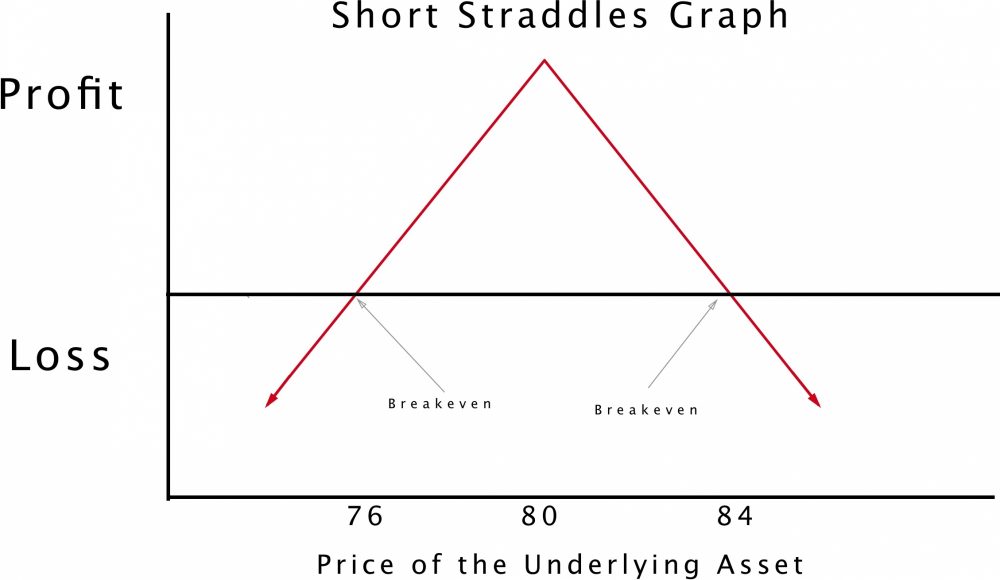

Scrutinizing the numbers in the above example will reveal the following break-even equations:

Break-even point (above the strike) = strike price + premiums earned - commissions

Break-even point (below the strike) = strike price - premiums earned + commissions

Using the numbers from the Wal-Mart example produces a trading range of $84 to $76. You need the stock price to stay in this range. If it breaks out, you will begin to lose money. You could hold until expiration, hoping the stock re-enters the break-even range and you don’t get an early assignment. Or you could cut your losses by buying option contracts to offset the ones you wrote. Doing so would take you out of the position.

A potential loss can be estimated using these equations:

Loss (if stock is above strike price) = Premiums collected – commissions + strike price – stock price

Loss (if stock is below strike price) = Premiums collected – commissions + stock price – strike price

Because of the high risk and low return potential of the short straddle position, it is recommended only for experienced traders.

Related Topics: Short Straddles, Straddles, Volatility, Credit Spreads