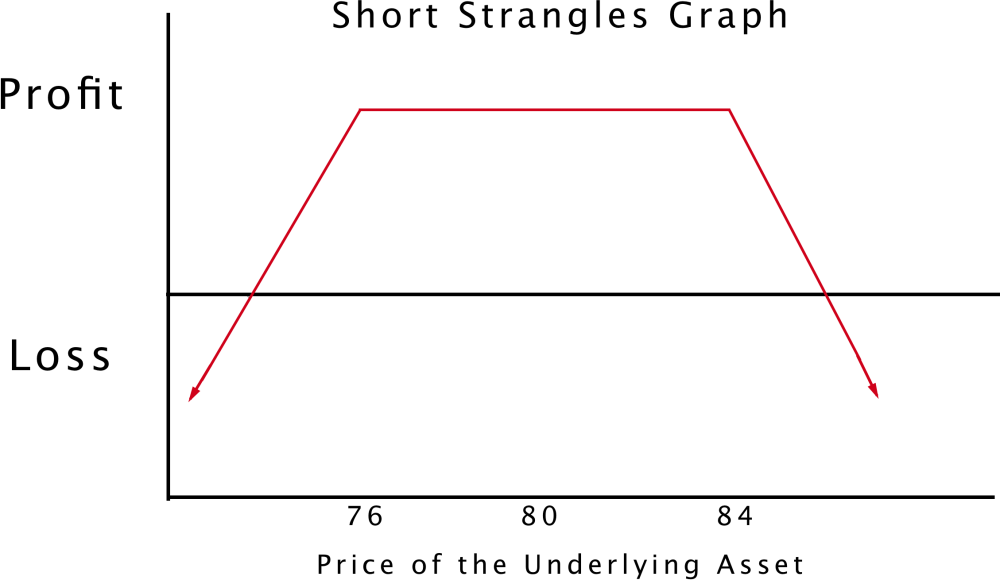

A short strangle play is a good opportunity to earn some option premiums if you expect the underlying stock to remain in a narrow trading band until the contracts expire. The maximum gain is limited to just these premiums. If you pay commissions, the greatest profit is even lower. If you guess wrong, and the stock makes a significant move to either the upside or downside, you could experience a substantial loss.

Opening a Short Strangle Position

The short strangle is created by selling one call option and one put option, both with the same underlying stock and expiration date. The call contract has a higher strike price than the put, which makes the strangle different than the straddle play. Both contracts in the strangle strategy are out-of-the-money.

Example of a Short Strangle

Suppose you think Johnson & Johnson (JNJ) will move sideways for the next few months. The company doesn’t appear to have any new technologies in the pipeline, nor will it release any earnings. You also don’t expect any major news announcements. If JNJ doesn’t make any major revelations, the stock price is likely to remain fairly calm.

With a current stock price of $132, you sell a call option for $1 per share. The contract is worth 100 shares and has a strike price of $134. The total premium received is $100. At the same time, you sell a put option that is also out-of-the money. It has a strike price of $130 and is valid for 100 shares. You’re able to receive $1.50 per share, for a total of $150. The grand total for both contracts is $250. Remember that this income will be reduced by any trading fees your broker charges you.

Equations for the Short Strangle

Looking at the numbers in our example reveals the following breakeven prices:

Upper limit = call strike + call premium per share + put premium per share – commission per share

Lower limit = put strike – call premium per share – put premium per share + commission per share

In the Johnson & Johnson example, the upper limit is $136.50 ($134 + $2.50). The lower limit is $127.50 ($130 - $2.50). These figures assume no commissions are paid to the broker-dealer.

Short Strangle Hazards

As long as JNJ experiences no significant volatility and stays within that trading band, between $127.50 and $136.50, the derivative investment will be profitable. If the stock moves outside this rather narrow band, the trade will begin to lose money.

Remember that any option contract that is in-the-money by a penny or more at expiration will be automatically exercised. Contracts can also be exercised early. This could force you to buy shares of JNJ from a holder of a put contract (at an inflated price), or sell shares (at a below market price) to a holder of a call contract. If you don’t already have the shares in your brokerage account, you would have to buy them at market price.

If JNJ went to $140, the put option would be worthless and the call would be worth $6 per share, for a total of $600. You received $250 in premiums, so the total loss on the trade would be $350. Because the loss is calculated by subtracting the call strike price from the stock price, there is in theory no maximum to the loss if the equity goes up.

If it were discovered that one of the company’s products causes a health problem, and the stock goes down to $120, the call option would have no value, while the put contract would be worth $10 per share, for a total amount of $1,000. Subtracting the amount made in premiums, the loss would be $750. Because the stock can’t go lower than $0, the loss on the downside is limited.

Related Topics: Short Straddles, Straddles, Strangles , Short Strangles , Short Strangles