Spicer's Soapbox

Like many aspiring investors, I started my journey by trying to grow my wealth through stock investing, inspired by the strategies of Warren Buffett. At around age 21, I made my first stock trades. But there was a catch: I didn’t have much money, and the idea of waiting decades to see my wealth compound wasn’t appealing.

Like many aspiring investors, I started my journey by trying to grow my wealth through stock investing, inspired by the strategies of Warren Buffett. At around age 21, I made my first stock trades. But there was a catch: I didn’t have much money, and the idea of waiting decades to see my wealth compound wasn’t appealing.

Throughout my investing career, I have always applied my energies to basis reduction and not seeking discounts when buying a position in a company. I love to use call options or put credit spreads to reduce the basis of a core holding. In this post, I will share with you some of my basis reducing ideas.

Many people think they can quit their day job and start day trading. The truth is, most do not succeed day trading long term. There is an alternative that can generate monthly income just like you hoped to do by day trading. In this post we explore the concept of selling premium in the options market using probability-based options trading.

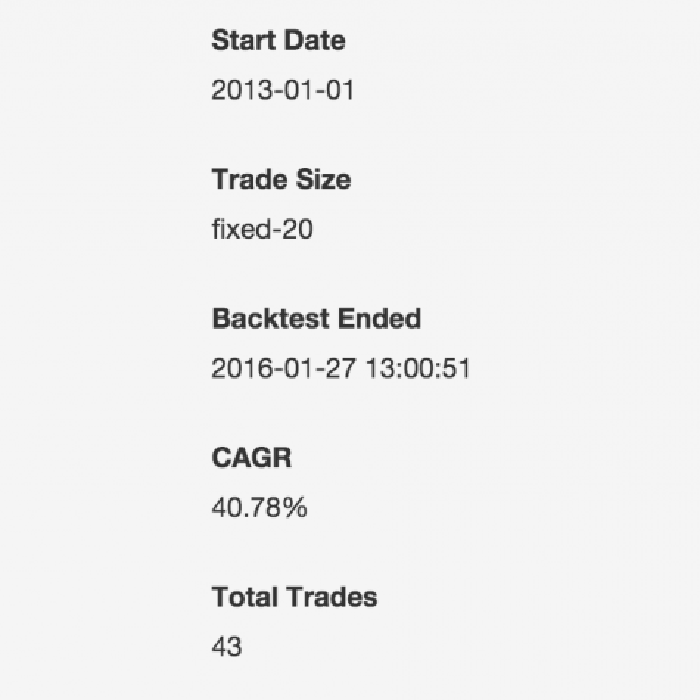

Over the years I have learned that there is no upside to emotional trading. The market is random, and if you try to guess what the next tick will be you will lose. In this post I walk you through designing a trading strategy that prevents your emotions from sabotaging your trading through the wildest of times.

I like directional trading but for the most part directional options trading is a hobby. There is nothing better than picking a direction, applying a leveraged bet via options or futures, and watching that trade take off. Here I will explain why directional trading is just a hobby.

When I first started Stockpeer I expected to mostly share my experiences trading the stock market via automation. But I find myself talking less about automation for an important reason: automation can lead to a lack of engagement—aka complacency.

Recently I have been playing around with something new: trading the futures market as a hedge against my options trading strategy. Why hedge a good bet you ask? Though the strategy I rely on the most—trading put credit spreads on a consistent basis.

To start I want to point out 2 things: this idea is not originally mine, and though I talk mostly about trading I think the concept applies to all forms of investing (buy-and-hold, real estate, fixed income, and so on). From time to time I attend a meetup group.

Want day trading returns without the headache of sitting in front of 26 big-ass monitors all day? You’re in luck because today we are going to discuss trading weekly put credit spreads on the SPY. The idea is pretty basic. I sell a put credit spread on the SPY that expires in 7 days.

I’m baaaaaack! But that’s not to say I am returning empty handed. . . You did notice that I took a nearly 5-month sabbatical from Stockpeer blogging—right? The catalyst was the arrival of my second child, a dangerously sweet little girl!