Warren Buffett often says that he tap dances to work. He has found a method of trading that gets him high. I, however, would be bored to tears if I invested the way Buffett invests: I need more action, which is why I like to trade credit spreads and day trade the SPY.

Spicer's Soapbox

How much money should you risk with each trade? Trade size is one of the most important considerations of an active trading strategy, and maintaining optimal trade size over time involves technique. In this post we will examine 3 methods for determining trade size.

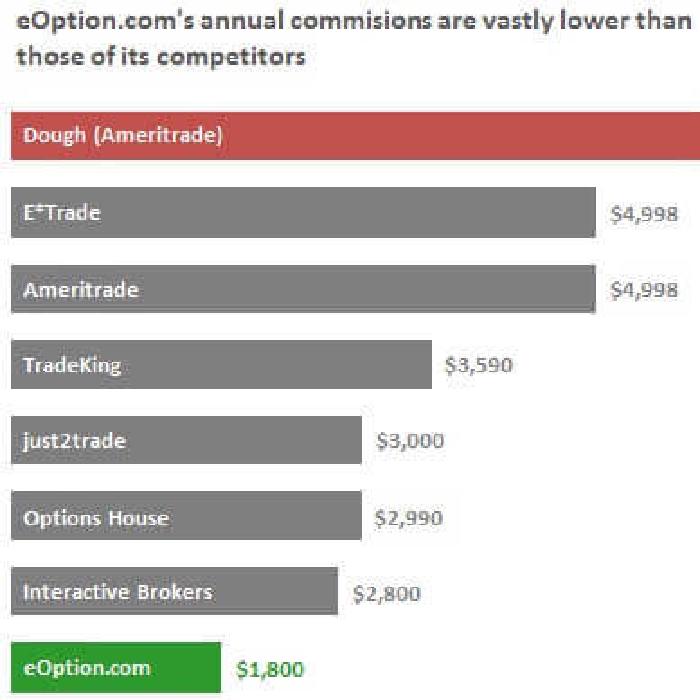

If you're anything like me you already have a consistent trading strategy figured out. You’re just placing the same trades repeatedly, trying to rack up as many occurrences throughout the year as you can. But the more you trade, the more commissions impact your performance—which is why eOption.com is one of my favorite brokers for trading credit spreads.

If you're anything like me you already have a consistent trading strategy figured out. You’re just placing the same trades repeatedly, trying to rack up as many occurrences throughout the year as you can. But the more you trade, the more commissions impact your performance—which is why eOption.com is one of my favorite brokers for trading credit spreads.

When I got interested in trading credit spreads, like most I harbored some skepticism. A credit spread trade seemed to be the type that works—until rather dramatically it does not. Then I set off to figure out the correct way to trade SPY put credit spreads. The path was familiar: backtesting.

When I talk to people about my credit spread trading strategy I often hear the claim that credit spread trading works great for 5, 10, or 20 thousand dollars, but the strategy can’t be scaled up. Are these skeptics suggesting a lack of liquidity to fill bigger orders?

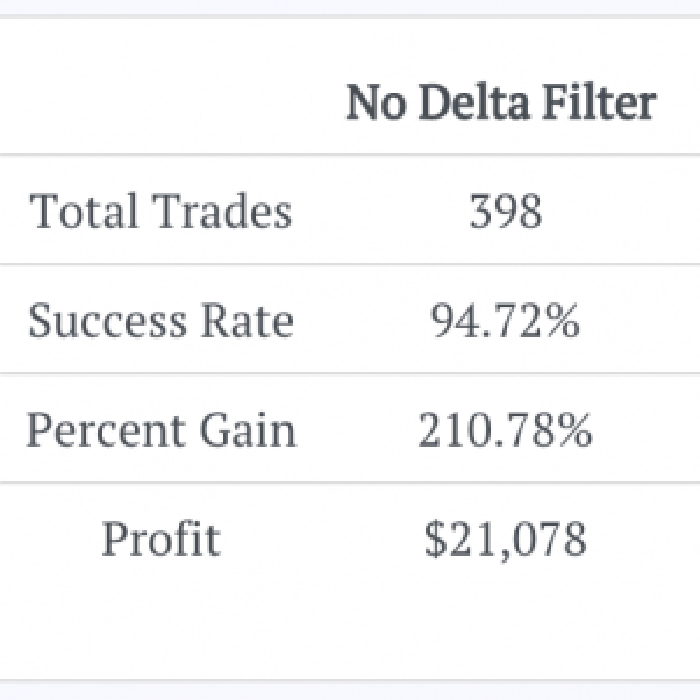

To study how delta affects an opening trade I did—of course—some backtesting. I took a $10,000 account and placed put credit spread trades from 2011 to current. I opened up spreads that were $2 wide, at least 4% out of the money, and no more than 45 days to expiration.

Almost all of my credit spread trading is focused on the S&P 500 via the SPY or S&P 500 futures. Why am I hyperfocused on the SPY? So I can sleep at night (well, try to sleep—I do have a young son and a daughter on the way).

Every great trader has a bag of tricks. Each of these opportunities, if you will, is a predefined market condition signaling when to enter a trade and when to close it. One that has been in my bag for awhile is buying the SPY when the Relative Strength Index (RSI) indicator hits 30.

Like most traders I got started as a stock picker following the most basic of rules: do your homework and have a diversified portfolio. This credo is sound, and it’s the approach I use for some of my accounts. The key to this more traditional approach is understanding that your emotions do play a factor in your investing decisions—and that learning how to manage your emotions can be the pivot between success and failure.

Like most traders I got started as a stock picker following the most basic of rules: do your homework and have a diversified portfolio. This credo is sound, and it’s the approach I use for some of my accounts. The key to this more traditional approach is understanding that your emotions do play a factor in your investing decisions—and that learning how to manage your emotions can be the pivot between success and failure.

The day I learned to pay attention to volatility was the day I started to be consistently profitable in options trading. Most options traders start out trading stocks and they learn that if a stock is associated with good news its value often increases, whereas bad news sends a stock down.