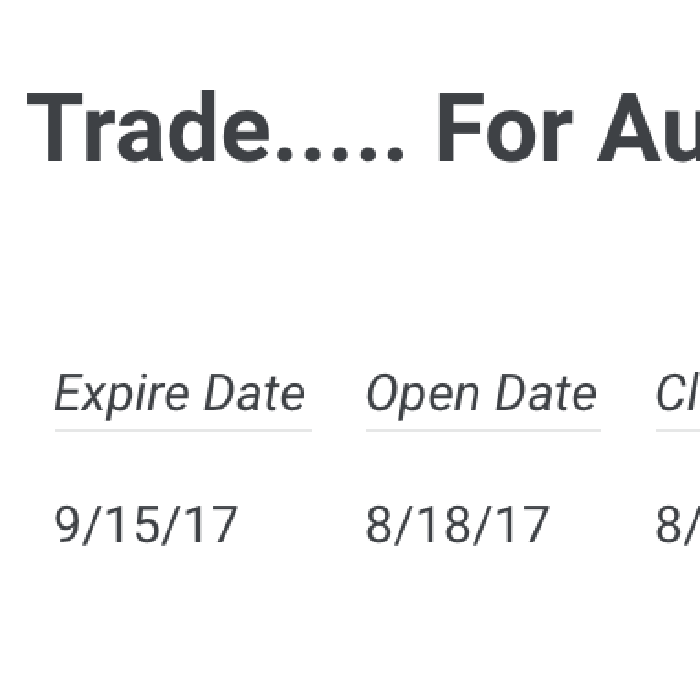

If you are an options volatility trader November was a boring month. I opened 2 put credit spread trades in November -- none closed. We will look at these closing trades in December.

We are in sit and wait mode. Just like this dog......

We like to explore, educate, and share ideas involving options trading. Come along with us on

our journey to demystify the complex yet rewarding world of options trading.

If you are an options volatility trader November was a boring month. I opened 2 put credit spread trades in November -- none closed. We will look at these closing trades in December.

We are in sit and wait mode. Just like this dog......

If your an options volatility trader this is how you felt in the month of October. I was unable to open any put credit spread trades in October. Bottomline......volatility was super low! I think the market is just sort of flat waiting for tax reform.

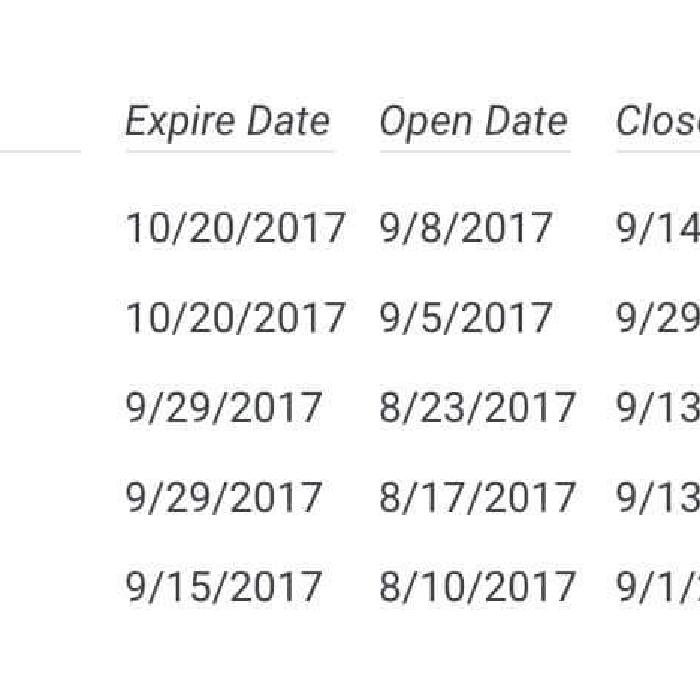

Once again it is time for our monthly summary of trades I closed. Below are the put credit spread trades I closed in September 2017. My birthday month!! Compared to August a number of put credit spreads closed this month. Volatility continues to be very low. When volatility is low we have less opportunities to place trades. Click to take a look at the trades.

If your a follower of this blog or a follower of my trades you might have noticed I stopped posting trades. That is all about to change starting with this post. I am once again committed to posting the trades I place monthly. The reason for the absence in trade posting is we have been crazy busy preparing for the launch of our new trading platform -- Just not enough hours in the day :(.

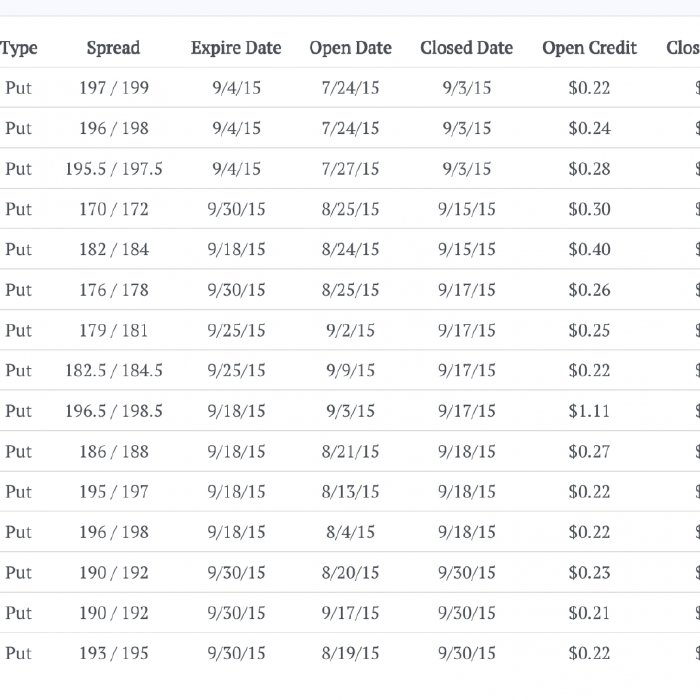

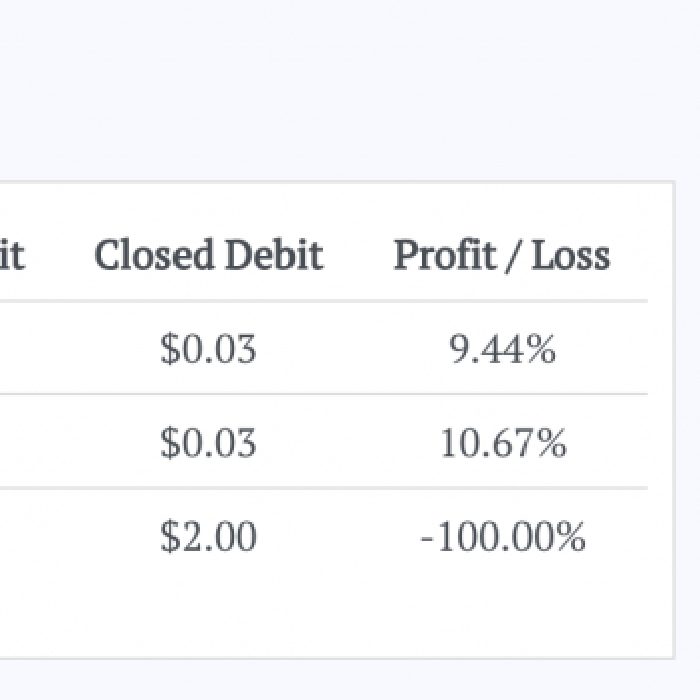

September was a tough month. The market took a major pull back. I lost a fair amount of money. I think if the next 3 months are good I should be able to recoup the losses. Some of the trades were rolled trades (the ones with high credits).

Here we explore the put credit spread trades I placed on the SPY durning the month of August 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Here we explore the put credit spread trades I placed on the SPY durning the month of July 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Here we explore the put credit spread trades I placed on the SPY durning the month of June 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

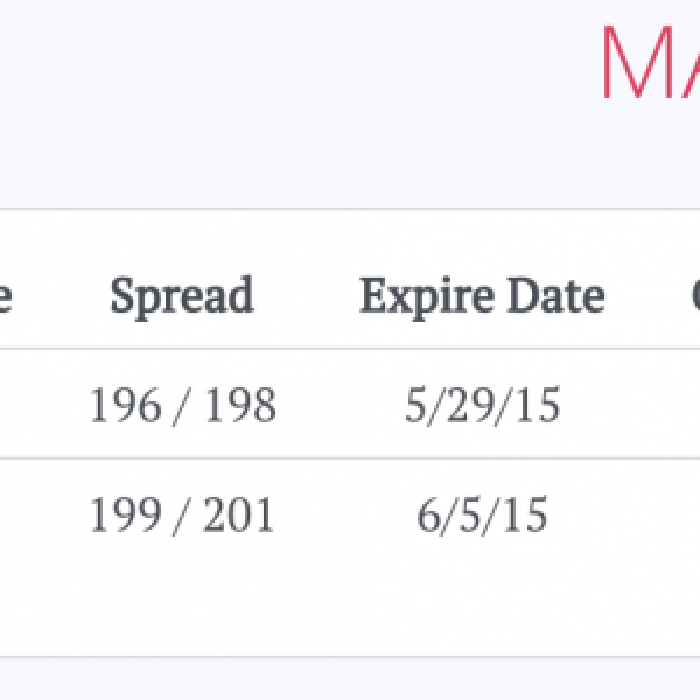

Here we explore the put credit spread trades I placed on the SPY durning the month of May 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

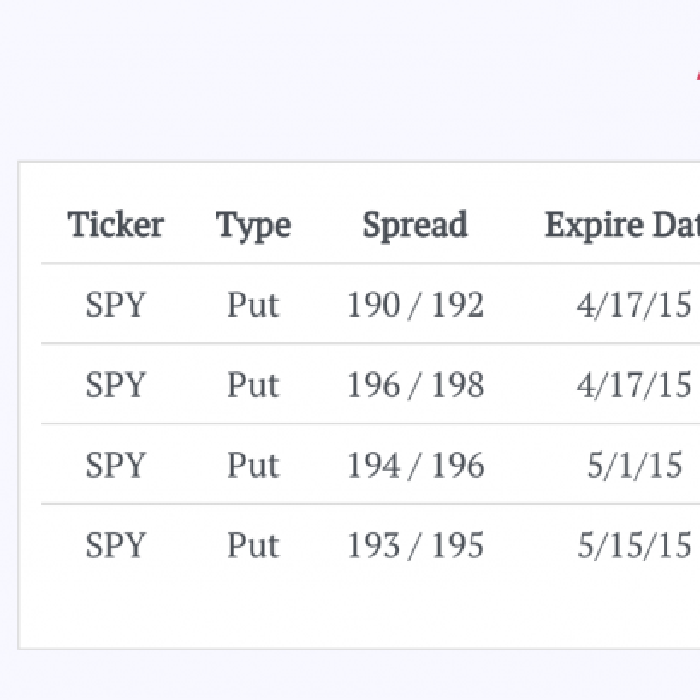

Here we explore the put credit spread trades I placed on the SPY durning the month of April 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Options Cafe Newsletter

Get our latest news delivered to your inbox.