Here we explore the put credit spread trades I placed on the SPY durning the month of March 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Spicer's Trades

Many people think day trading is gambling: you might win for awhile, but eventually you will blow up your account. I agree—yet I day trade the SPY almost every day. Day trading is part of my overflow method and multiple strategy approach to managing my portfolio.

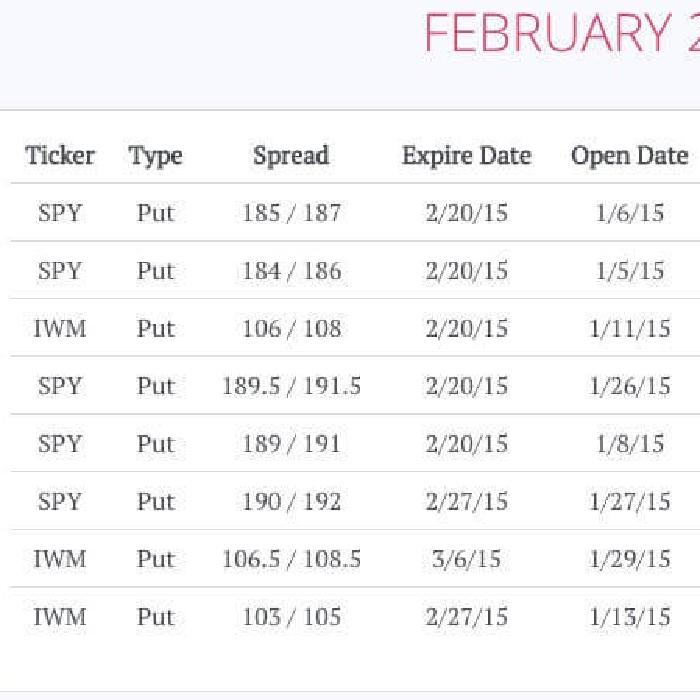

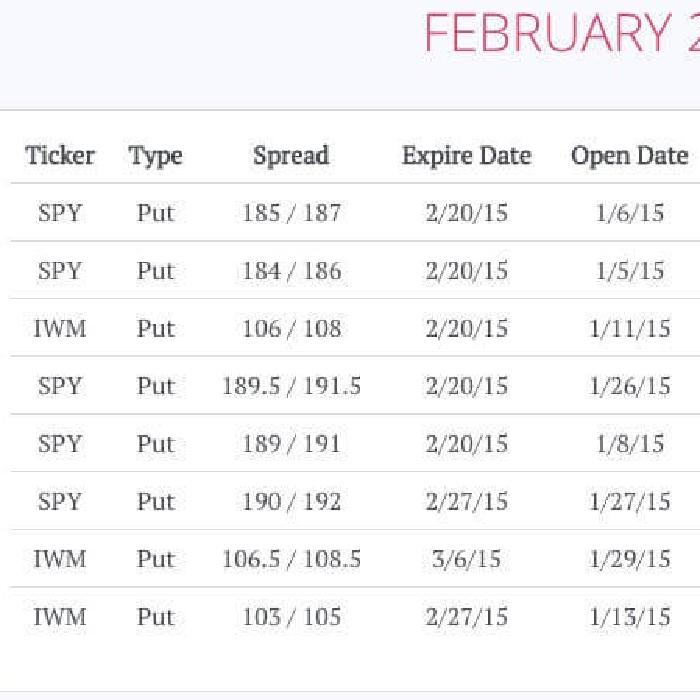

Here we explore the put credit spread trades I placed on the SPY durning the month of February 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

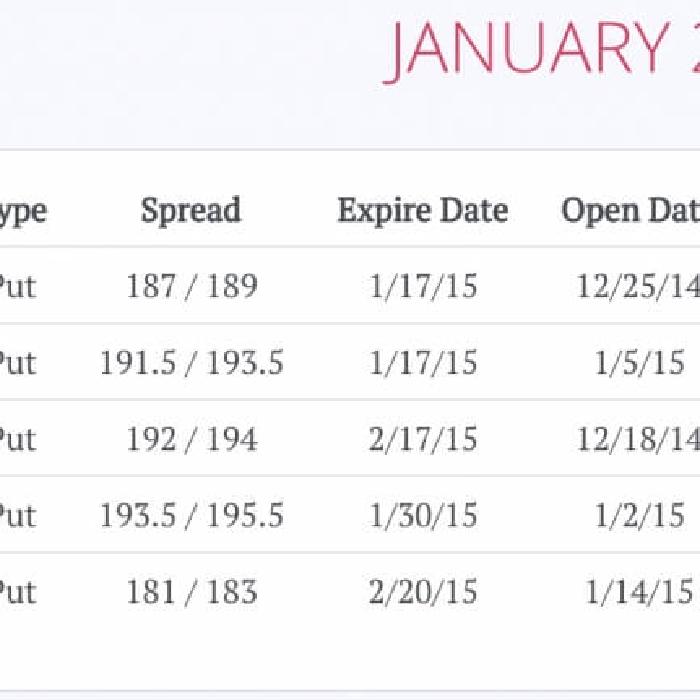

Here we explore the put credit spread trades I placed on the SPY durning the month of January 2015. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

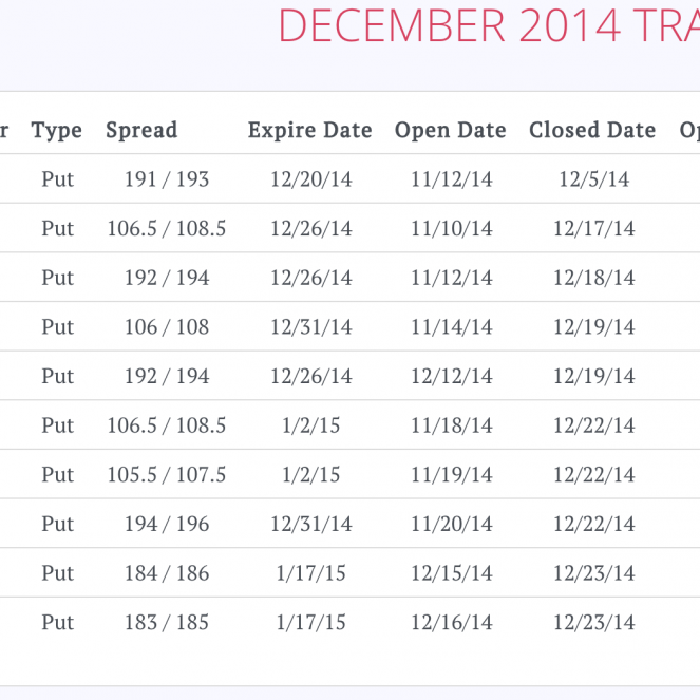

Here we explore the put credit spread trades I placed on the SPY durning the month of December 2014. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

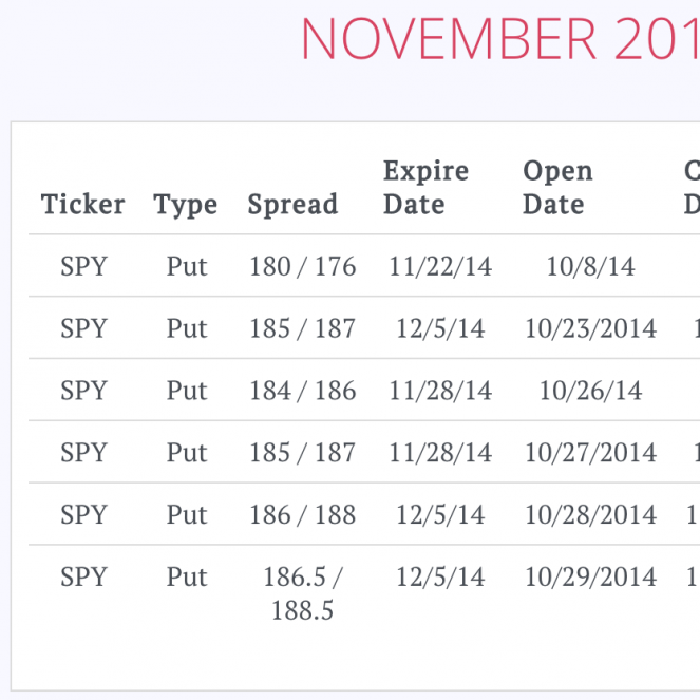

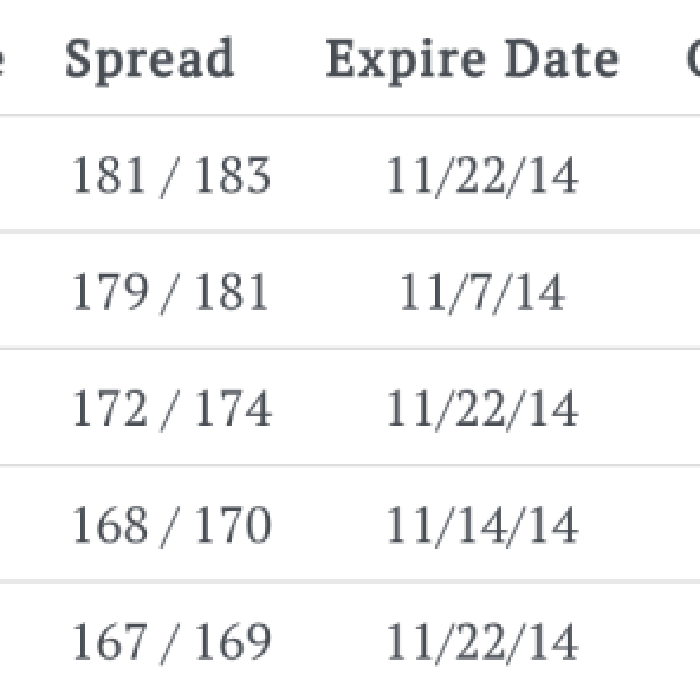

Here we explore the put credit spread trades I placed on the SPY durning the month of November 2014. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Below you will find all of the trades I closed out in October 2014. I plan to post a summary of my complete (not cherry picked) credit spread portfolio each month, and in the future I will share trades as I make them.