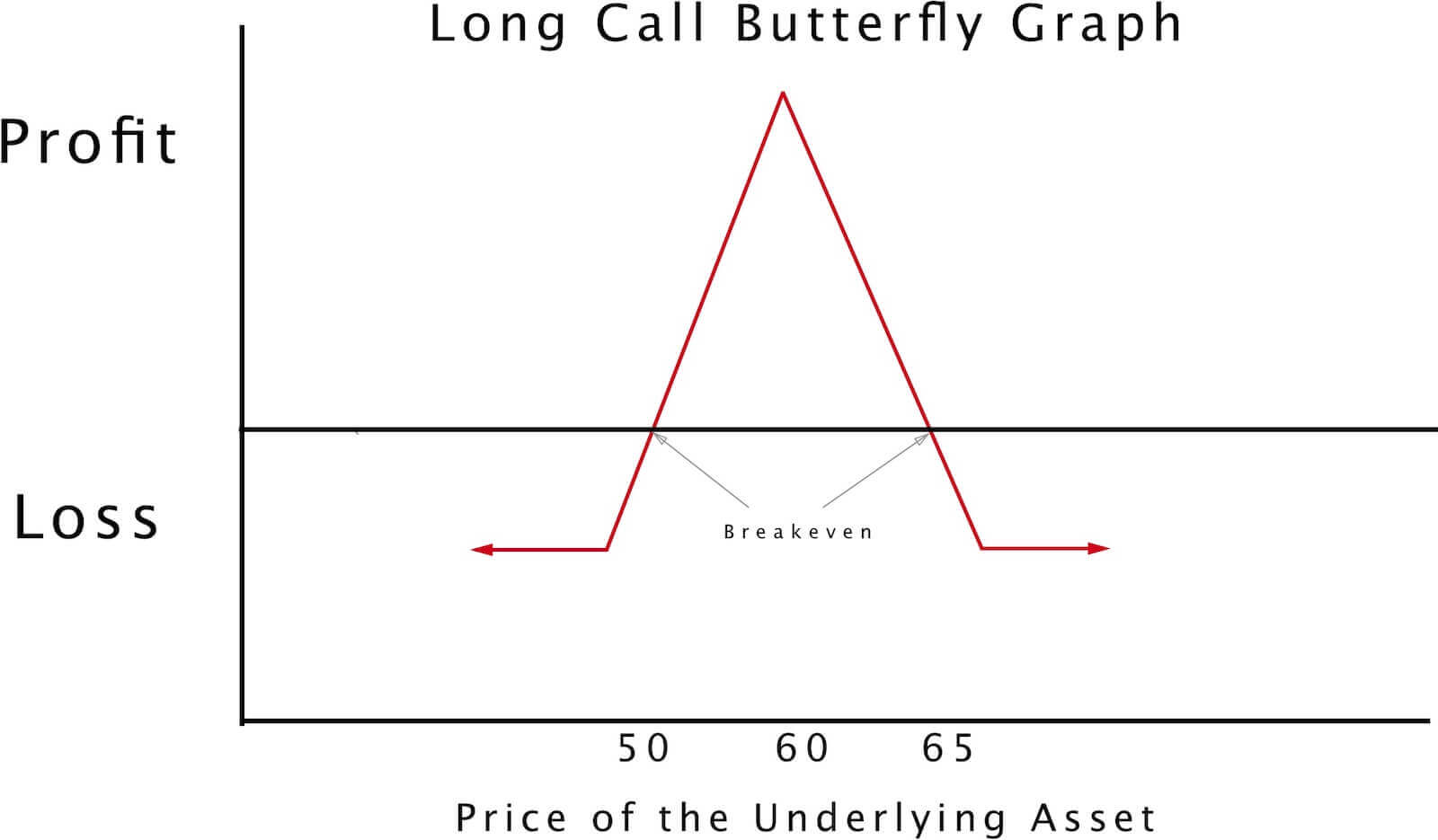

If you expect a stock to trade mostly sideways for the conceivable future, the butterfly option strategy may be worth taking a look at. While it has limited profitability, it also has finite risk. The most you can lose on the trade is the initial cost of entry.

Setting up a Butterfly Spread

To create a long butterfly spread position, you trade four option contracts simultaneously. You write two contracts that are at-the-money. At the same time, you buy one contract that is out-of the money, and purchase one more contract that is in-the-money. These final two contracts should have strike prices that are equidistant from the two contracts that were sold.

All four derivatives have the same expiration date and are of the same type, calls or puts. They can be either, but not a mix.

This option strategy gets its name from the two contracts that are traded on either side of the middle two contracts. They are considered the wings of the option play.

Making and Losing Money

The goal in this derivative investment is for the underlying stock to be at the shorted calls’ strike price on expiration day. This is where the greatest return is achieved. The further the stock moves from that price, the lower the return or the greater the loss will be, up to a certain point.

Because there are two short options and two long options, if the stock makes a move that causes the two short options to gain intrinsic value, the other two options, which are of the same type, will also increase in value. Thus, this strategy always negates losses.

Example of a Long Butterfly Spread

Suppose you noticed that General Mills (ticker GIS) has been moving sideways for some time. You expect this trend to continue based on your technical and fundamental studies. Although you don’t have a lot of risk capital, you decide to use a butterfly derivative strategy to earn a little extra income, knowing that the investment is limited in risk.

The stock is trading at $60. You sell two call options, each with a strike price of $60. You also buy one call with a strike of $55 and another call with a strike of $65. All four securities have the same expiration date.

Buy 1 ITM Call ($50)

Sell 2 ATM Calls ($60)

Buy 1 OTM Call ($65)

The written calls produce a revenue of $1.50 each. Because there are two contracts of 100 shares apiece, the profit is $300.

The contract with the lower strike costs 80¢ per share, while the upper-strike contract is priced at $2.60 per share. The cost of the long contracts is $340. Subtracting this amount from the revenue generated from the written contracts produces a $40 cost for the entire trade.

If GIS stays at $60 and ends there on the expiration date, the two written contracts will be worthless, and so will the call contract you hold at $65. The final contract with a strike of $55 has $5 of intrinsic value per share, producing a profit of $500, which is the total gain from this butterfly strategy. Subtracting $500 from the $40 net debit produces a net gain of $460 for the butterfly investment, not calculating any commissions paid.

On the other hand, if General Mills had reported above-average earnings and the stock price went to $70, all four contracts would have intrinsic value. The two short contracts would be worth $1,000 each, producing a total loss of $2,000. The contract with the lower strike would be worth $1,500, while the higher-strike call would have a value of $500. Clearly, the long and short contracts cancel out, leaving just the cost of entry as the total loss.

Butterfly Equations

Looking at the numbers in the General Mills example, we can determine the following equations, which show the breakeven points:

Upper break-even level = Highest strike price – net premium paid – commissions

Lower break-even level = Lowest strike price + net premium paid + commissions

Notice that the more you pay in commissions and premiums, the narrower the range of profit.

Related Topics: Butterfly Spread, Call Options