Today I’m going to walk you through the mechanics of what I look for as I set up a new trade using option greeks. I pay close attention to the Greeks to get a feel for how my trade is going to behave between the time I put it on and the time it expires. Today, I’m looking at a bull call spread on Applied Optoelectronics, Inc. (AAOI). Before we look at the Option Greeks, let me give you the rundown of what I’m looking at on this stock.

When Trading Option Greeks Consider The Underlying First

I trade AAOI a lot. It presents continual options opportunities, so it’s always on my watchlist. The company reported earnings the week before I put on this trade. While they beat consensus numbers, they offered cautious guidance for the next quarter. So, the stock just got crushed. It has lost some 34% of its value since the company reported. Nothing else has changed fundamentally, so I’m back in.

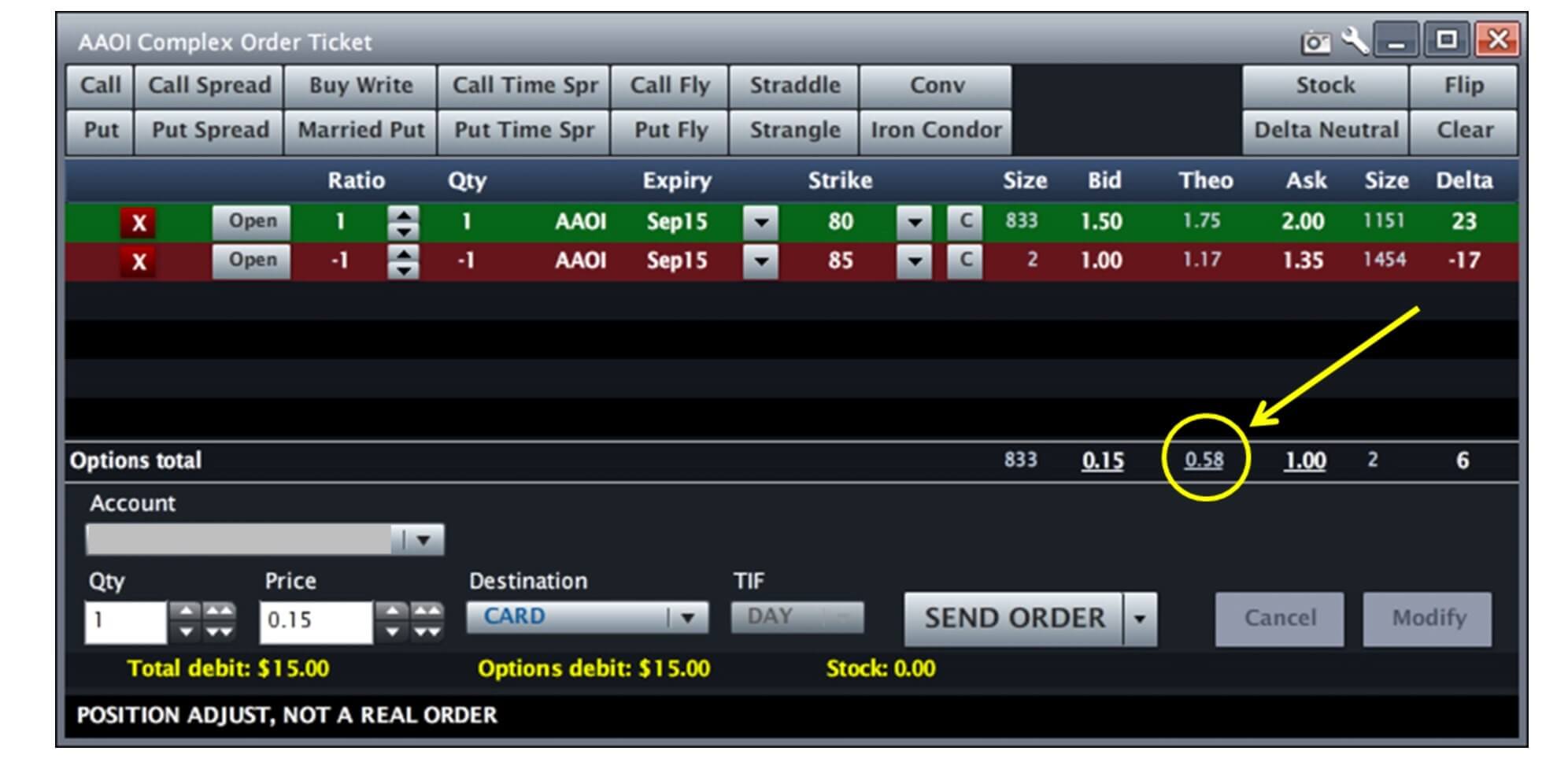

I’m setting up a bull call spread with regular September expiration. That’s just 37 days away…but my sense is I’ll be out of the trade before then (hopefully with a gain). The options market is telling me that the expected move between now and then is about 11.25 points. So, that’s where I’m going to look at my strikes for this spread. Let’s see what the Greeks are telling us.

Next Look at The Greeks

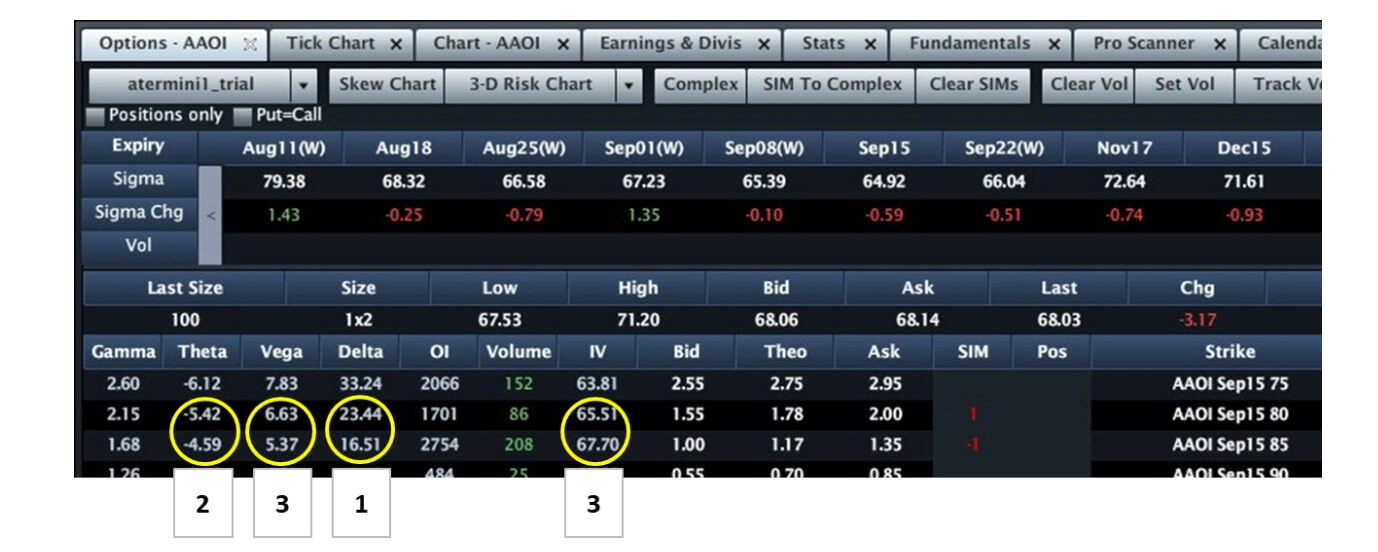

Because this is a vertical spread I’m long some Delta and I’m short some Delta. I’ve circled this as # 1 in the image above. When you do the math, you’ll see that I’ve got hardly any net Delta at all; just 6.93. That means that for every 1 point move in AAOI stock, this spread is going to advance less than 7-cents. Doesn’t sound like much, but when you consider that we put on this spread for just 58-cents, that’s not a bad move – especially for this high-beta stock.

How The Options Greeks Could Go Wrong?

So, the next thing to look at is # 2, Theta. Here again, it’s a net number. And, between now and the close of business tomorrow this puppy is going to lose 0.83-cents of its value to time decay. The important thing to remember is that Theta is right now as low as it’s going to be for the rest of this contract’s life. It’s only going to get bigger, and bigger, and bigger from here. And, it’s going to get bigger at a faster pace every day for the next 37 days. So, again, I better be right on the direction of this stock or this baby is going to expire worthless!

Now, let’s look at # 3. You’ll notice that there are two circles labeled # 3. They are related. Look at the circle to the left. That’s the one over Vega. Here again, we see that because we’re long one strike and short the other, Vega is a net number. It’s 1.26. This tells me that if implied volatility increases one percent (or one point) then my net premium is going to go up 1.26-cents. If it goes down one percent, then my premium shrinks by 1.26-cents.

What Could Go Right?

Now look at the # 3 on the right. Here we’re looking at implied volatility. I’m not concerned about netting these two numbers. I’m more concerned about where they are in relation to historical volatility. Take a look at the image below to get a sense for that.

The blue line inside the yellow oval shown in the image above is historical volatility (HV). The red line is implied (IV). When I took this screenshot HV was at 167.11. IV was at 67.65. I’ll talk more about this in the weeks ahead, but the relation between these two is so out of whack, that I think that IV will increase rather than decrease from here. If that happens, then my net premium is going to expand right along with it. This, oh by the way, is why I put on this trade today.

As you can see there are lots of factors in trading option greeks understanding how they work is key to successfully trading options. Greeks drive the decisions of most options traders.

Related Topics: Greeks, Theta, Volatility, Delta