Buy Low Sell High! You’ve heard that old adage about a zillion times because it is the essence of what makes a good trade. But, most novice options traders think of the term as referring only to an option’s premium. Buying premium at a low level and then selling it at a higher level. But, the term is equally applicable – actually more applicable – to buying and selling volatility. In my opinion, that’s where all the opportunity is.

The price of an option is determined by six variables, five of which are known values based on pretty straightforward measures. There’s no guesswork about them. For example, the intrinsic value of an option is determined by the market price of the underlying. It’s a very black and white measurement. Nobody’s opinion is involved. It’s pure mathematics, plain and simple. That’s not the case with implied volatility.

Implied volatility is the market’s estimate as to how much a stock is going to move – up or down – over a set period of time. Sometimes the market gets it right. Sometimes it doesn’t. Sometimes it estimates implied volatility too high and sometimes it pegs it too low. So, today, I’m going to walk you through a couple of trade setups you can use when implied volatility is higher than historical volatility.

In each setup I’m going to use GameStop Corp (GME) as my example. I’m going to show you how to trade volatility when you’re a bull and when you’re a bear.

Step One – Should We Be Long Or Short?

Take a look at the image below. Here we’re looking at a graph comparing implied volatility (the red line) to historical volatility (the blue line). When I took this screenshot 30-day implied volatility was at 54.43 and historical volatility was at 23.27. That’s huge!

That's the biggest mismatch we've seen in more than a year. Since implied volatility is so out of whack with historical, I think that a trader has a better chance of winning by selling premium rather than buying it. And, that’s the case whether the trader is a bull or a bear. Let’s say you’re a bull.

The Bull Case – Trade Setup

If you’re a bull and you want to make a directional trade to profit from an up move in the stock you have two choices. You can go long calls (or a call spread) or you can short a put spread. There’s no naked writing in my methodology. And, as I suggested above, with implied volatility so high, I’d be awfully shy about going long. There’s just too much risk of volatility shock. So, I’m going to suggest that in this circumstance the upside move is a bull put spread.

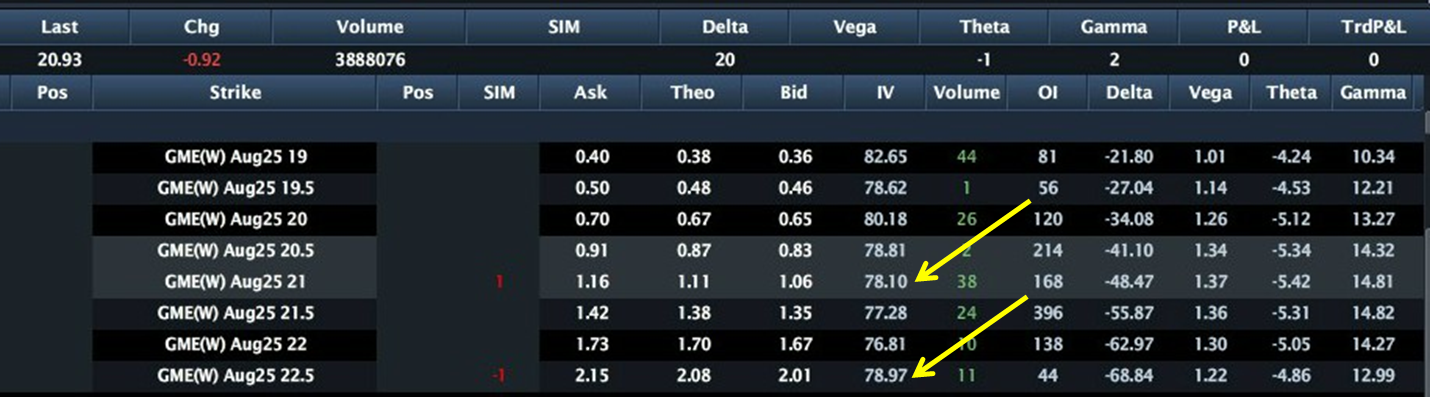

Let's look at what GME is offering the bulls. The expected move is about 2.2 points and the stock is at 20.93. That means the market thinks the stock could go to 23.13. So, if I write a credit spread and GME moves as expected, both of the strikes I’ve chosen should expire worthless and I’ll max out my profits. My credit spread is long the 21 strike and short the 22-half strike.

That will generate 97-cents in premium.

Now let's look at what the bears might expect. I’m going to keep this simple and use the same strikes and follow the same logic, that there’s just too much risk being long premium with volatility so high.

The Bear Case – Trade Setup

To make this call spread a credit spread – and therefore a bear spread – I’m going to sell the 21 and buy 22-half.

That's going to bring in 56-cents of premium income. Using the expected move of 2.2 points, the market is suggesting that on the downside GME could trade to 18.73. So, being short the 21 strike is well within that move. If the stock did trade there, then both options would expire worthless and I’d get to keep my 56-cents.

Volatility Trading Is Opportunity

The examples above are some of the simplest ways to trade volatility. There are plenty more strategies that a trader can use to take advantage of a mismatch between implied volatility and historical volatility.

Many of those strategies are pretty complex. But, the best part about them is that you don’t need to make a bet one way or the other. You don’t have to make a directional play for those other strategies to work out. You can be completely neutral and still make profitable trades.

This is one of the main reasons that I believe that trading volatility is where all the opportunity is!

Related Topics: Volatility, Put Credit Spread