Most wheel strategy guides leave out critical details: position sizing, tax implications, dividend complications, and what happens when things go wrong. This complete guide covers everything you need, including my real results (wins and losses), so you can execute the wheel strategy with confidence.

What Is the Wheel Options Strategy?

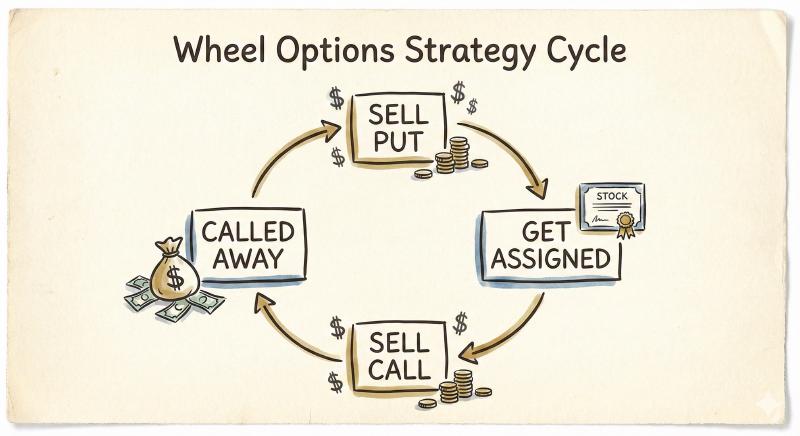

The wheel options strategy is a systematic approach to options trading that generates income by cycling between two phases: selling cash-secured puts and selling covered calls. The strategy gets its name from the continuous "wheel" motion as you rotate between these two positions.

Here is the core concept: you start by selling put options on stocks you would be willing to own. If the stock stays above your strike price, you keep the premium as pure profit. If the stock drops below your strike, you get assigned shares at an effective discount (the strike price minus the premium collected). Once you own shares, you sell covered calls against them, collecting more premium while you wait for the stock to recover. When your shares get called away, you start the cycle over with cash-secured puts.

The wheel strategy works because you are always selling premium, which means time decay (theta) works in your favor regardless of which phase you are in. Unlike directional trades where you need the market to move a certain way, the wheel strategy profits from the passage of time and the eventual mean reversion of stock prices.

The Two Phases of the Wheel Options Strategy

Phase 1: Cash-Secured Put Phase - You sell put options on a stock at a strike price below the current market price. This position is "cash-secured" because you have enough cash in your account to purchase 100 shares at the strike price if assigned. If the stock stays above the strike at expiration, the put expires worthless and you keep the entire premium. If the stock falls below the strike, you are assigned 100 shares at the strike price, effectively buying the stock at a discount when you factor in the premium received.

Phase 2: Covered Call Phase - Once you own shares (either from assignment or from buying stock outright), you sell call options against your shares. This is "covered" because you own the underlying shares to deliver if the call is exercised. If the stock stays below the strike at expiration, you keep the premium and can sell another call. If the stock rises above the strike, your shares are called away at a profit and you return to Phase 1 with the cash from the sale.

Step-by-Step: How to Execute the Wheel Options Strategy

Understanding the theory is important, but execution is where most traders struggle. Here is my exact process for trading the wheel strategy, refined through over 160 completed trades.

Step 1: Select Your Underlying Stock

Stock selection is the most important decision in the wheel options strategy. I will cover my detailed criteria in the next section, but the key principle is this: only trade the wheel on stocks you genuinely want to own. If you would not be comfortable holding 100 shares of a company through a 30% drawdown, that stock is not appropriate for your wheel strategy.

Never select stocks based solely on premium size. High premiums mean high risk. Select stocks you would be happy to hold for 12+ months regardless of price.

Step 2: Sell a Cash-Secured Put

Once you have identified your target stock, sell a put option with these considerations:

- Strike Selection: I typically sell puts 5-15% out of the money, depending on the stock's volatility and where I see support levels. The strike should be a price where you would genuinely be happy to own shares.

- Expiration: I prefer 30-45 days to expiration (DTE). This timeframe balances premium collection with manageable risk. Longer expirations tie up capital and increase directional risk, while shorter expirations require more active management for less premium.

- Premium Target: I look for at least 1-2% return on the cash secured per month. If a stock cannot generate adequate premium, it might not be volatile enough for the wheel strategy.

When you sell the put, you will immediately receive a credit (the premium). Your broker will require you to maintain sufficient buying power to purchase 100 shares at the strike price (this is the "cash-secured" part).

Step 3: Monitor and Manage the Position

After opening the position, you have three possible outcomes:

- Stock stays above strike: The put expires worthless, you keep the full premium, and you can sell another put to restart the cycle.

- Stock drops below strike: You are assigned 100 shares at the strike price. Your effective cost basis is the strike price minus the premium received.

- You close early: If the put has gained significant value (meaning the stock went up), you can buy it back early to lock in profit and free up capital for another trade.

I typically buy back puts when I can capture 50% or more of the maximum profit with significant time remaining. This frees up capital to redeploy into new positions and reduces risk exposure.

Step 4: If Assigned, Sell a Covered Call

Once you own shares (from assignment), immediately sell a covered call to begin generating premium on your stock position:

- Strike Selection: I typically sell calls at or above my cost basis to ensure any assignment results in a profitable trade. If the stock has dropped significantly, I may sell calls below my cost basis and accept breaking even or a small loss to free up capital.

- Expiration: Same 30-45 DTE framework as the puts.

- Timing: Sell calls on green days when premium is elevated due to recent upward movement.

Step 5: Repeat the Cycle

When your shares are called away, you receive cash equal to the strike price multiplied by 100 shares. You are now back to Phase 1 with cash ready to sell puts again. This continuous cycling is why the strategy is called "the wheel."

Stock Selection Criteria for the Wheel Options Strategy

Poor stock selection is the number one reason traders fail with the wheel strategy. Selecting stocks based solely on premium size leads to disaster because high premiums usually mean high risk. Here are my criteria for wheel strategy candidates:

1. You Must Actually Want to Own the Stock

This is not negotiable. The wheel strategy requires holding stock through downturns. If you pick a stock purely for its premium and would panic if assigned, you have already lost. Ask yourself: would I be comfortable holding this stock for 12+ months if it dropped 40%? If not, skip it.

2. Adequate Liquidity and Options Volume

Look for stocks with tight bid-ask spreads on options (ideally under $0.10 for near-the-money strikes). Wide spreads eat into your profits through slippage. I also prefer stocks with weekly options availability for more flexibility in strike and expiration selection.

3. Stock Price in Your Comfort Zone

Each put contract controls 100 shares, so a $50 stock requires $5,000 in buying power per contract. I recommend starting with stocks in the $20-$60 range until you have significant capital. Currently, I am trading stocks like SOFI (~$15), INTC (~$20), DKNG (~$40), and RIVN (~$15), which keeps position sizes manageable.

4. Sufficient Implied Volatility for Worthwhile Premium

Boring, low-volatility stocks might be safe, but they generate minimal premium. I look for stocks with enough volatility to generate 1-2% monthly returns on secured capital. Tech, biotech, and growth stocks often fit this criteria, but remember: higher volatility means higher assignment risk.

5. No Upcoming Binary Events

Avoid selling puts into earnings announcements, FDA decisions, or other major catalysts. The elevated premiums might look attractive, but the risk of a gap down through your strike is too high. I close or roll positions before earnings rather than gambling on the outcome.

6. Avoid Dividend Stocks (Usually)

Dividend-paying stocks introduce early assignment risk for covered calls, which I will discuss in detail later. If you do trade dividend stocks, you must account for ex-dividend dates in your call selling strategy.

My Current Wheel Strategy Holdings

For transparency, here are the stocks I am currently trading with the wheel strategy as of January 2026:

- Put Phase: UNG, INTC, SMMT, BMNR, IONQ, RKT, DKNG, RIVN, SOFI

- Call Phase: ETSY

Notice the diversification across sectors: energy (UNG), semiconductors (INTC), biotech (SMMT, BMNR), quantum computing (IONQ), fintech (RKT, SOFI), sports betting (DKNG), and EV (RIVN). This diversification helps smooth returns when individual positions move against me.

Position Sizing and Portfolio Allocation

Position sizing is where most wheel strategy guides fail to provide actionable guidance. Here is my framework:

- Maximum 5% of total portfolio per single stock position

- Keep 60-80% deployed, 20-40% in cash reserves

- Never over-leverage—keep positions fully cash-secured

- Start small and scale up as you gain experience

The 5% Rule

I allocate no more than 5% of my total portfolio to any single wheel position. If my portfolio is $100,000, that means maximum $5,000 exposure per stock. For a $50 stock, that is one contract. For a $25 stock, that is two contracts.

This rule prevents any single stock from devastating your portfolio. Even if a stock drops 50% and I am assigned, the maximum impact is a 2.5% portfolio drawdown (50% of 5%), which is recoverable.

Total Wheel Allocation

I keep 60-80% of my options trading capital deployed in wheel positions at any time, with the remainder in cash for opportunities or to manage positions that need adjustment. Running at 100% deployment is risky because you have no flexibility when trades move against you.

Cash Requirements

Remember that selling cash-secured puts requires holding the full assignment value in cash or margin. One contract on a $40 stock requires $4,000 in buying power. Make sure you understand your broker's margin requirements and never over-leverage. The wheel strategy should be conservative, not aggressive.

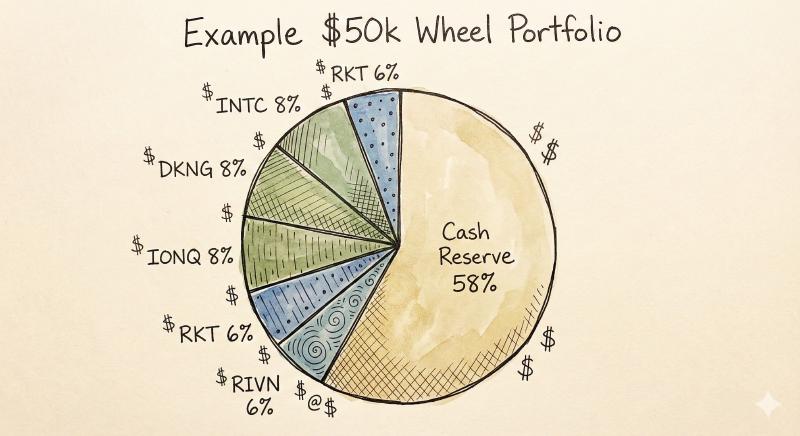

Example Portfolio Allocation

Here is how I might allocate a $50,000 wheel strategy portfolio:

- SOFI ($15 stock): 2 contracts = $3,000 max risk

- INTC ($20 stock): 2 contracts = $4,000 max risk

- DKNG ($40 stock): 1 contract = $4,000 max risk

- RKT ($15 stock): 2 contracts = $3,000 max risk

- RIVN ($15 stock): 2 contracts = $3,000 max risk

- IONQ ($40 stock): 1 contract = $4,000 max risk

- Cash reserve: $29,000

This gives exposure to 6 different stocks while maintaining substantial cash reserves for management and new opportunities.

Managing Early Assignment Risk

Early assignment occurs when the option holder exercises their option before expiration. For puts, this means you receive shares earlier than expected. For calls, your shares are taken earlier than expected. Understanding early assignment is critical for proper wheel strategy execution.

Early Assignment on Cash-Secured Puts

Early assignment on puts is rare and usually not problematic. It typically only happens when:

- The put is deep in the money with little time value remaining

- The option holder needs to exercise for tax or margin reasons

If you are early assigned on a put, you simply receive shares sooner than expected. Your cost basis remains the strike price minus the premium received. The main inconvenience is having capital tied up in shares rather than cash, but you can immediately sell covered calls to continue generating income.

Early Assignment on Covered Calls

Early assignment on calls is more concerning and typically happens around ex-dividend dates. Here is why: if the extrinsic value of an in-the-money call is less than the upcoming dividend, it becomes economically rational for the call holder to exercise early, capture the dividend, and sell the stock.

To avoid dividend-related early assignment:

- Close or roll calls before the ex-dividend date if they are in the money

- Avoid selling calls with strikes below the current price heading into ex-dividend

- Consider avoiding dividend stocks entirely for the wheel strategy

If you are early assigned on a call, you lose the shares at the strike price. Your profit or loss is locked in, and you return to the put phase. The main issue is missing potential upside if the stock continues higher after assignment.

Dividend Considerations for the Wheel Strategy

Dividend-paying stocks add complexity to the wheel strategy that many guides overlook. Here is what you need to know:

Ex-Dividend Dates and Covered Calls

The ex-dividend date is the cutoff for receiving the next dividend payment. If you own shares on the ex-date, you receive the dividend. This creates early assignment risk for covered calls as discussed above.

My approach: I generally avoid dividend stocks for the wheel strategy. The extra complexity and early assignment risk are not worth it when plenty of non-dividend stocks offer excellent premium. If you do trade dividend stocks, track ex-dates religiously and never have in-the-money calls open heading into the ex-date.

Dividend Capture Strategy Variation

Some traders intentionally try to capture dividends within the wheel by timing puts to get assigned before ex-dates and calls to avoid assignment until after. This is more complex than standard wheel execution and requires precise timing. I do not recommend it for beginners.

Tax Implications of the Wheel Options Strategy

Taxes are a critical consideration that most wheel strategy guides ignore. The wheel strategy can be tax-inefficient if not managed properly. Here is what you need to know (consult a tax professional for advice specific to your situation):

Short-Term vs Long-Term Capital Gains

Option premiums from puts and calls are taxed as short-term capital gains, regardless of how long you hold the option. In the US, short-term gains are taxed at your ordinary income rate, which can be 22-37% for higher earners. This is significantly higher than the 15-20% long-term capital gains rate.

The wheel strategy generates almost exclusively short-term gains because:

- Option premiums are always short-term

- Shares held during the call phase are typically held for less than one year

- Frequent cycling prevents building long-term holding periods

Cost Basis Adjustments

When you are assigned shares from a put, your cost basis is the strike price minus the premium received. When shares are called away, your sale price is the strike price plus the premium received. Make sure your broker reports these correctly or track them yourself for accurate tax reporting.

Wash Sale Rule Considerations

The wash sale rule can create complications if you take losses and then re-enter positions within 30 days. In the wheel strategy, this can happen if:

- You close a losing put and immediately sell another put on the same stock

- You sell shares at a loss and then sell a put on the same stock within 30 days

Wash sales do not eliminate your loss—they defer it by adding the disallowed loss to your new position's cost basis. But it can create tax reporting complexity. If you trade the same stocks repeatedly with the wheel, consult a tax professional about wash sale implications.

Tax-Advantaged Accounts

One way to avoid the short-term gain problem is to trade the wheel strategy in a tax-advantaged account like an IRA. This eliminates annual tax drag and allows compound growth. However, you cannot use margin in most IRA accounts, so every put must be fully cash-secured.

Rolling Options to Manage Positions

Rolling is the technique of closing an existing option and simultaneously opening a new one, typically at a different strike or expiration. Rolling is a powerful tool for managing wheel positions that have moved against you.

When to Roll

Consider rolling when:

- Your put is in danger of assignment and you want to avoid it: Roll out (further expiration) and/or down (lower strike) to collect additional premium and give the stock more time to recover.

- Your covered call is about to be assigned and you want to keep shares: Roll up (higher strike) and/or out (further expiration) for additional premium while raising your effective sale price.

- You want to lock in profit early and redeploy capital: Close the position and open a new one with better risk/reward characteristics.

How to Roll

Most brokers have a "roll" function that combines the closing and opening trades into a single order. This provides better execution than doing two separate trades. When rolling, aim to collect a net credit (receive more premium than you pay to close).

Rolling Rules I Follow

- Never roll for a debit: If you have to pay to roll, you are throwing good money after bad. Accept the assignment or loss instead.

- Do not roll indefinitely: If I have rolled a position twice without improvement, I typically accept assignment rather than continuing to defer.

- Roll early, not late: It is easier to roll for a credit when there is still time value in the option. Waiting until expiration day limits your options.

Rolling Example

Suppose I sold a put on DKNG at the $35 strike for $1.50 premium (expiring in 30 days). The stock drops to $33 with 7 days to expiration. My put is now worth $2.80, so I am down $1.30.

I could:

- Accept assignment: Buy shares at $35, effective cost basis $33.50 ($35 - $1.50 premium)

- Roll down and out: Buy back the $35 put for $2.80, sell a new $33 put expiring in 45 days for $2.00. Net cost: $0.80 debit. New break-even: $33 - $1.50 + $0.80 = $32.30

Wait—that roll is a debit. According to my rules, I would not take it. Instead, I might roll out only (same strike, later expiration) for a credit, or accept assignment and begin selling covered calls.

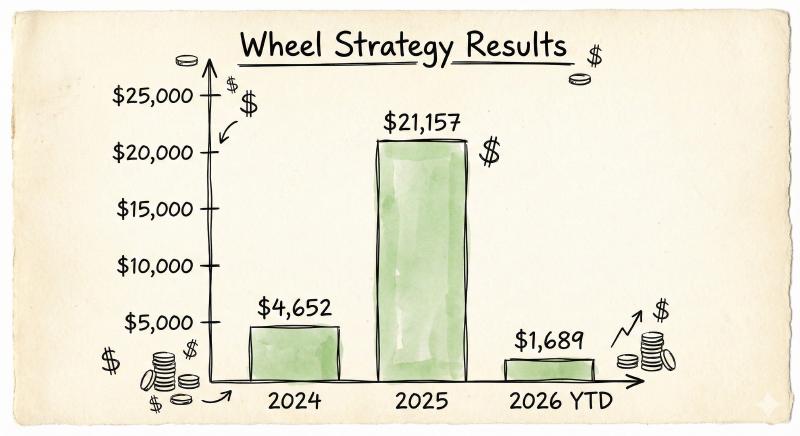

My Real Trading Results with the Wheel Options Strategy

I believe in full transparency, which is why every trade I make is logged publicly on this website. Here are my actual results with the wheel strategy:

Performance Summary

| Year | Total Profit | Completed Trades |

|---|---|---|

| 2024 | $4,652 | 28 |

| 2025 | $21,157 | 124 |

| 2026 (YTD) | $1,689 | 8 |

| Total | $27,498 | 160 |

You can see every trade on the 2025 Wheel Strategy results page and the 2024 Wheel Strategy results page.

What the Numbers Show

A few observations from my results:

- Scalability: 2025 was dramatically more profitable than 2024 because I committed more capital and traded more actively. The strategy scales well.

- Consistency: I made money in most months. Even months with losses (April 2025: -$66, October 2024: -$407) were small compared to winning months.

- Recovery: After losing months, the systematic approach kept me in the market generating premium. Emotional traders would have stopped; I kept executing.

My Worst Trades

For complete transparency, here are some trades that did not work out:

Every trader experiences losses. What matters is following your rules and ensuring winners outpace losers over time.

- INTC (August 2024): Lost $680 when Intel collapsed after disappointing earnings. I was assigned shares and eventually worked my way out, but it was painful.

- F - Ford (June 2024): Lost $516 during a period of EV uncertainty. Should have been more careful with auto stocks.

- BMNR (November 2025): Lost $1,124 on this biotech position. Biotech stocks are volatile, and this one moved against me hard.

These losses are part of trading. What matters is that winning trades significantly outpaced losing trades over time, and I followed my rules consistently regardless of short-term outcomes.

When NOT to Use the Wheel Options Strategy

The wheel strategy is not appropriate for every situation. Here is when you should avoid it:

When You Cannot Afford Assignment

If getting assigned 100 shares would represent a significant portion of your portfolio, you do not have enough capital for the wheel strategy on that stock. Never sell puts where assignment would cause financial stress.

During High Uncertainty Events

Earnings announcements, FDA decisions, major product launches—these binary events can move stocks far more than typical premium covers. Close positions or avoid opening new ones before major catalysts.

When You Are Bearish on the Stock

The wheel strategy has a bullish-to-neutral bias. You profit when stocks go up, stay flat, or go down a little. If you expect a stock to crash, the wheel strategy is the wrong tool. You would be selling puts on the way down and getting assigned repeatedly.

When Volatility Is Extremely Low

During periods of very low implied volatility (like 2017 or early 2020), option premiums compress to the point where the wheel strategy is not worth the capital commitment. If you cannot generate at least 1% monthly return on secured capital, consider other strategies.

When You Do Not Have Time to Monitor Positions

While the wheel strategy is relatively passive compared to day trading, it is not set-and-forget. You need to monitor positions, roll when appropriate, and manage assignments. If you cannot check your portfolio at least every few days, the wheel may not be right for you.

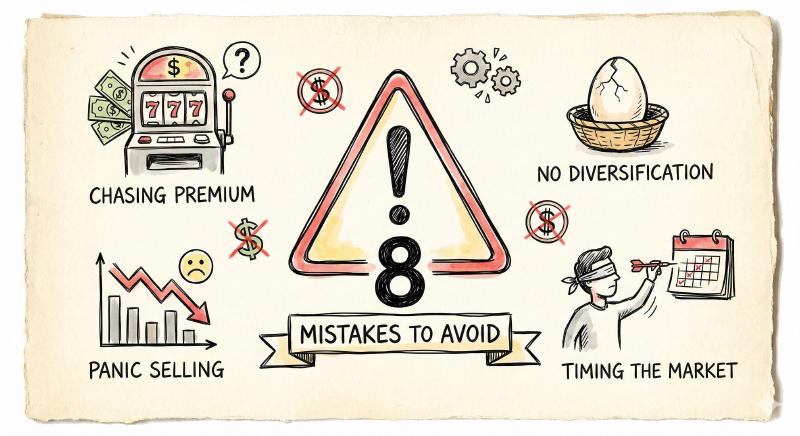

Common Mistakes to Avoid with the Wheel Options Strategy

After executing over 160 wheel trades, I have learned what works and what does not. Here are the most common mistakes I see traders make:

Mistake 1: Chasing Premium on Risky Stocks

High premiums exist for a reason—they compensate for high risk. If a $20 stock offers $3 in monthly premium, that is a 15% return, which sounds amazing until the stock drops 40% and you are stuck holding expensive shares. Stick to stocks you genuinely want to own, not stocks with the highest premiums.

Mistake 2: No Diversification

Running the wheel on a single stock concentrates risk. If that stock collapses, your entire wheel strategy collapses. I run the wheel on 8-10 stocks simultaneously, ensuring no single position dominates my results.

Mistake 3: Selling Puts at Strikes You Do Not Actually Want to Buy At

Greed leads traders to sell puts at strikes too close to the current price for extra premium. When assigned, they are unhappy holding shares. Only sell puts at strikes where you would genuinely want to buy the stock.

Mistake 4: Ignoring Assignment

Some traders panic when assigned. They sell shares at a loss and swear off the strategy. Assignment is not a failure—it is part of the process. Assignments happen roughly 30-50% of the time if you are selecting appropriate strikes. Accept it, sell covered calls, and continue executing.

Mistake 5: Not Having an Exit Plan for Dogs

Sometimes you will get stuck with shares that do not recover. Maybe the company's fundamentals deteriorated, or the sector fell out of favor. Holding forever and selling covered calls into oblivion is not the answer. Know when to cut losses and redeploy capital.

Mistake 6: Rolling Endlessly to Avoid Losses

Rolling is a tool, not a magic fix. Some traders roll losing positions repeatedly, collecting small credits while the stock continues falling. Eventually, you are selling puts at absurdly low strikes for minimal premium. Accept that some trades lose and move on.

Mistake 7: Ignoring Opportunity Cost

Capital tied up in an underwater wheel position cannot be deployed elsewhere. If you are holding shares at a $50 cost basis and the stock is at $30, you might spend months selling covered calls for minimal premium. Sometimes selling at a loss and redeploying capital to better opportunities is the right move.

Mistake 8: Overleveraging

Margin allows you to sell more puts than you have cash to cover. This works great in bull markets and destroys accounts when stocks drop. Keep your wheel positions fully cash-secured or understand exactly how margin calls work before using leverage.

Wheel Options Strategy vs Other Income Strategies

The wheel strategy is not the only way to generate income from options. Here is how it compares to alternatives:

Wheel vs Credit Spreads

Credit spreads (like put credit spreads) have defined risk because you buy a protective option. The wheel has theoretically unlimited risk (the stock could go to zero). However, the wheel typically generates higher premium per capital deployed and does not require you to pay for protection.

I use both strategies depending on market conditions. In 2025, I shifted heavily toward the wheel strategy because the volatile, headline-driven market was better suited to stock-based strategies than index spreads.

Wheel vs Iron Condors

Iron condors profit from stocks staying in a range and have defined risk. They work well in low-volatility, range-bound markets. The wheel strategy is more adaptable because it profits from upward moves (puts expire worthless) and can recover from downward moves through covered calls.

Wheel vs Dividend Investing

Dividend stocks provide passive income but typically yield 2-4% annually. The wheel strategy can generate significantly higher returns (I generated over 50% in 2025) but requires active management and accepts stock price risk. Dividend investing is more passive but lower return.

Frequently Asked Questions About the Wheel Options Strategy

What is the wheel options strategy?

The wheel options strategy is an income-generating approach that cycles between selling cash-secured puts and covered calls. You sell puts on stocks you want to own, get assigned shares when they drop below your strike, sell calls against those shares until they are called away, then restart with puts.

How much money do you need for the wheel strategy?

At minimum, you need enough to buy 100 shares of your target stock. For a $20 stock, that is $2,000. I recommend at least $10,000 to properly diversify across multiple positions. With $50,000+, you can run a well-diversified wheel portfolio.

What is a good return for the wheel strategy?

Returns vary based on stock selection and market conditions. I consider 1-2% monthly return on deployed capital (12-24% annually) to be reasonable. My 2025 results exceeded this significantly at over 50%, but that included favorable market conditions.

What happens if a stock drops significantly while running the wheel?

If your put gets assigned, you own shares at the strike price minus premium received. You then sell covered calls to generate income while waiting for recovery. If the stock drops further, your calls may generate little premium. At some point, you must decide whether to hold, roll, or accept the loss and exit.

Can you lose money with the wheel strategy?

Yes. The wheel strategy loses money when stocks drop significantly and do not recover. You can end up holding shares at prices well above current market value. This is why stock selection and position sizing are critical—you must be willing to hold through drawdowns and not over-allocate to any single stock.

Is the wheel strategy better in a bull or bear market?

The wheel strategy performs best in bull markets (puts expire worthless) and sideways markets (consistent premium collection). It struggles in sustained bear markets because you get assigned repeatedly at declining prices. However, the flexibility to adjust strikes and the income from covered calls provides some cushion compared to pure long stock positions.

Should I use the wheel strategy in an IRA?

IRAs are excellent for the wheel strategy because gains are tax-deferred (traditional) or tax-free (Roth). The main limitation is that most IRAs do not allow margin, so all puts must be fully cash-secured. This is actually a good discipline that prevents overleveraging.

How do I choose strike prices for the wheel strategy?

For puts, choose strikes at prices where you genuinely want to own the stock. I typically go 5-15% out of the money depending on volatility. For calls, choose strikes at or above your cost basis to ensure profitable exits. Technical support and resistance levels can help guide strike selection.

What expiration should I choose for wheel trades?

I prefer 30-45 days to expiration (DTE). This provides good theta decay while maintaining manageable directional risk. Shorter expirations require more frequent management for less total premium. Longer expirations tie up capital and increase exposure to directional moves.

Getting Started with the Wheel Options Strategy

If you are ready to start trading the wheel options strategy, here is my recommended approach:

Paper Trade First

Before risking real money, practice the mechanics with paper trading. Get comfortable with assignment, rolling, and the emotional aspect of holding positions through drawdowns.

Start with One Stock

Do not try to run the wheel on 10 stocks immediately. Pick one quality stock, execute the strategy for a few cycles, and learn from the experience.

Size Conservatively

Start with position sizes you can afford to lose entirely. As you gain experience and confidence, gradually increase allocation.

Track Everything

Log every trade, including your thought process, outcomes, and lessons learned. Review your trades regularly to identify patterns and mistakes.

Be Patient

The wheel strategy is not a get-rich-quick scheme. It is a systematic approach to generating consistent income over time. Give it at least 6-12 months before evaluating results.

Conclusion: Is the Wheel Options Strategy Right for You?

The wheel strategy is one of the most reliable income-generating approaches in options trading when executed with proper position sizing and stock selection.

The wheel options strategy combines the premium-selling benefits of puts and calls into a systematic framework that removes emotion and guesswork. Over 160 trades, I have generated over $27,000 in profit using this strategy.

But the wheel strategy is not magic. It requires:

- Adequate capital to hold stock positions

- Patience to execute systematically through winning and losing periods

- Discipline to follow position sizing and stock selection rules

- Willingness to accept assignment and hold shares through drawdowns

If you can commit to these requirements, the wheel strategy can be a powerful addition to your trading toolkit. If you are looking for quick profits or cannot stomach holding underwater positions, consider other strategies.

For more detailed instruction on executing the wheel strategy, including video walkthroughs, stock selection frameworks, and real-time trade alerts, consider enrolling in the Options Cafe course. You will get access to all my trades as I make them, allowing you to learn from real-world execution rather than hypothetical examples.

The markets will always present challenges. The wheel options strategy gives you a framework to profit regardless of the environment. Execute consistently, manage risk appropriately, and let the compounding power of premium selling work in your favor.

Related Topics: Wheel Options Strategy, Wheel Strategy, Options Wheel, Cash Secured Puts, Covered Calls, Options Income Strategy, Premium Selling, Options Trading for Income, Stock Assignment