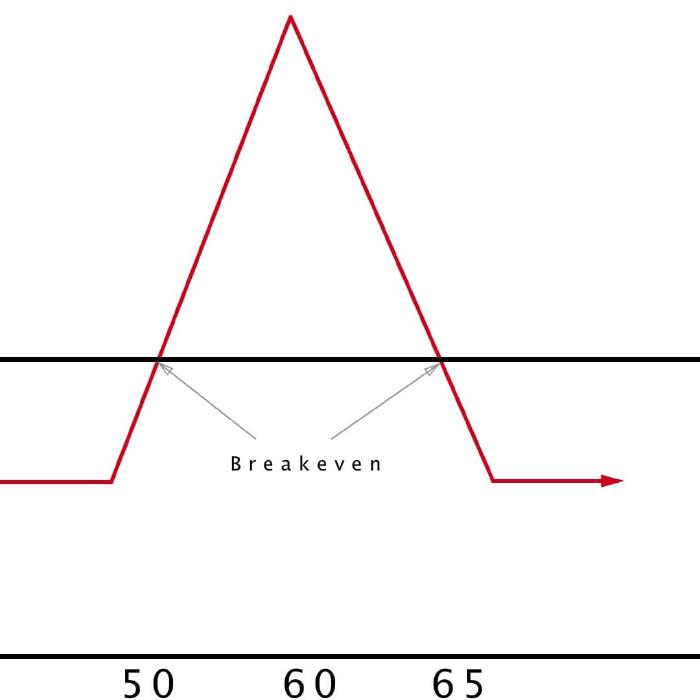

The options butterfly spread is a low-risk options trading strategy that stands a high chance of producing a small profit. The butterfly options trading strategy uses four options contracts to produce profits off of price stable markets.

Related To: Butterfly Spread

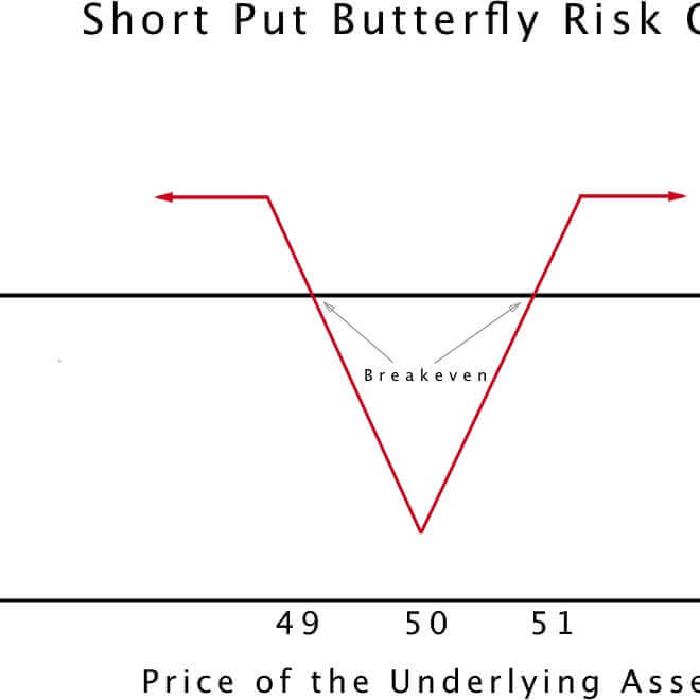

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

If you want a conservative option investment that controls losses, take a look at the butterfly strategy. This derivative tactic comes with finite profitability, but also downside protection. The butterfly play is best for stocks that have low volatility.

Prev

1