When you foresee upcoming volatility in a stock, an option play that can make money from it is the short call calendar spread. Because there are two expiration dates in the strategy, it has a considerable amount of complexity and should only be attempted by experienced traders.

Related To: Calendar Spread

Instead of trading stocks or other securities, why not trade time? The long calendar spread allows you to buy and sell option contracts with different expiration dates, with the likelihood of profiting from time decay. The maximum loss of this strategy is capped at the net debit the investment incurs at the entry point.

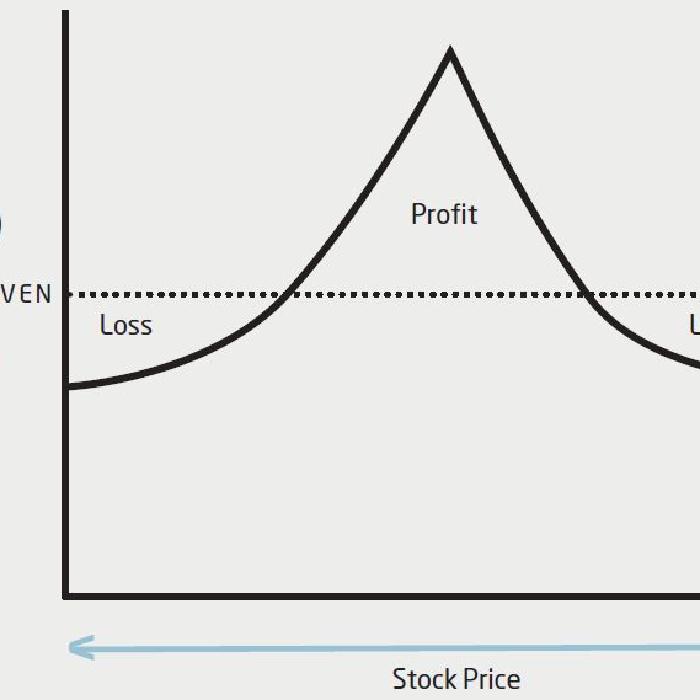

The short calendar spread is a good opportunity to profit from a stock’s impending upswing or decline. The maximum gain from the investment is the net credit received when entering the trade, and the maximum loss could be substantial. Therefore, this option strategy should only be used by experienced traders.