Bearish pressure on a stock can generate profits for short sellers. It can also earn money for option traders. Using a bear call spread, a net premium is earned, and this income will be pocketed if the stock makes just a modest decline.

Related To: Call Options

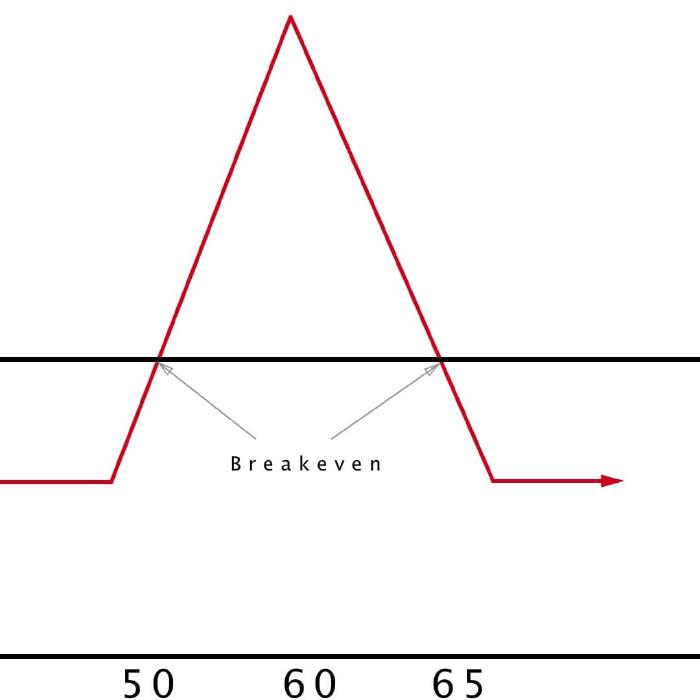

If you want a conservative option investment that controls losses, take a look at the butterfly strategy. This derivative tactic comes with finite profitability, but also downside protection. The butterfly play is best for stocks that have low volatility.

A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.

A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.

Prev

1