A credit spread option is an act of taking two or more options and selling the premium they produce. Yes, that sounds confusing. I'll explain, but first, let's explore quickly the concept of writing a contract. In this post, we will explore how traders can make monthly income trading options via spreads.

Related To: Credit Spreads

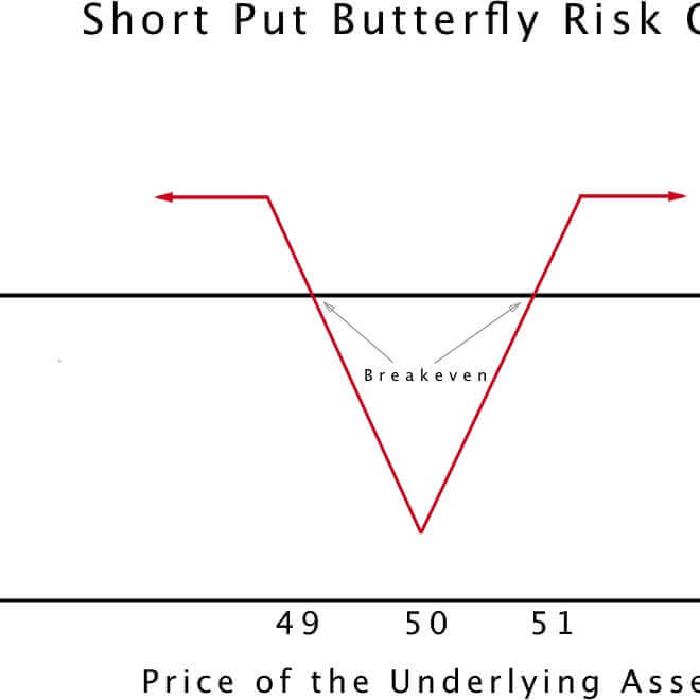

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

If your a follower of this blog or a follower of my trades you might have noticed I stopped posting trades. That is all about to change starting with this post. I am once again committed to posting the trades I place monthly. The reason for the absence in trade posting is we have been crazy busy preparing for the launch of our new trading platform -- Just not enough hours in the day :(.

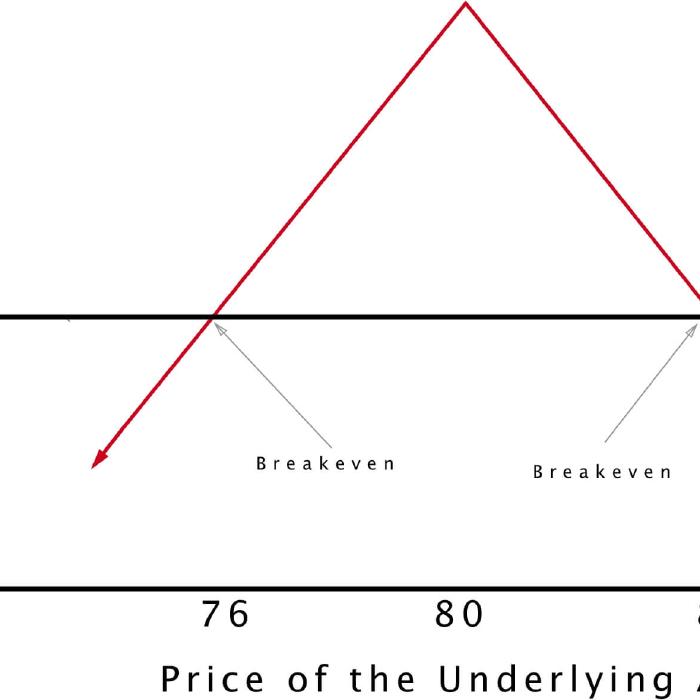

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

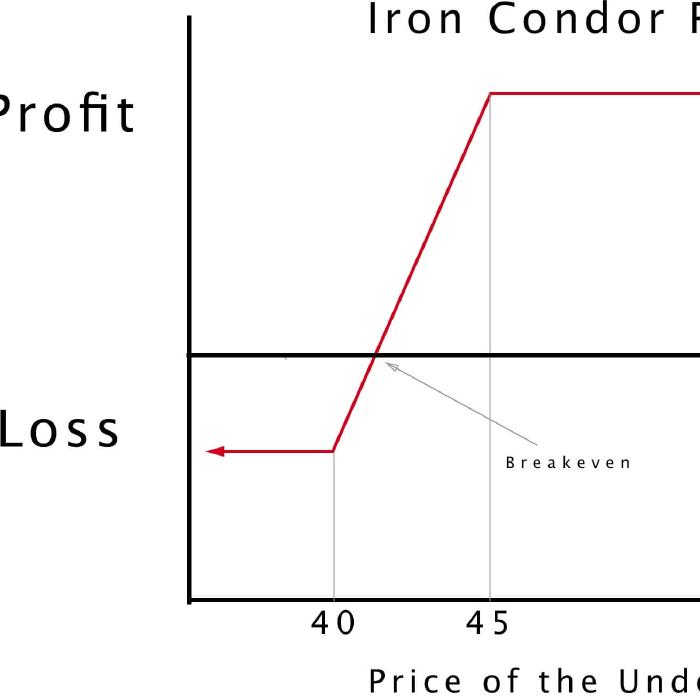

The Iron Condor is a very useful options trading strategy. While considered "advanced" by many, once you get a good handle on the iron condor, traders at any level can use it. This options trading strategy is especially useful for profiting off of stable markets that are experiencing sideways price movements. Next up ........Iron Condor Explained.

In the options trading world there is a type of trade called a put credit spread. The goal of this trade is to collect money and hope the market does not move against you.