Here we explore the put credit spread trades I placed on the SPY durning the month of March 2018. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Related To: Monthly Income

The options butterfly spread is a low-risk options trading strategy that stands a high chance of producing a small profit. The butterfly options trading strategy uses four options contracts to produce profits off of price stable markets.

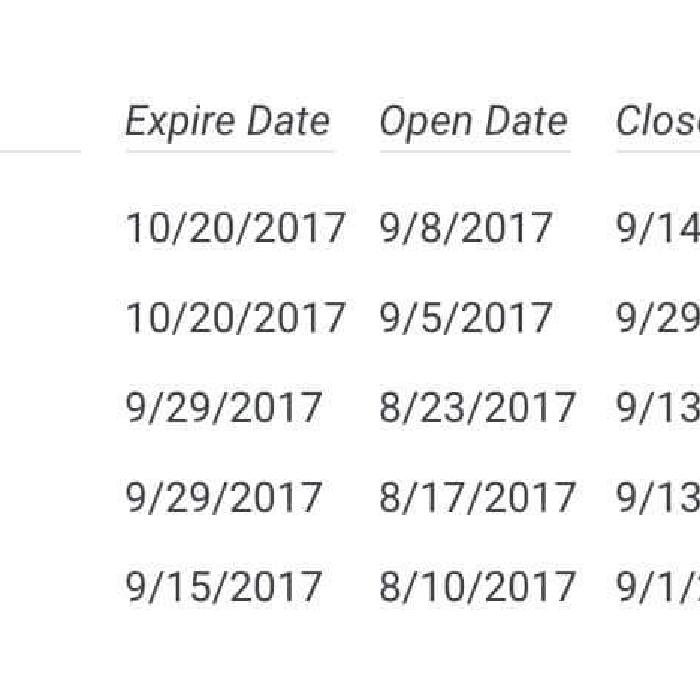

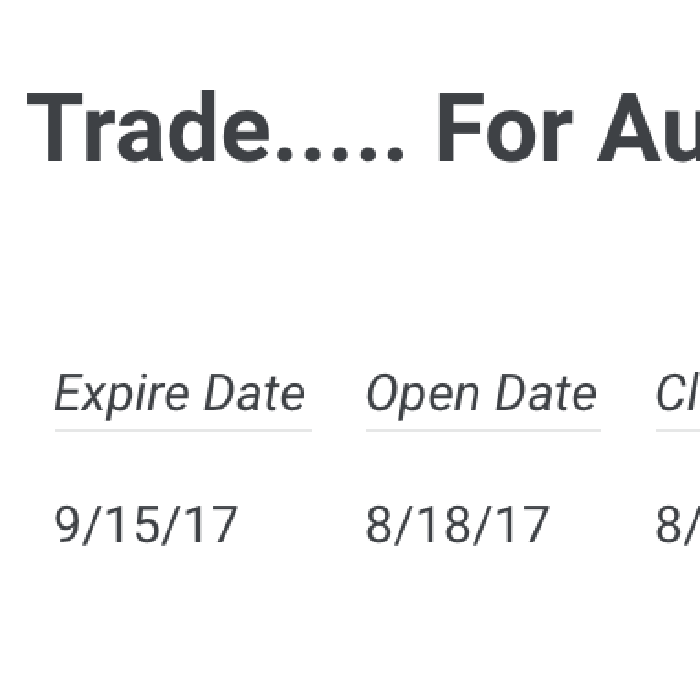

Once again it is time for our monthly summary of trades I closed. Below are the put credit spread trades I closed in September 2017. My birthday month!! Compared to August a number of put credit spreads closed this month. Volatility continues to be very low. When volatility is low we have less opportunities to place trades. Click to take a look at the trades.

Many people think they can quit their day job and start day trading. The truth is, most do not succeed day trading long term. There is an alternative that can generate monthly income just like you hoped to do by day trading. In this post we explore the concept of selling premium in the options market using probability-based options trading.

If your a follower of this blog or a follower of my trades you might have noticed I stopped posting trades. That is all about to change starting with this post. I am once again committed to posting the trades I place monthly. The reason for the absence in trade posting is we have been crazy busy preparing for the launch of our new trading platform -- Just not enough hours in the day :(.