Related To: Options Trading

The wheel strategy is one of the most reliable ways to generate consistent income from options trading. But here's what many traders miss: your stock selection matters more than your options execution. You can have perfect timing and flawless trade management, but if you're running the wheel on the wrong stocks, you're setting yourself up for disappointment.

The wheel strategy is one of the most reliable ways to generate consistent income from options trading. But here's what many traders miss: your stock selection matters more than your options execution. You can have perfect timing and flawless trade management, but if you're running the wheel on the wrong stocks, you're setting yourself up for disappointment. Like many aspiring investors, I started my journey by trying to grow my wealth through stock investing, inspired by the strategies of Warren Buffett. At around age 21, I made my first stock trades. But there was a catch: I didn’t have much money, and the idea of waiting decades to see my wealth compound wasn’t appealing.

Like many aspiring investors, I started my journey by trying to grow my wealth through stock investing, inspired by the strategies of Warren Buffett. At around age 21, I made my first stock trades. But there was a catch: I didn’t have much money, and the idea of waiting decades to see my wealth compound wasn’t appealing. Introduction Ever tried to learn options trading through scattered online resources like YouTube videos and ended up more confused than a chameleon in a bag of Skittles? You’re not alone. While the internet is a treasure trove of information, sorting through it to find valuable trading education can feel like searching for a needle in a haystack—without the haystack.

Introduction Ever tried to learn options trading through scattered online resources like YouTube videos and ended up more confused than a chameleon in a bag of Skittles? You’re not alone. While the internet is a treasure trove of information, sorting through it to find valuable trading education can feel like searching for a needle in a haystack—without the haystack.

Day trading options can be a lucrative venture for traders who understand the intricacies of the options market. Unlike the typical buy-and-hold strategy, day trading involves quick decision-making and strategic planning to capitalize on short-term movements in the market.

Deciding between SPX and SPY for your investments? The key difference lies in SPX being a non-tradable index and SPY a tradable ETF. Our guide focuses on the distinct trading dynamics and opportunities each presents, helping clarify which might suit your strategy without overwhelming you with the finer points reserved for our in-depth exploration of “spx vs spy”.

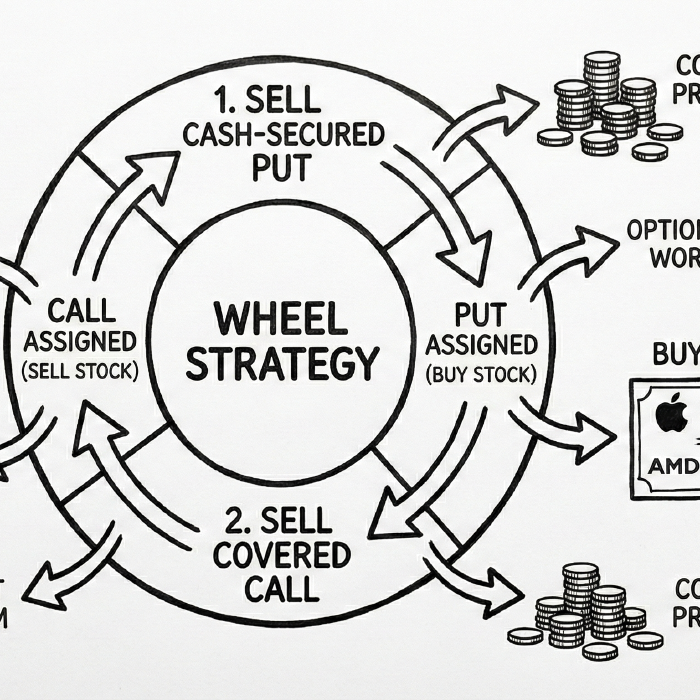

The Options Wheel Strategy is a methodical approach to options trading that combines both income generation and potential stock ownership in a seamless cycle.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront. A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio.

A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio. A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.

A call option is a contract that gives you the right, but not the obligation, to buy an asset at a specific price within a set time period. Call options are one of the two basic types of options (the other being put options), and understanding them is essential for anyone looking to trade options.