July has come and gone. We partied for America's birthday and closed a few profitable trades! Darn good month! My SPY Put Credit Spread trading strategy continued to do well.

Related To: Put Credit Spread

June 2018 was another winning month for my SPY Put Credit Spread trading strategy. Since IVR has been pretty low closing this many trades was a darn good thing. Just have to be careful to not trade too big.

May 2018 was a winning month for my SPY Put Credit Spread trading strategy. It felt good to lock away some winning trades after last month.

April 2018 was a losing month for my SPY Put Credit Spread trading strategy. While these months are never fun they serve as an opportunity to remember to be humble in this trading strategy.

Here we explore the put credit spread trades I placed on the SPY durning the month of March 2018. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

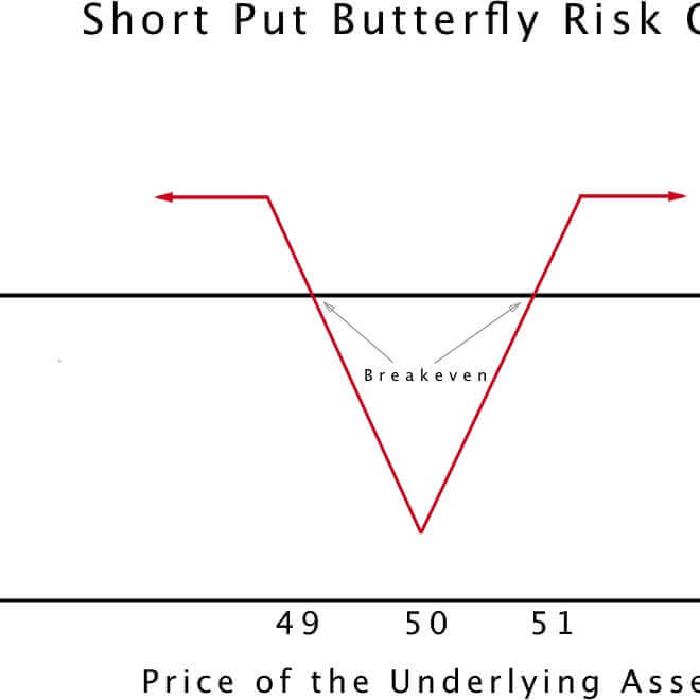

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

If your a follower of this blog or a follower of my trades you might have noticed I stopped posting trades. That is all about to change starting with this post. I am once again committed to posting the trades I place monthly. The reason for the absence in trade posting is we have been crazy busy preparing for the launch of our new trading platform -- Just not enough hours in the day :(.

Volatility Trading is a variable in an option pricing model used to determine the theoretical value of an option. And, among all the variables in an option pricing model, it is the only one that is derived from market sentiment. But, the market doesn’t always get it right. That creates opportunity for an options trader.

When I got interested in trading credit spreads, like most I harbored some skepticism. A credit spread trade seemed to be the type that works—until rather dramatically it does not. Then I set off to figure out the correct way to trade SPY put credit spreads. The path was familiar: backtesting.

In the options trading world there is a type of trade called a put credit spread. The goal of this trade is to collect money and hope the market does not move against you.