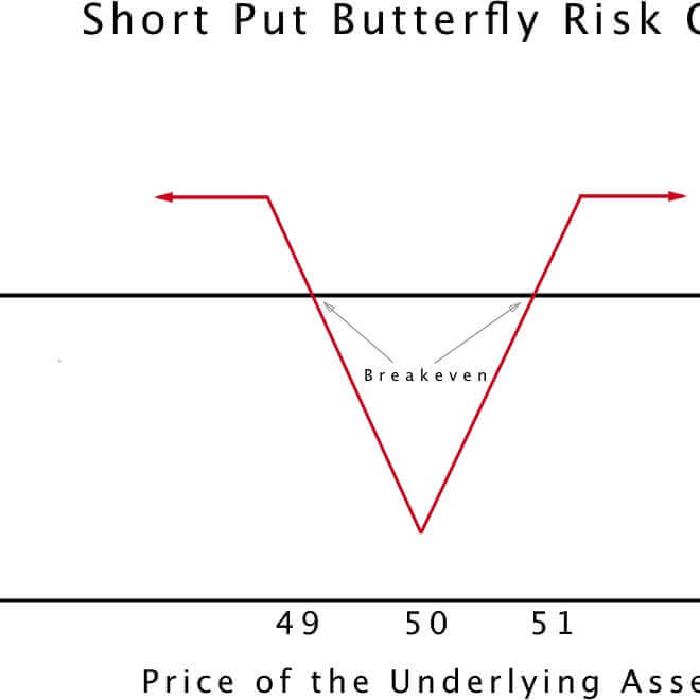

The short butterfly option trading strategy is a good way to earn small profits, while keeping downside risk to a bare minimum. If you think a stock is set to experience a sizeable move, either up or down, break out your short butterfly playbook.

Related To: Put Options

When I got interested in trading credit spreads, like most I harbored some skepticism. A credit spread trade seemed to be the type that works—until rather dramatically it does not. Then I set off to figure out the correct way to trade SPY put credit spreads. The path was familiar: backtesting.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront. In this guide, I'll explain put credit spreads using a simple insurance analogy, walk through real examples with actual numbers, and show you when and why traders use this strategy.

A put credit spread (also called a bull put spread) is an options strategy where you sell a put option and simultaneously buy a lower-strike put option, collecting a net credit. It's one of the most popular income-generating strategies because it profits when the underlying stock stays flat or goes up—and you get paid upfront. In this guide, I'll explain put credit spreads using a simple insurance analogy, walk through real examples with actual numbers, and show you when and why traders use this strategy. A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio. In this guide, I'll explain put options using a simple real-world analogy, then show you how they work with actual stock examples.

A put option is a contract that gives you the right, but not the obligation, to sell an asset at a specific price within a set time period. Put options are one of the two basic types of options—the opposite of call options—and understanding them is essential for anyone looking to trade options or protect their portfolio. In this guide, I'll explain put options using a simple real-world analogy, then show you how they work with actual stock examples.

Prev

1