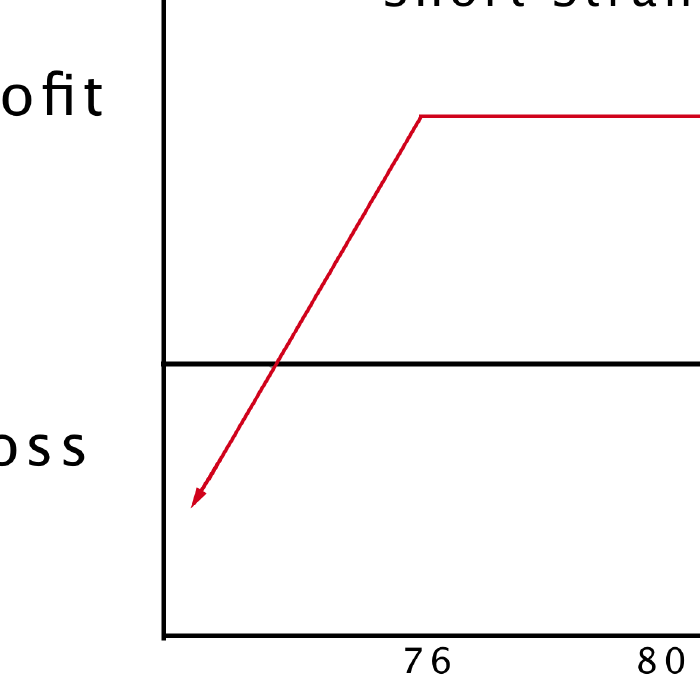

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.

Related To: Short Straddles

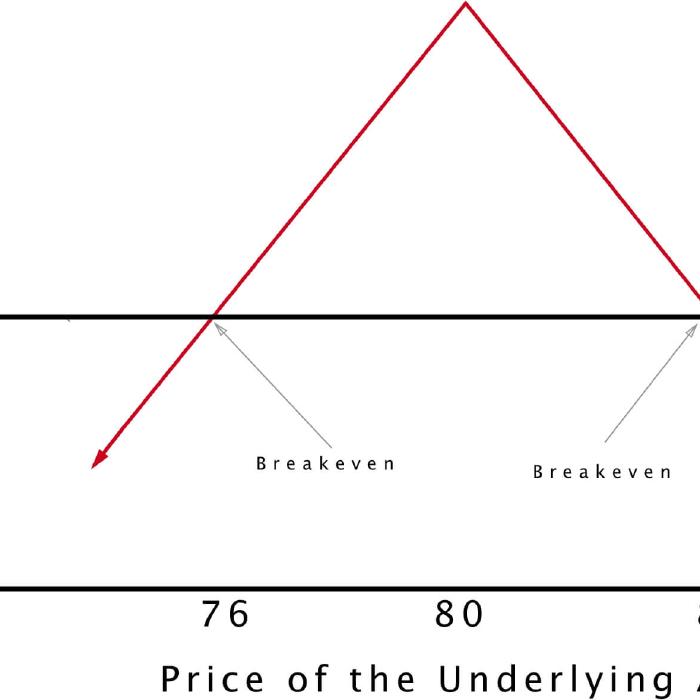

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

Prev

1