June 2018 was another winning month for my SPY Put Credit Spread trading strategy. Since IVR has been pretty low closing this many trades was a darn good thing. Just have to be careful to not trade too big.

Related To: Spy

May 2018 was a winning month for my SPY Put Credit Spread trading strategy. It felt good to lock away some winning trades after last month.

April 2018 was a losing month for my SPY Put Credit Spread trading strategy. While these months are never fun they serve as an opportunity to remember to be humble in this trading strategy.

Here we explore the put credit spread trades I placed on the SPY durning the month of March 2018. This is my primary trading strategy for monthly income. By trading put credit spreads on the SPY I am typically in a trade for 23 days but no more than 45 days.

Volatility is back! Seems the day of the market just creeping up every day are over. In February 2018 the market tanked creating tons of new opportunities for entering Put Credit Spread trades. Sadly, we took some losses but in this post I explain that is not a bad thing.

In January 2018 the markets where pretty stable -- Well stable in the eyes of an options volatility trader. It was not until the end of January when the market made a turn and volatility came back into the market. I opened a few trades in January 2018 but none closed.

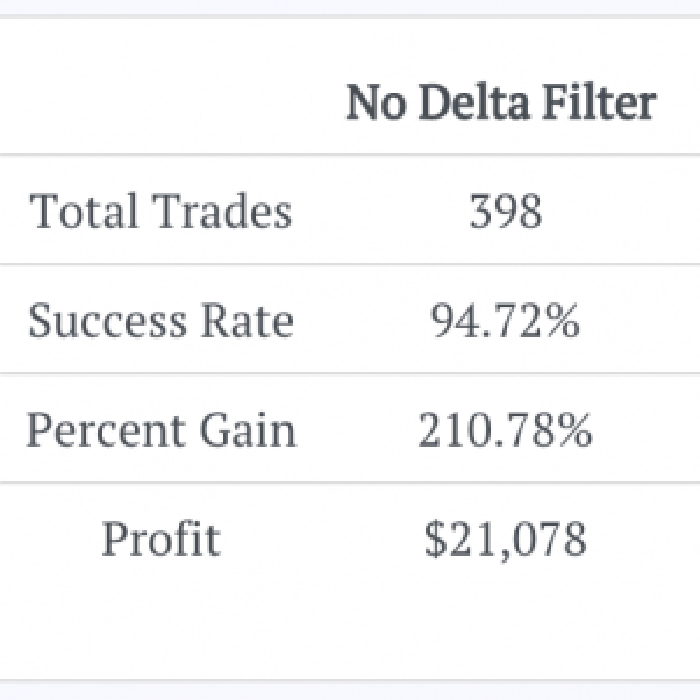

When I got interested in trading credit spreads, like most I harbored some skepticism. A credit spread trade seemed to be the type that works—until rather dramatically it does not. Then I set off to figure out the correct way to trade SPY put credit spreads. The path was familiar: backtesting.

To study how delta affects an opening trade I did—of course—some backtesting. I took a $10,000 account and placed put credit spread trades from 2011 to current. I opened up spreads that were $2 wide, at least 4% out of the money, and no more than 45 days to expiration.

Almost all of my credit spread trading is focused on the S&P 500 via the SPY or S&P 500 futures. Why am I hyperfocused on the SPY? So I can sleep at night (well, try to sleep—I do have a young son and a daughter on the way).

During any 30-day period from 1993 through 2014 the SPY (the Exchange Traded Funds, or ETFs, tracking the S&P 500) closed down 5% or more 11% of the time. I know this obscure fact because for every one of the 5,502 trading days during that period I compared the SPY closing price with the closing price 30 trading days later.