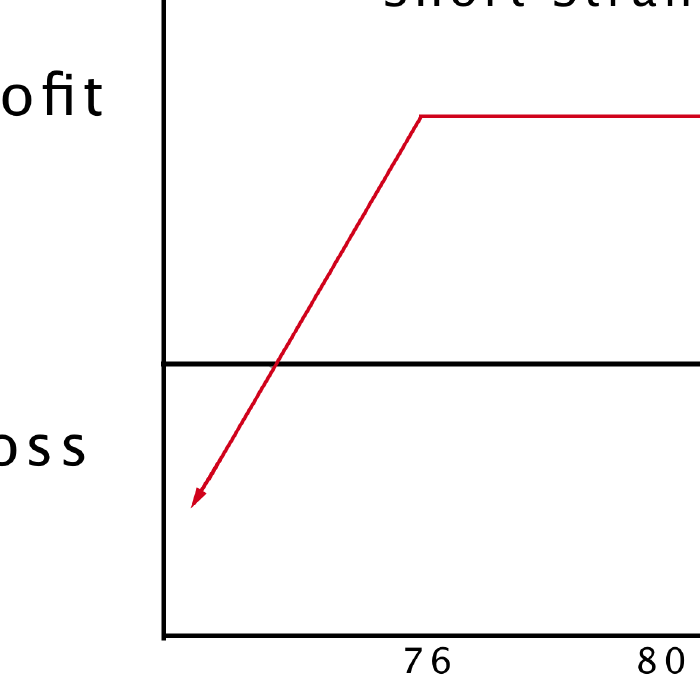

The short strangle option strategy is an opportunity to profit when a stock moves sideways. Instead of just selling one call or one put, you sell one of each, which produces twice the income. But the maximum loss with this type of trade is unlimited, while the potential gain is capped at the amount of premiums received.

Related To: Straddles

American corporations release their earnings reports every 3 months. The data gives investors an idea of how well the companies are doing financially. If an earnings announcement contains any information traders weren’t expecting, the stock price could plummet or skyrocket, depending on whether the release is negative or positive.

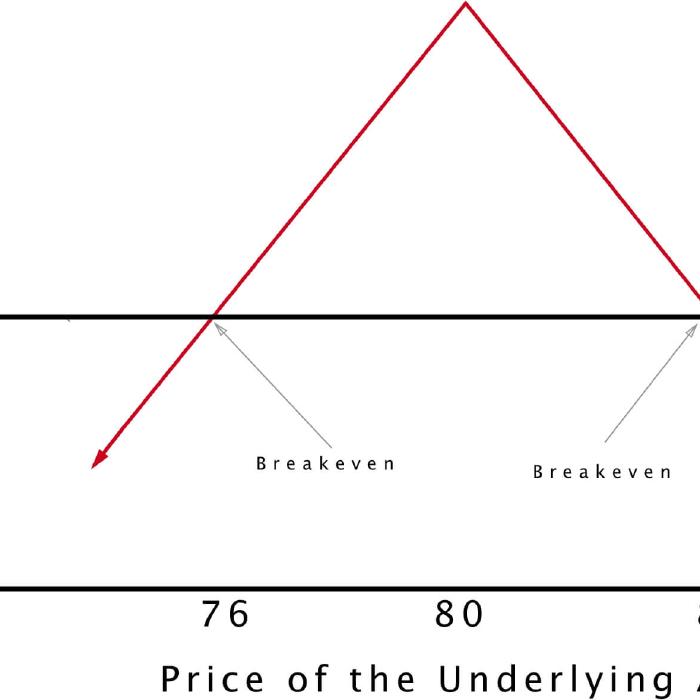

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

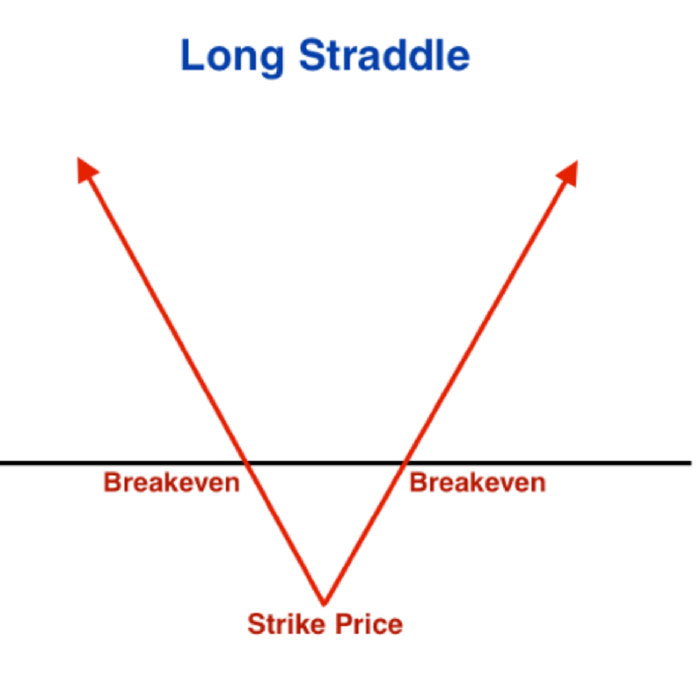

Although volatility is often spoken of in the financial press as undesirable, long straddles are one case where you can profit from it. If you foresee major price swings in the near future. Time to learn about long straddles.