Related To: Volatility

Options trading strategies can provide opportunities to profit from short-term stock movements while managing risk. It's essential to understand the risks and rewards associated with each strategy and to consider factors such as transaction costs, taxes, and liquidity.

Options trading strategies can provide opportunities to profit from short-term stock movements while managing risk. It's essential to understand the risks and rewards associated with each strategy and to consider factors such as transaction costs, taxes, and liquidity.

There are six variables that determine an option’s theoretical value. But, theoretical value is not the same things as market value. The thing that links theoretical and market value together is one key variable out of the whole mix. This one key variable is volatility and it has a huge influence on how an option is going to trade.

Knowing how the Greeks influence premium is not academic. Understanding how they are likely to affect your next trade is a critical component of that trade’s set up. You should always perform an analysis of the Greeks before you send an order to your broker. Here are some important things to look for.

Volatility Trading is a variable in an option pricing model used to determine the theoretical value of an option. And, among all the variables in an option pricing model, it is the only one that is derived from market sentiment. But, the market doesn’t always get it right. That creates opportunity for an options trader.

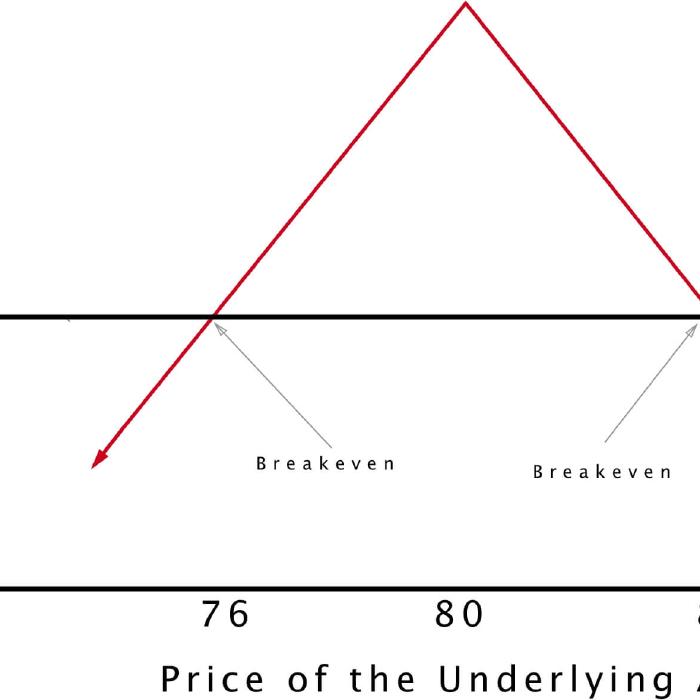

Short straddles present an opportunity to make a profit whenever a stock appears stuck in a neutral price zone. This option strategy generates extra income by selling double the usual number of contracts. While the profitability is capped at the amount of premiums received, the potential loss is unlimited.

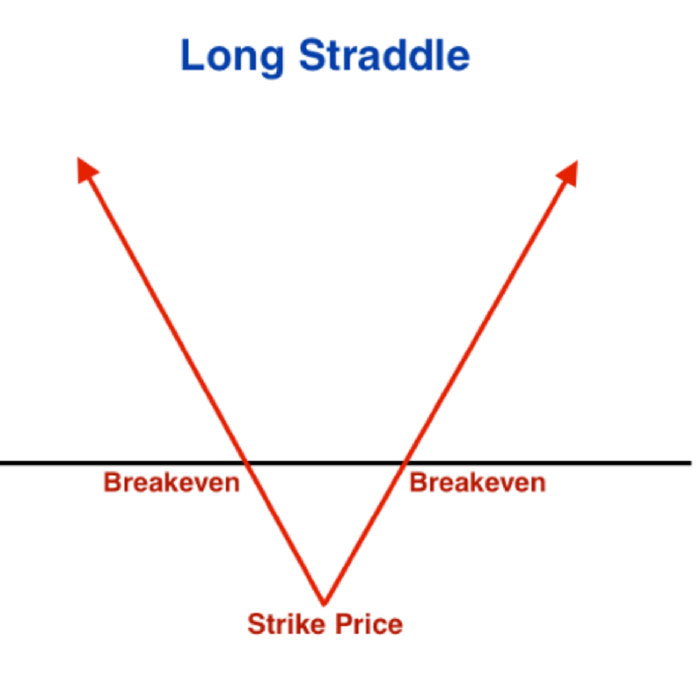

Although volatility is often spoken of in the financial press as undesirable, long straddles are one case where you can profit from it. If you foresee major price swings in the near future. Time to learn about long straddles.